Divergence of Gold And Bitcoin – Which Represents A True Safe-Haven?

Commodities / Gold & Silver 2019 Oct 24, 2019 - 04:34 PM GMTBy: Chris_Vermeulen

Recently, Mark Zuckerberg appeared before the US Congress to discuss his new Libra project and to attempt to calm concerns related to his new global alternate currency project. It appears this project is putting global political leaders in a particularly powerful position of either accepting the Libra project as a viable future solution and implementing new laws and regulations in support of it or to shelve the idea while they consider the local and global risks associated with a project that creates a new class of global currency. (Source: https://www.bloomberg.com)

Recently, Mark Zuckerberg appeared before the US Congress to discuss his new Libra project and to attempt to calm concerns related to his new global alternate currency project. It appears this project is putting global political leaders in a particularly powerful position of either accepting the Libra project as a viable future solution and implementing new laws and regulations in support of it or to shelve the idea while they consider the local and global risks associated with a project that creates a new class of global currency. (Source: https://www.bloomberg.com)

We believe the risks associated with a massive corporate and international backed Crypto/Alternate currency are far too great, at this time, for the US government to attempt to consider with only 12+ months to go before the US Presidential elections. This is almost like opening Pandora’s Box in terms of total global risks and outcomes. It becomes almost impossible for the US government, Federal Reserve or any other global central bank to be able to protect its citizens from the risks associated with any type of technology collapse, fraud, hacking or any other unknown risks associated with such an idea.

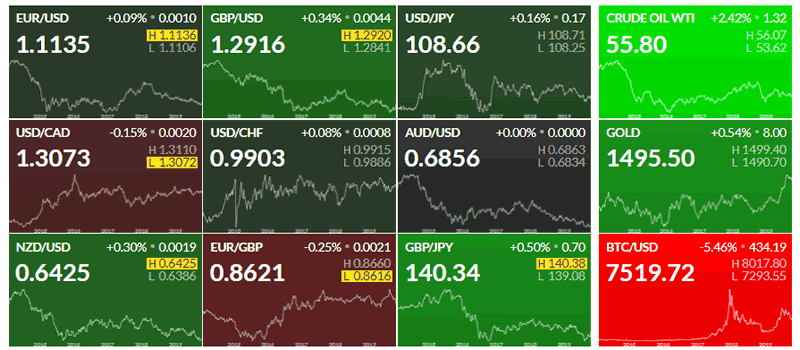

The concept of a “Safe-Haven” may come into question over the next 10+ months as investors continue to question what may happen in the global markets, global political events and asset valuations related to Cryptos, Precious Metals, and foreign currencies. Our researchers believe mature economy currencies will quickly become new currency Safe-Havens for global investors over the next 10+ months as banking, credit and economic risks continue to shake out weaker markets.

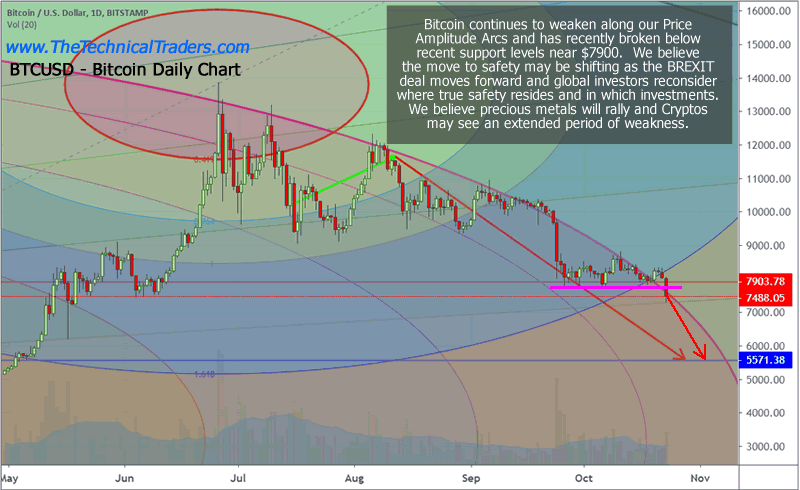

Cryptos may see some support as price rotates over the next 10+ months prior to the US Presidential elections, yet we believe the real global asset markets (stocks, currencies, debt/credit, and bonds) will take center stage as the world transitions through a very tumultuous period prior to the November 2020 US elections. Even for a period of time shortly after the US elections, global assets will continue to reposition as future economic and regional asset value expectations shift.

There is a very real potential that global investors continue to seek safety and liquidity in the global major markets, economies and global currencies. Additionally, Precious Metals continue to show very little signs of weakening over the past 12+ months.

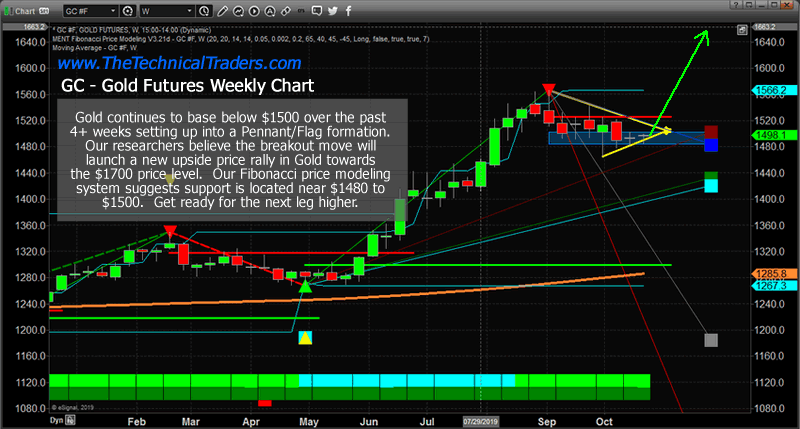

In fact, Precious Metals have continued to stay much stronger than many other investments over the past few years. Gold is up +17.60% from October 2017. Palladium is up 78.81% since October 2017. Silver is up 4.9% over that same period of time. Once the next upside price leg begins in Precious Metals, we may see a massive price increase in Gold and Silver. Supply issues continue to push Palladium prices higher as well.

Imagine being able to trade the precious metals sector easily with little downside risk and only being involved during the rallies and not the selloffs, all while generating 2x the return that GDXJ has return in 2019. /www.thetechnicaltraders.com/partners/idevaffiliate.php?id=127&url=https://www.thetechnicaltraders.com/metals-are-following-downside-sell-off-prediction-before-the-next-rally/" target="_blank">Take a look at this trading strategy here.

Gold is setting up in a manner that is very similar to what happened in April 2019 – a sideways momentum base pattern that eventually broke to the upside in early June 2019. Once that move higher began to take place, the continued move to the upside was very quick and extensive. We believe the next upside move in Gold and Silver will be very similar – a moderately slow rotation out of the momentum base, then a fast acceleration to the upside as global investors realize the shift to safety has begun again.

We believe Cryptos may be left on the sidelines as investors prefer more traditional assets as a measure of safety as global concerns continue to weigh on investor’s minds headed into a very contentious US presidential election. Currencies, Metals, Mature global market assets and true value stocks may become the investment of choice until we see some real clarity for the future from the global markets, global central banks, and global political leaders.

I urge you visit my /www.thetechnicaltraders.com/partners/idevaffiliate.php?id=127&url=https://www.thetechnicaltraders.com/#trackrecord" target="_blank">Wealth Building Newsletter and if you like what I offer, join me with the 1-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis. Join Now and Get a Free 1oz Silver Bar!

I can tell you that huge moves are about to start unfolding not only in metals, or stocks but globally and some of these supercycles are going to last years. A gentleman by the name of Brad Matheny goes into great detail with his simple to understand charts and guide about this. His financial market research is one of a kind and a real eye-opener. PDF guide: /www.thetechnicaltraders.com/partners/idevaffiliate.php?id=127&url=https://www.thetechnicaltraders.com/ebook-2020-cycles-the-greatest-opportunity-of-your-lifetime/" target="_blank" rel="noreferrer noopener">2020 Cycles – The Greatest Opportunity Of Your Lifetime

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.