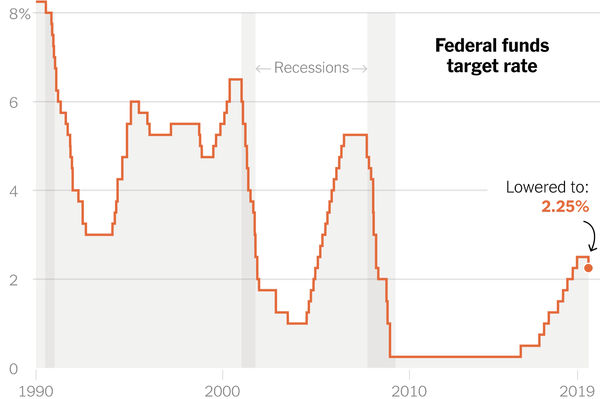

Gold and Silver Boosted by first Fedrate cut since Financial Crisis

Commodities / Gold & Silver 2019 Aug 07, 2019 - 10:41 AM GMTBy: John_Lee

The Federal Reserve cut interest rates on Wednesday (July 31, 2019) for the first time in more than a decade.It was trying to keep America’s record-long economic expansion going by insulating the economy from mounting global threats.

Source: US Federal Reserve

August 1, 2019, just a day after Fed rate cut.US President Donald Trump said the US would place a 10 per cent tariff on $300bn in additional Chinese goods. This escalation of the trade war between Washington and Beijing is a new threat to the global economic outlook.The announcement unsettledfinancial markets continued on Friday and lead to a haven buying of bonds and a broad equity sell-off.

Gold chart shows 6-year breakout above $1,380.Head and shoulder patternindicatesimminent reachingof $1,660

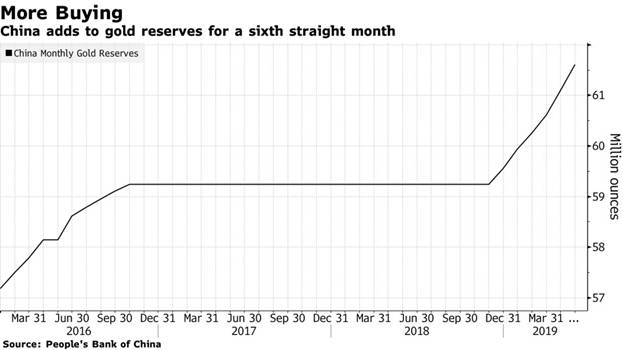

China is buying more gold as the trade war drags on; Russia joins the party.

The rise China’s gold holdingreflects the Chinesegovernment’s “determined diversification” away from dollar assets, according to Argonaut Securities (Asia) Ltd analyst Helen Lau. She added that retail demand has also picked up. At this rate of accumulation, China could buy 150 tons in 2019, she says.

“It’s a diversification away from the U.S. dollar, particularly given the trade tensions and the potential technology cold war that’s evolving,” says Bart Melek, global head of commodity strategy at TD Securities. “We have to remember that gold is nobody’s liability.”

Russia’s total gold reserves top $100 billion as central bank adds another 600K ounces in June

Russia bought 200,000 ounces in May, 550,000 in April, 600,000in March, one million in February, and 200,000 in January.

During the last decade, Russia’s gold reserves have gone from 2% to 19% (as of the end of 2018 Q4), according to the World Gold Council.

With central banks rushing tobuy gold,other institutions and retailers will surely follow.

With real estate crumbling, investors rush to gold and silver

- Manhattan real estate had its worst first quarter since the financial crisis, according to a report from Douglas Elliman and Miller Samuel.

- Sales fell 3 percent in the first quarter, which marked sixth straight quarters of decline.

- That is the longest decline in the 30 years that the real estate appraisal firm has been keeping data.

With the housing market toppling, it’s no surprise investors are turning to gold and silver, the hard assets whose value has stood the test of time.

Ray Dalio says gold will be a top investment during the upcoming “paradigm shift” for global markets

Hedge fund multi-billionaire kingpin Ray Dalio is seeing a case for gold as central banks (1) get more aggressive with policies that devalue currencies and (2) are about to cause a “paradigm shift” in investing.

Dalio, the founder of the world’s largest hedge fund, wrote in a LinkedIn post that investors have been pushed into stocks and other assets that have equity-like returns. As a result, too many people are holding these types of securities and are likely to face diminishing returns.

“I think these are unlikely to be good real returning investments and that those that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold,” the Bridgewater Associates leader said.

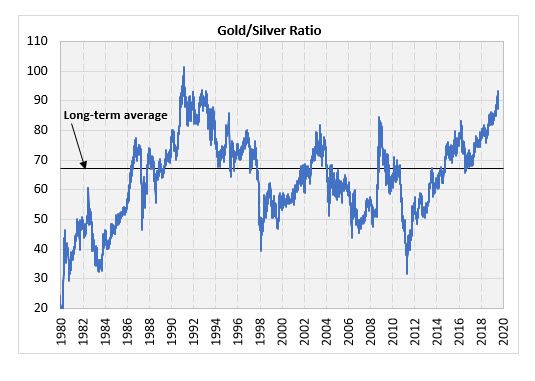

Silver isset to outperform gold based on gold/silver ratio, silver mining companies present excellent entry points.

At 90, the gold/silver ratio is the highest it’s been in 25 years.The average level since 1990 has been 67.

Source: Kitco.com

Silver outperforms after an extremely high gold/silver ratio reading. It averagesa gain of close to 10% over the next year, when the gold/silver ratio is at the current level.

Source: Kitco.com

Silver could hit $28 in the near term, catching up to gold.

With US presidential election coming in 2020 and the Fed’s having little stomach for a market correction, analysts agree that the path of least resistance for interest rates is down.

Rising silver price is bullish for silver mining companies such as Prophecy Development CorpProphecy(TSX:PCY , OTCQX: PRPCF)

Prophecy’s Pulacayo-Paca project has30 million indicated silver ounces, 21 millioninferred silver ounces; only 30% of the known mineralization drilled. With 95 million Prophecy shares outstanding, investors are getting half an ounce of silver in the ground for every share of Prophecy.

Prophecy’s Pulacayo-Paca silver grades are at 256g/t open pit and 455g/t underground, rankingPulacayo near some of highest-grade silver deposits in the world (silver resource and grade from www.prophecydev.com).

With past drill intercepts such as1,031 g/t Ag over 25 meters (PUD 109), and 1,248 g/t Ag over 10 meters (PUD 118), Prophecy is preparing to drill Pulacayo-Pacain the fall; investors might justrediscover this silver giant sleeper in the midst of bullish silver run.

John Lee, CFA

jlee@prophecydev.com

August 5, 2019

John Lee, CFA is an accredited investor with over 2 decades of investing experience in metals and mining equities. Mr. Lee is the Chairman of Prophecy Development Corp (www.prophecydev.com). John Lee is a Rice University graduate with degrees in economics and engineering.

Disclaimer: The views expressed herein are those of the author and may not reflect those of Prophecy Platinum Corp. or Prophecy Coal Corp. The information herein is provided for information purposes only, and is in no way to be construed as advice or solicitation to make any exchange in precious metal products, commodities, securities or other financial instruments. No warranty expressed or implied exists between the author of this article and the reader as to the accuracy of the information herein provided. The information contained herein is based on sources, which the author believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available information. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. Any opinions expressed are subject to change without notice. Prophecy Platinum Corp., Prophecy Coal Corp. and the author of this article do not accept culpability for losses and/or damages arising from the use of this article.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.