Where the World Is Going in 2020

Economics / Global Economy Jan 03, 2020 - 04:32 PM GMTBy: Patrick_Watson

We all want to know the future. Unfortunately, the future isn’t talking. It’s just coming, like it or not.

We all want to know the future. Unfortunately, the future isn’t talking. It’s just coming, like it or not.

We can, however, make educated forecasts. I think John Mauldin is broadly correct: the future is bright, but we’ll go through darkness first.

In fact, many of us are already in pretty dark situations, “left behind” in a supposedly thriving economy. We’re told there is no inflation even as the real cost of living rises ever higher.

Where is it leading us? To answer that, we have to think about how we got here.

America Alone

In his recent "Inflationary Angst" letter, John Mauldin shared an inflation chart, broken down into spending categories.

The cost of things average people must buy—healthcare, education, housing—tends to have risen more than wages did over the last two decades.

But aggregate inflation measures, like the Consumer Price Index, don’t show this. Falling prices elsewhere held them down. Those tend to be “luxury” goods… which is why inflation is no problem unless you’re poor.

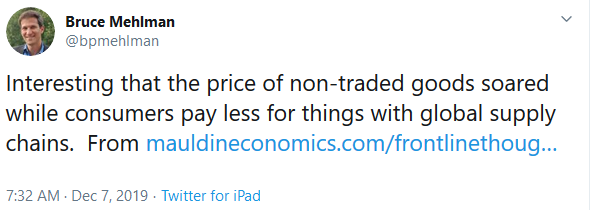

My friend Bruce Mehlman had a different reaction on Twitter.

Source: Bruce Mehlman

He’s right; the fastest-rising spending categories are things you can’t easily import from other countries. If you suddenly need surgery, you’re going to the nearest hospital pronto.

On the other hand, US hospitals and colleges do import certain components and personnel. That’s why we have foreign-born nurses and professors. It doesn’t seem to have reduced their costs, though.

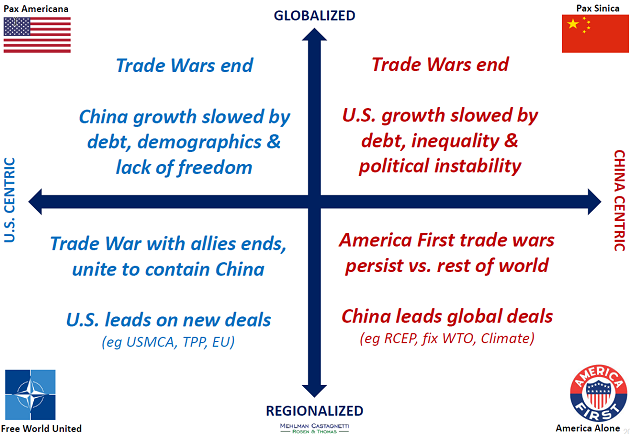

Bruce’s latest slide deck is about global trends re-shaping the world. He distilled his outlook into a two-factor equation: globalization vs. regionalization, US-centric vs China-centric.

Source: Bruce Mehlman

I realized long ago that globalization was on its last legs. I also think trade conflict will continue and even intensify. So Pax Americana or Pax Sinica (the top two quadrants) aren’t very likely.

The bottom left scenario—what Mehlman calls a “Free World United”—would be a partial end to trade wars, with the US and its allies uniting against China. That might happen but not without a leadership change in Washington. And maybe not even then.

So the “America Alone” scenario within an otherwise China-centered world seems the most likely. For Americans, this will probably mean even greater economic difficulties than we face now.

How people who are already struggling will deal with it is unclear. But it probably won’t go well.

Small Winners

Recently, I shared a report by Gavekal Research co-founder Louis-Vincent Gave called “The Knowledge Revolution and Its Consequences".

Louis has a great way of systematically thinking through a situation to see where it leads. He thinks technology and political trends are aligning against mega-powers like the US and China. His key points:

- Modern Western economies have become knowledge based. This means Marx’s three factors of production (land, labor, capital) now have a fourth.

- Neither physical strength nor access to capital are sufficient for economic success. Power now resides with those best able to organize knowledge.

- The internet has eliminated “middlemen” in most industries. In a representative democracy, politicians are basically middlemen.

- Hence, the knowledge revolution should bring a shift to direct democracy, but those who benefit from the current structure are fighting this transition.

- This is the source of much angst around the world, including the current wave of popular protests.

- Smaller political entities should find the evolution toward direct democracy easier to achieve than big, sprawling governments.

- Today’s great powers have little choice but to spend their way to political stability, which is unsustainable, and/or try to control knowledge, which is difficult.

The conclusion is that future growth potential should be highest in smaller countries with stronger, more flexible political institutions. The US, China, and most of Europe don’t qualify. Places like New Zealand and Switzerland have better odds.

That brought to mind one of my favorite Enlightenment philosophers, who happens to have been Swiss.

Subhead

Eighteenth-century thinker Jean-Jacques Rousseau wrestled with how to preserve individual freedom when we also have to depend on each other for survival.

Rousseau saw politics as a social contract between a sovereign and citizens. What we call “government” is the interface between them.

The sovereigns of Rousseau’s time were mostly kings, but he envisioned a democracy in which the people collectively were sovereign. But then he ran into a math problem.

In a tiny democracy of, say, a thousand citizens, each possesses one-thousandth of the sovereignty… small, but enough to have a meaningful influence.

Each individual’s share of sovereignty, and therefore their freedom, diminishes as the social contract includes more people. So, other things being equal, Rousseau thought smaller countries would be freer and more democratic than larger ones.

How do we reconcile that with democracy in a US composed of 330 million citizens? I’m not sure we can. It worked pretty well for a long time but maybe, as population grows, the math is catching up to us.

If so, the options are a non-democratic US or a smaller US. Or maybe no US at all.

This land we now inhabit wasn’t always the United States. Nothing requires it to remain so. At some point, it will develop into something else.

When and how that will happen, we don’t know yet. But we know it will.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

By Patrick_Watson

© 2019 Copyright Patrick_Watson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.