US Real Estate Stats Show Big Wave Of Refinancing Is Coming

Housing-Market / US Housing Jun 02, 2020 - 01:33 PM GMTBy: Chris_Vermeulen

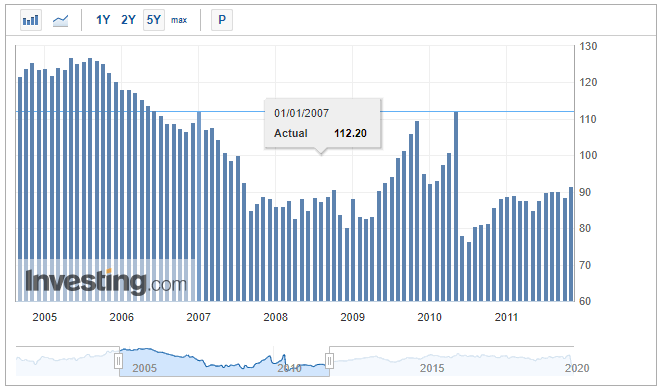

Current data released for the May Real Estate and Consumer Spending activity suggests a wave of refinancing is taking place – and not much else. Pending home sales slipped to 69. That level is 7.4 points below the lowest level in 2010 – at the height of the 2008-09 credit crisis that collapsed the global Real Estate values. How big is this new low level in Pending home sales? It’s HUGE.

It suggests the rate of sales in the US for Real Estate has collapsed beyond levels that were seen at the worst possible time in recent history (July 2010). In fact, over the past 20 years, there has never been a time when the pending home sales index has collapsed below 74 to 75 – until today.

2008-2011 Pending Home Sales Data

The sudden collapse of Pending Home Sales as a result of the COVID-19 virus event should not have come as any surprise to skilled technical investors. Don’t misread this data – there are still homes selling in the US market, buyers are just being far more selective and discerning in regards to their purchases and timing.

Anyone who understands Supply and Demand theory knows that when price levels are perceived to be excessive, consumers slow their purchases considerably as the supply is determined to be overvalued in price. This slowing of purchasing results in a supply glut that will eventually push price levels lower (attempting to attract more buyers).

It is this process of shifting perceptions in the Supply and Demand relationship that is likely taking place right now in the Real Estate market. Low rates in combination with the COVID-19 virus are not prompting more sales of Real Estate right now. Consumers simply don’t have the confidence (perception) that future price appreciation in Real Estate will be substantially based on the current market environment. Thus, the perception of the value of Real Estate changes from optimism to caution.

Before we continue, be sure to opt-in to our free-market trend signals before closing this page, so you don’t miss our next special report!

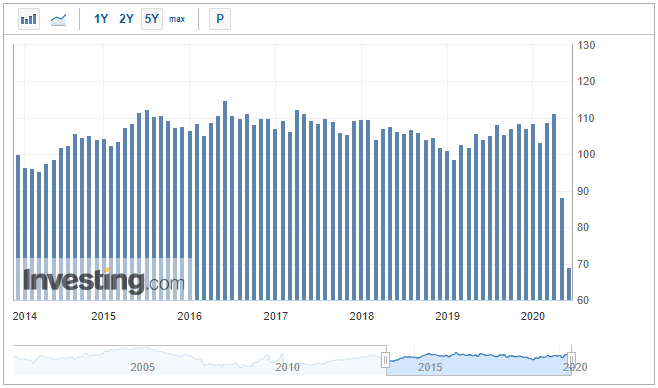

2020 Pending Home Sales Data

A large portion of the issue related to Real Estate is consumer confidence in their ability to earn real incomes and the stability of employment and opportunity related to their future. The COVID-19 virus event has really disrupted a large portion of the US consumer market as well as the future expectations of consumers and spending habits. This disruption is likely to take at least 12 to 24+ months to settle before any real bottom is likely to take place on a broad scale.

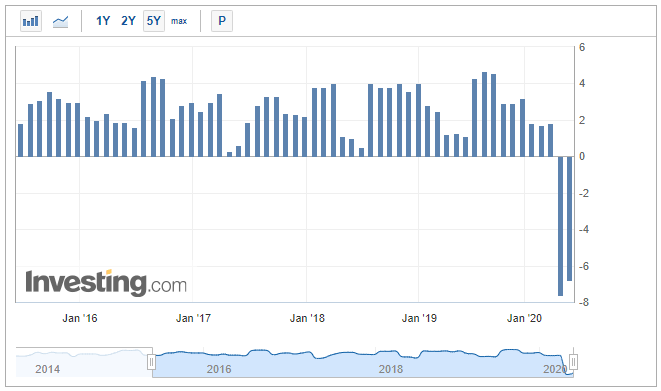

Real consumer spending has collapsed in April and May 2020. Even though the US government has spent trillions attempting to support the US economy, the continued shutdown of cities and states has cut consumers’ jobs, incomes, and the need to go out and spend like normal. Even though they may be saving some extra money throughout this time, the destruction to local and state economies/revenues is devastating.

May 2020 Real Consumer Spending Data

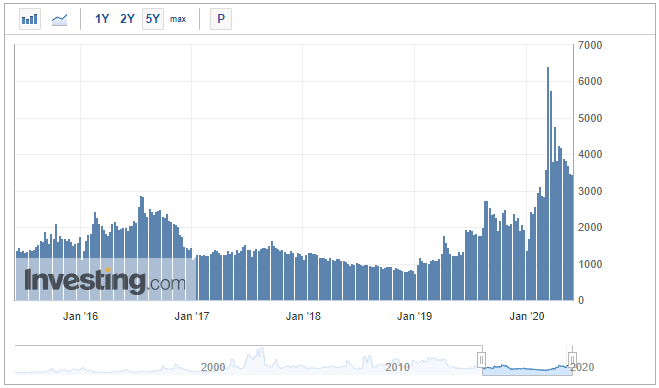

The one aspect of the low-interest rates that we do expect to peak soon is the refinance market. Stronger homeowners with solid income opportunities are able to refinance at lower rates now and that activity seems to be spiking. This is very similar to what happened in 2009-2011 where stronger consumers were able to take advantage of very low-interest rates and were able to shed the 5 to 7%+ mortgages and refinance at much lower levels. Once these transactions peak, these homeowners will likely be settled in their homes for another 5 to 10+ years with new lower rates (unless something disrupts their financial/income situation).

May 2020 Mortgage Refinance Index

Concluding Thoughts:

Combining all of this data into a consensus analysis for technical traders, we come to the conclusion that a wave of refinancing has likely peaked and that consumers are now in the early stage of attempting to understand what the recovery will look like going forward over the next 6 to 12+ months. Add into the mix that we have a US Presidential election taking place in 6 months and the potential policy and tax changes that could take place as a result of this election and we have a real “consumer abyss” setting up over the next 6+ months.

With the Fed doing all they can to support the markets, the COVID-19 virus still causing shutdowns and other issues and the consumer waiting for some clear skies and positive expectations, the US and global economy could be stuck in a mode of greatly decreased consumer activity over the next 6 to 12+ months – which translates into a shift in perspective related to business creation, optimism, income/earnings and much more. A dramatic shift in consumer expectations over a longer period of time could result in far more damaging longer-term issues for assets, state and local governments, and more.

Once the wave of refinancing is completed, we’ll have to see how the housing market data relates to increased consumer optimism. At this point, we don’t believe anything is likely to change consumer attitudes until after the November 2020 elections. Skilled technical traders should prepare for some really big price swings over the next 12+ months. This is the time for technical traders to shine with the setups and data that is being presented right now as well as in the future.

You don’t have to spend days or weeks trying to learn my system. You don’t have to try to learn to make these decisions on your own or follow the markets 24/7 – I do that for you. All you have to do is follow my research and trading signals and start benefiting from my research and trades. My new mobile app makes it simple – download the app, sign in and everything is delivered to your phone, tablet, or desktop.

I offer trading signals for active traders, long-term investors, and wealth/asset managers. Each of these services is driven by my own experience and my proprietary trading systems and modeling systems. I have a small team of dedicated researchers and developers that do nothing but research and find trading signals for my members. Our objective is to help you protect and grow your wealth.

Please take a moment to visit www.TheTechnicalTraders.com/tti to learn more about our passive long term investing signals, Also, get our swing trading signals here www.TheTechnicalTraders.com/ttt. I can’t say it any better than this… I want to help you create success while helping you protect and preserve your wealth – it’s that simple.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.