Will Powell Decouple Gold from the Stock Market?

Commodities / Gold & Silver 2020 May 25, 2020 - 05:28 PM GMTBy: Arkadiusz_Sieron

This week, Powell gave a long television interview and a testimony to the Senate. What groundbreaking did he say, and what do his remarks imply for the gold market?

Powell Gives Interview and Testifies

Powell dominated media news this week. On Sunday, the Fed Chair gave an interview to CBS news magazine “60 Minutes,” while on Tuesday, he testified before Congress. What did he say? In an interview, Powell tried to persuade viewers that the Fed has not exhausted its powers to help the economy: “we’re not out of ammunition by a long shot (…) So there’s a lot more we can do to support the economy, and we’re committed to doing everything we can as long as we need to”. But are you really so powerful, if you need convince others that you are powerful?

He also reiterated his bearish views from the recent speech to the Peterson Institute for International Economics on the US economic growth in 2020, in which he said that in the second quarter, the GDP could drop by 20-30 percent on an annualized basis, while the unemployment rate could soar to 20-25 percent. Although the GDP will start to recover in the third quarter, it will take some time to pick up steam and the economy won’t get back to where it was before the outbreak of pandemic by the end of this year.

Powell also said that the Congress should spend more money to prevent mass bankruptcies and that it is not the time to worry about the long-term consequences of the rising Fed’s balance sheet and federal debt. So, investors could be prepared for even more interventions from the Fed and Treasury. New lending and spending programs should support gold prices, as the precious metals investors – contrary to bureaucrats and policymakers – really do think about long-term effects. After all, all crises leave scars and the coronavirus crisis will be no exception.

In his testimony before the Senate Banking Committee, Powell basically reiterated what he said earlier. First of all, he assured that the Fed could do much more. He said: “We are committed to using our full range of tools to support the economy in this challenging time even as we recognize that these actions are only a part of a broader public-sector response”.

Implications for Gold

So, Powell does not expect – and we neither – the V-shaped recovery. Actually, Powell said that some sectors of the economy will recover only after the emergence of the vaccine! This is also what we said several times: only vaccine will fully restore the confidence among households, entrepreneurs and investors and without such confidence the recovery of the US economy will not be vivid. The lack of vigorous rebound creates a downside risk for the global stock markets, but it’s rather positive for the gold market.

So far, we claimed that U-shaped recovery (or even L-shaped in some sectors) is more likely. However, there might be also a W-shaped path, a stop-go economy, where the economy swings between contraction and growth, between lockdowns and re-openings, depending on the number of new infections. Such manic-depressive economy should be positive for the gold prices, perhaps even more than the U-shaped recovery, as there is much more uncertainty in the former scenario.

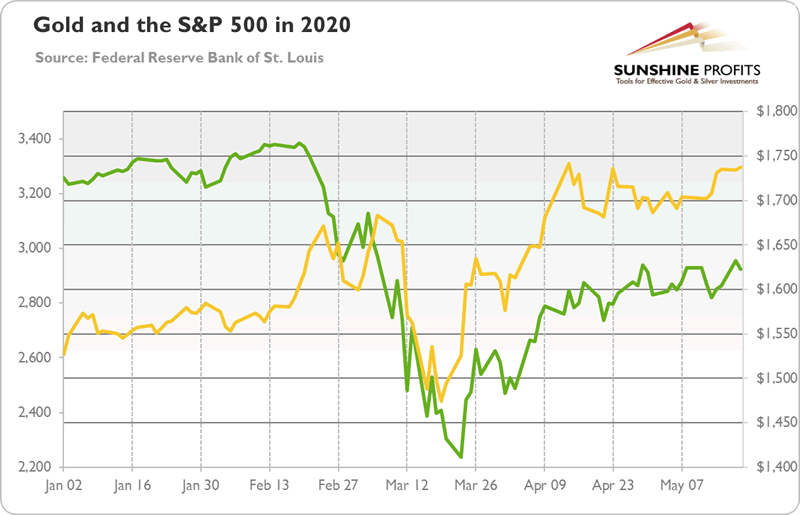

Importantly, Powell’s cautious remarks and worries about the U-shaped or W-shaped recovery could cool stock markets bulls. Over the last few days, we have seen a possible decoupling of the tandem upside moves in gold and equities, as the chart below shows.

Chart 1: Gold prices (yellow line, right axis, London P.M. Fix) and the S&P 500 Index (green line, left axis) from January 2 to May 19, 2020

The price of gold went further up, while the S&P 500 Index came under pressure and seemingly started trading sideways. It is, of course, yet to be seen, whether the real decoupling will actually occur, but there are no doubts that in case it does, it could be a big (positive) change for the gold market.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.