Stocks Likely to Breakout Instead of Gold

Stock-Markets / Stock Markets 2019 Aug 20, 2019 - 06:55 PM GMTBy: Harry_Dent

The funny thing is that gold and stocks currently seem to like the same thing: more money printing.

The funny thing is that gold and stocks currently seem to like the same thing: more money printing.

Treasury bonds keep falling in rates and we’re seeing a slowing global economy despite Trump’s tax cuts and central banks leaning towards easing. That has hurt stocks a bit, as has the recent near break-off in trade negotiations with China. Markets were fearing a currency war now that the trade war is at an impasse.

So, no surprise gold has been rallying here. But for stocks, the surprise is that they’re holding up as well as they are considering the slow growth foreshadowed by the bond markets and trade impasses.

Hence, my preferred scenario for stocks – with a minor pullback here and then a continued strong break up on the Dark Window scenario – still seems the most likely, especially with today’s strong rally.

The rally we saw was spurred largely by Trump’s decision to delay a few tariffs and put trade negotiations back on officials’ calendars in two weeks. Stocks loved that of course, and gold didn’t.

But what we’re seeing is also consistent with Andy Pancholi at marketimingreport.com reporting on Monday that he sees positive cycles for China over the same timeframe.

Gold’s Bad Break

Peter Schiff – who is also living in Puerto Rico – emailed me recently and asked when I would turn more bullish on gold. My answer was $1,525. I have been eyeing that as the key resistance; if pierced, gold would have substantially higher targets –$1,600 to as high as $1,800.

But Tuesday’s news caused gold to fall sharply just as the futures markets showed gold breaking up to $1,540+… that would have been a clear breakout. Is this the end for gold for now, or is this news transitory? These two reversals in gold and stocks look convincing for now, and bullish for stocks.

Stocks In the Spotlight

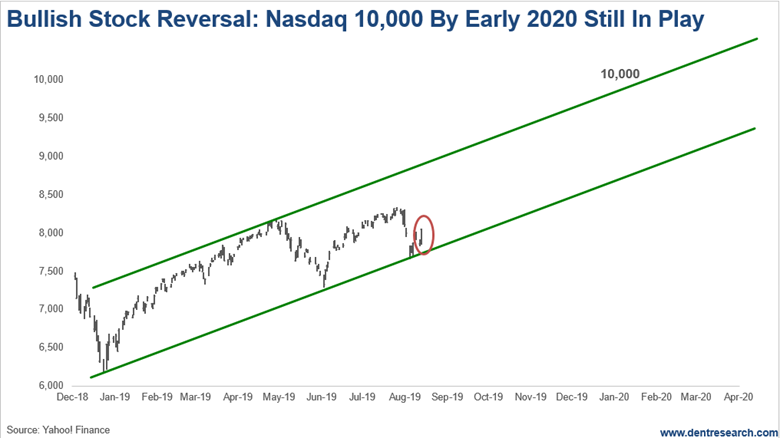

I have warned that stocks are also at a critical point; they could break up sharply towards 10,000 on the Nasdaq or down towards 5,700 –quite a spread! Given that stocks have held up as well as they have amidst the bad news on China and the bearish bond markets, we could be about to see that upside breakout soon now that the news has suddenly switched gears towards a trade deal instead of currency wars.

If we can hold the upward bottom trendline in this chart around 7,820 – and today’s 160-point rally at the open was a good start – this could be in motion. The breakout point would be around 8,500 on the Nasdaq and 27,500 on the Dow. The channel drawn would take us right up to my 10,000+ target between January and March of next year.

However, if stocks end up breaking down further, then the two targets continue to be about 7,290 on the less bearish side, and all the way down to 5,700 at the extreme.

The trends are more clear and bullish on stocks today, and may get clearer on gold quite soon. But this could be it for gold.

We’ll keep watching and guiding.

Harry

Follow me on Twitter @HarryDentjr

P.S. Another way to stay ahead is by reading the 27 simple stock secrets that our Seven-Figure Trader says are worth $588,221. You’ll find the details here.

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2019 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.