Gold Price Trend Forecast Analysis - Part1

Commodities / Gold & Silver 2020 Sep 07, 2020 - 03:56 PM GMTBy: Nadeem_Walayat

Hope you have all had good August holidays despite the fast materialising Covid-19 second peaks across the world with the United States leading the way by galloping ahead of the rest. Though much of Europe has also taken it's eye off the ball and is fast seeing it's 2nd peaks materialising with the UK managing to fair better largely due to intelligence of it's citizens rather than any actions from our inept government. Though it is still on a rising trend trajectory as new cases continue to climb with the opening of schools and universities set to feed the covid-19 monster going forward.

If the pandemic was not bad enough for August the UK has had atrocious weather to the extent where one wondered if it's better to lose the £1000 or so spent on bookings than to venture out in this miserable weather.

The primary focus of this analysis is the prospects for the Gold price going into 2021 -

- QE4EVER

- Inflation Mega-trend going Hyper!

- The End of Capitalism?

- Gold Price Analysis and Trend Forecast

- Silver New All time High Coming?

- Is Intel a dying mega corp?

- Nvidia Ampere Blast off!

- TSMC

- AI stocks current state

- Can Trump win 2020?

It has definitely been a good few months too be owning Gold and Silver! My immediate reaction to the new all time highs was that there is a lot of inflation coming down the road, a warning to further leverage oneself to the Inflation Mega-trend consequences of rampant government money printing in attempts at containing the economic consequences of the Chinese virus all as a consequences of gross negligence at the handling of the pandemic that I am sure those who have followed my analysis will be fully aware of, our governments have been NEGLIGENT on an EPIC SCALE! Just look to South Korea and Taiwan amongst many others as to how this Pandemic should have been handled and those are examples WITH the benefit of HINDSIGHT! A good 5 weeks ADVANCE warning of what should be done to contain the virus. Instead our moronic governments did NOTHING until it was TOO LATE!

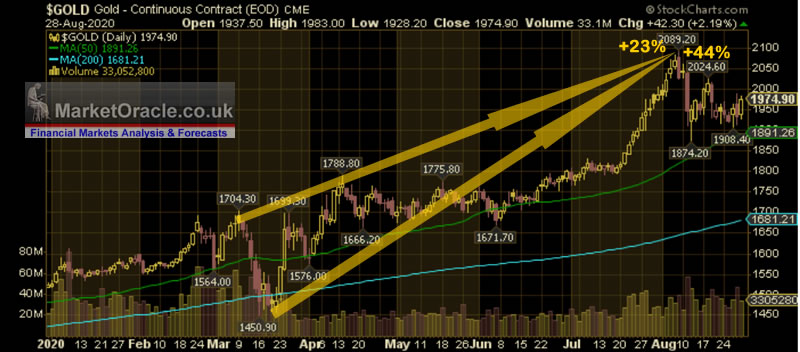

The Gold price traded to a new all time high to well beyond the $2000 milestone after having held in a trading range at just below $1800 for most of the post corona crash bounce.

June saw the gold price further lift it's trading range to $1840 before the fuse was lit and Gold preceded to bust through $1900, and soon above it's previous $1911 all time high, then $2000, finally coming within a whisker of hitting $2100 before turning lower to enter into a trading range of between $2025 and $1875.

My last in-depth analysis of the Gold price was over 7 months ago in Mid January 2020 that concluded in forecast expectations for a trading range for the first few months of the year to give way to a strong bull run from Mid April to target a trend towards $1800 by the end of Summer 2020.

21st Jan 2020 - Gold Price Trend Forecast 2020

Gold Price Trend Forecast 2020 Conclusion

My forecast conclusion is to expect a weak first 4 months or so of the year in preparations for another assault on resistance at $1630, that will likely see the Gold price break through to new highs for this bull market. Whilst downside looks limited to around $1520.

How high could Gold go? I think $1800 / +18% could be pushing thing's a little too far, more likely is to see Gold trading to a high of around $1770 towards the end of Summer 2020.

Risk to the Forecast: That I maybe under estimating how high the Gold price could go during 2020.

Gold's bull run has been nothing short of spectacular, the most significant signal for which was When Gold price soon recovered to rally beyond it's pre corona crash high of $1788, with the latest signal being the break above $1830 that sparked the current phase of Gold's bull market that achieved my forecast target during June 2020.

The rest of this extensive analysis whose primary focus ia a Gold Price trend forecast has first been made available to Patrons who support my work -

Gold Price Trend Forecast into 2021, Is Intel Dying?, Can Trump Win 2020?

- QE4EVER

- Inflation Mega-trend going Hyper!

- The End of Capitalism?

- Gold Price Analysis and Trend Forecast

- Silver New All time High Coming?

- Is Intel a dying mega corp?

- Nvidia Ampere Blast off!

- TSMC

- AI stocks current state

- Can Trump win 2020?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And access exclusive to Patrons only content:

How to Get Rich Investing in Stocks by Riding the Electron Wave.

Not to mention trend forecasts such as - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.