Three Financial Markets Price Drivers in a Globalized World

Stock-Markets / Financial Markets 2021 Jan 16, 2021 - 05:08 PM GMTBy: P_Radomski_CFA

Do you want to know how gold will be doing soon? Or the USDX? You have to look at the German and French economies. You may ask “What? How can they be tied together?” Well, the globalization of markets is one of the core foundations of the modern world. With everything interrelated, nothing in economics can be examined in a vacuum state. That includes the three precious metals price drivers: stocks, yields and currencies.

The EUR/USD currency pair is a perfect example of this interconnectivity. Being the most popular and most traded currency pair in the world, the EUR/USD is influenced by many factors, including the price action in the USD Index as well as the strength of the European and American economies at any given time. The same level of interconnectedness can be applied to the other price drivers.

Let’s take a fundamental look at stocks, yields and currencies.

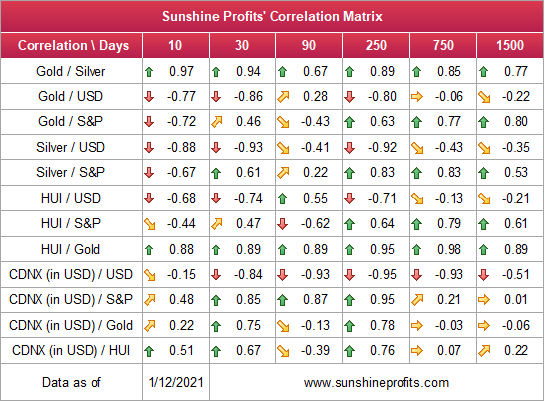

As you can see in our Correlation Matrix , the 30-trading-day correlation values are strongly negative in the case of all key parts of the precious metals market (gold, silver, senior miners, junior miners) and the USD Index, while they remain generally positive in case of the link with the stock market. Both links are most visible when we take the 250 trading days into account (effectively about 1 year).

Figure 1

The closer to -1 the number gets, the more negatively correlated given assets are, and the closer to 1 it gets, the stronger the positive correlation. Numbers close to zero imply no correlation.

So, what do these markets tell us about future movements in the price of gold?

Future History

Yesterday , I highlighted the record excess that’s building up across U.S. equities. And as we approach the middle of January, investors are giving new meaning to Paul Engemann’s Push It to the Limit .

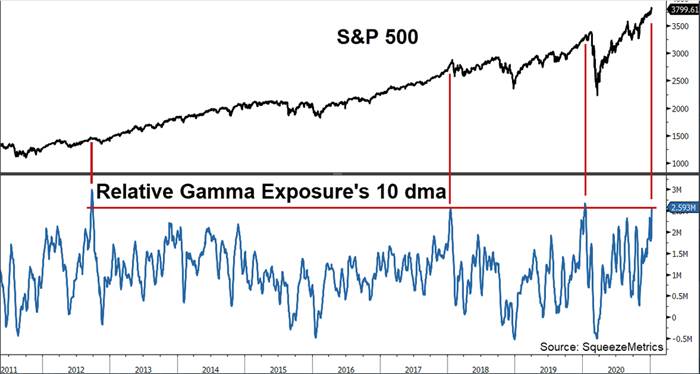

Last week, the S&P 500’s option Gamma (21-day moving average) reached the top 0.37% of all-time readings. And on Monday (Jan. 11), the 10-day MA set a new record.

Please see the chart below:

Figure 2

Keep in mind, Monday’s record was set on an absolute basis (by analyzing the number of outstanding options contracts). However, relative to the S&P 500’s market cap (which biases the reading lower as stocks move higher), it’s the fourth-highest since 2011. More importantly though, the last three times Gamma exposure reached the current level, the S&P 500 fell by 7.9%, 7.3% and 31.0% over the following two months (the vertical red lines above).

From a valuation perspective, the derivatives frenzy has also helped push the NASDAQ (4.17x), S&P 500 (2.85x) and Russell 2000’s (1.49x) price-to-sales (P/S) ratios to their highest levels ever.

Please see below:

Figure 3 – (Source: Bloomberg/ Liz Ann Sonders)

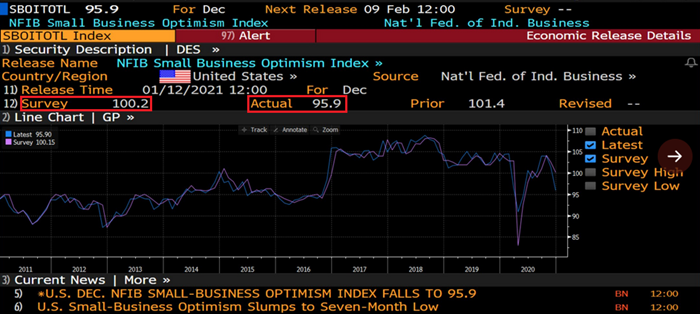

And a day after the milestones were set, U.S. small business confidence (the NFIB Small Business Optimism Index) fell to a seven-month low (Jan. 12).

Figure 4 - (Source: Bloomberg/Daniel Lacalle)

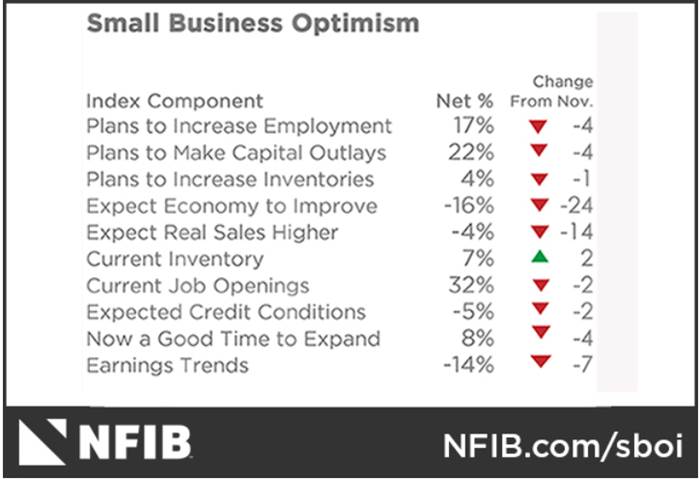

In addition, while economists expected a print of 100.2 (the red box on the left), the reading came in at 95.9 (the red box on the right), more than two points below the index’s historical average. Furthermore, nine out of 10 survey categories indicated that economic conditions are worse than they were in November.

Figure 5

As another wonder to marvel at, U.S. Treasury yields are also surging (which I’ve mentioned during previous editions). And because corporate profits are still on life support (due to the lack of real economic activity), the spread between the S&P 500’s earnings yield and the U.S. 10-Year Treasury yield just hit its lowest level in over two years.

Please see below:

Figure 6 – (Source: Bloomberg/ Lisa Abramowicz

To explain, the earnings yield is the inverse of the S&P 500’s price-to-earnings (P/E) ratio (calculated as earnings divided by price). The percentage is often compared to the yield on the U.S. 10-Year Treasury to gauge the relative value of stocks versus bonds. If you look at the middle of the chart, you can see that the spread between the two peaked at more than 6% in 2019 (as companies’ EPS rose and bond yields fell). However, with the opposite occurring today, the spread between the two has fallen below 2.23%.

Thus, with bond yields beginning to breathe new life, Jerome Powell’s (Chairman of the U.S. Federal Reserve) argument that P/E multiples are “not as relevant” in a world of low interest rates is starting to lose its luster.

EUR/USD Struggles with Reality

Despite bouncing yesterday (as declines rarely happen linearly), the EUR/USD is still treading fundamental water.

Over the last few weeks, I’ve been highlighting the increased economic divergence – as a weak U.S. economy is overshadowed only by an even-weaker Eurozone economy (Remember, currencies trade on a relative basis.)

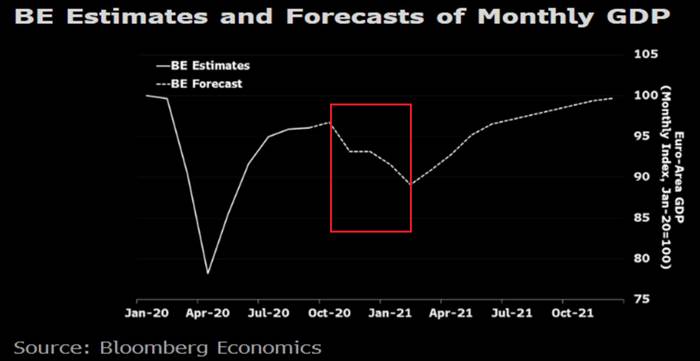

And as another data point of validation, yesterday, Bloomberg Economics reduced its first-quarter GDP forecast (for Europe) from a rise of 1.3% to a decline of 4.0%. Furthermore, the team also reduced their full-year GDP growth forecast from 4.8% to 2.9%.

Please see below:

Figure 7

If you analyze the red box, you can see the massive drop in economic activity that’s expected during the first three months of 2021. And even more pessimistic, Peter Vanden Houte, ING’s Chief Economist wrote (on Jan. 7) that he believes “it will take until the summer of 2023 for the Eurozone to regain its pre-crisis activity level.”

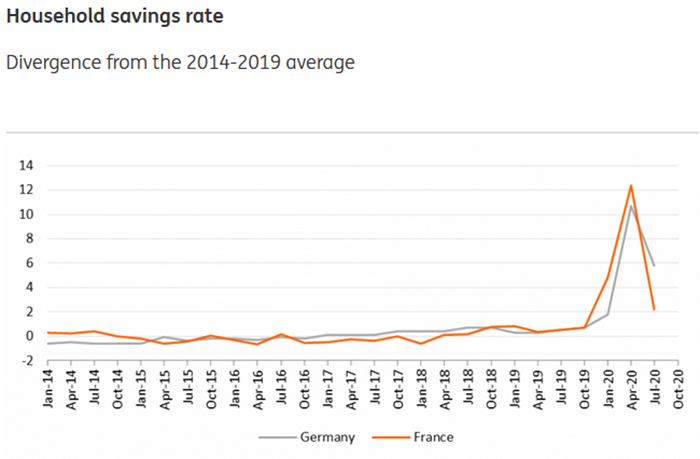

Also plaguing Europe, please have a look at the sharp decline in the Eurozone household savings rate:

Figure 8 – (Source: Refinitiv/ING)

To explain, the huge spike in 2020 was a function of government programs to replace lost wages at the onset of the pandemic . However, as the crisis unfolded and the level of government spending became unsustainable, the household savings rate in Germany and France (Europe’s two largest economies) sunk like a stone.

Moreover, with Eurozone retail sales plunging by 6.1% in November, and assuming the household savings rate followed suit, you can infer that households are allocating resources to necessities and not discretionary items that boost GDP.

The bottom line?

The European economy is underperforming the U.S. economy and the deluge of bad data is slowly chipping away at the euro. And as the fundamental damage continues, the EUR/USD should come under pressure and help propel the USD Index higher.

As part of the fallout, gold will likely drop below its rising support line and then decline further. Once it bottoms, we’ll have a very attractive entry point to go long in the precious metals and mining stocks.

Thank you for reading today’s free analysis. Its full version includes details of our currently open position as well as targets of the upcoming sizable moves in gold, silver and the miners. We encourage you to sign up for our free gold newsletter – as soon as you do, you'll get 7 days of free access to our premium daily Gold & Silver Trading Alerts and you can read the full version of the above analysis right away. Sign up for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.