Stock Market S&P 500 Continues To Climb, See What Sectors Are Set to Climb Even Higher

Stock-Markets / Stock Market 2021 Feb 09, 2021 - 06:13 PM GMTBy: Chris_Vermeulen

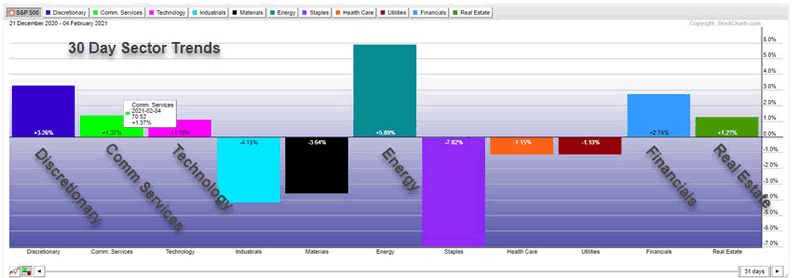

While you may not have been paying attention, some of the strongest sectors are already showing great strength and setting up for new breakout rallies. Over the past 30+ days, sector trends have rotated as the market volatility has increased. Right now, we are seeing strength in some of the same sectors that were leading the markets 60+ days ago: Discretionary, Comm Services, Technology, Energy, Financials, and Real Estate. If you are not paying attention to these trends, you may miss some of the best assets to trade given big sector ETF moves we’ve seen in early 2021.

Strongest Sectors Lead With Big Trends

Existing trends, investor expectations, and government policies all work together to drive forward trends and expectations in sectors. Looking at the following 30-day sector comparison graph from www.StockCharts.com, we can see that Discretionary, Energy, and Financials have been the strongest sectors over the past 30+ days. Comm Services, Technology, and Real Estate are close behind.

It is important to understand how these sectors and rotational trends within these sectors create opportunity when breakout patterns become evident. With continued strength in these sectors, traders can attempt to take advantage of potentially explosive upside trends before the breakouts take place.

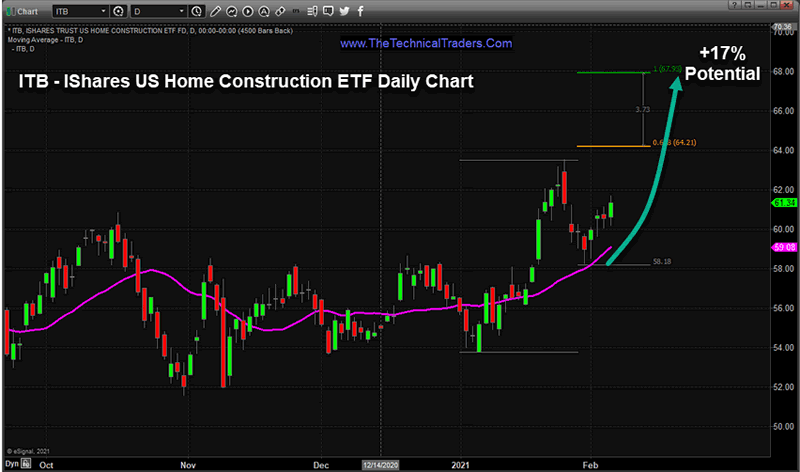

Home Construction Showing Potential – +12% or more

I will start off by illustrating the opportunities in ITB, the US Home Construction ETF. This Daily ITB chart highlights our use of the Fibonacci Extension tool to attempt to pinpoint upside price targets based on past price trends. The recent bottom near $58 suggests an upside price trend is likely to attempt to break above $64 while targeting $64.20 & $68. From the lows of this move, this represents a 17%+ rally where 12%+ of this move has yet to complete. The key to this upside breakout rally is for ITB to rally above $64.

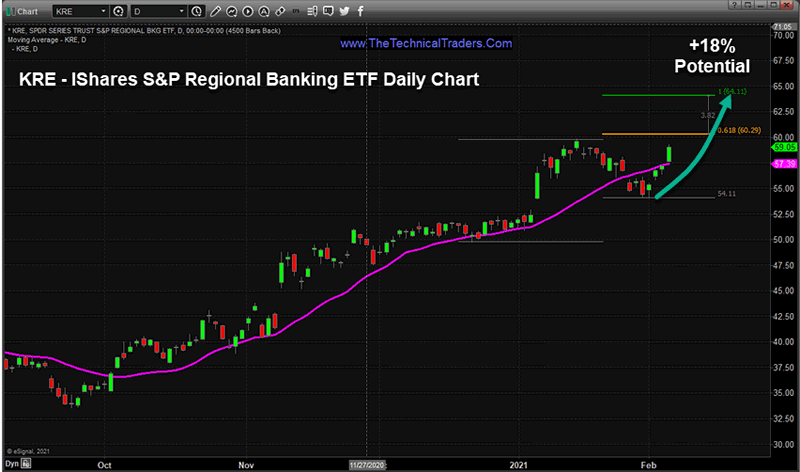

Regional Banking May Breakout Much Higher- +10% or more

Next, we will focus on Regional Banking with KRE, the S&P Regional Banking ETF. This Daily KRE chart, again, highlights our use of the Fibonacci Extension tool to attempt to pinpoint upside price targets based on past price trends. The recent bottom near $54 suggests an upside price trend is likely to attempt to break above $64 while targeting $60.00 & $63.60. From the lows of this move, this represents a 18%+ rally where 10%+ of this move has yet to complete. The key to this upside breakout rally is for KRE to rally above $60.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

Take special notice of the recent upside price rally that has recovered nearly all of the recent downside price rotation. KRE appears to be trending higher quite nicely and may attempt a breakout rally very soon.

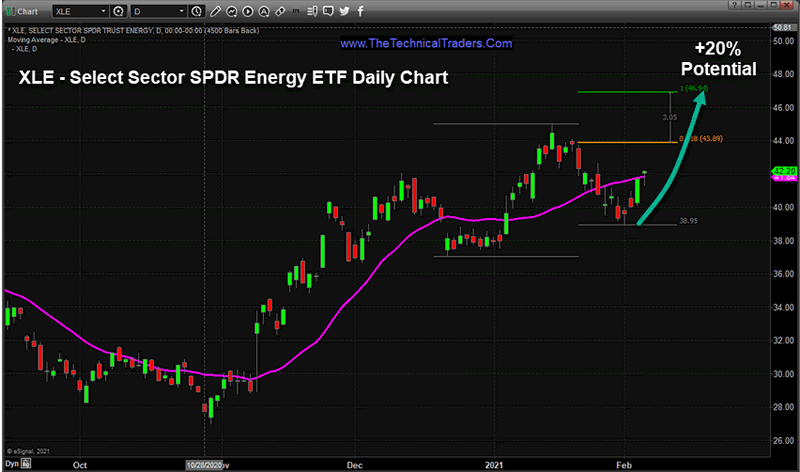

Energy Sector Still Has Great Potential – +11% or more

Last, we will focus on opportunities in Energy with XLE, the SPDR Energy ETF. This Daily XLE chart highlights our use of the Fibonacci Extension tool to attempt to pinpoint upside price targets based on past price trends. The recent bottom near $39 suggests an upside price trend is likely to attempt to break above $43.80 while targeting $44 & $47. From the lows of this move, this represents a 20%+ rally where 11.5%+ of this move has yet to complete. The key to this upside breakout rally is for XLE to rally above $44.

The similarities of these setups/pending upside breakout trends are not by accident. The strongest market sectors have recently rotated downward and have begun to resume the upward price trends. When this happens, the Fibonacci price extension utility we use to highlight the next most logical upside price targets can become very accurate for trading targets. Additionally, the opportunities of these trends, ranging from 8% to 18% or more based on the current setups, provides some very real opportunities should these breakout trends continue higher.

Sector trends can become a very powerful tool for traders to consistently find and execute profitable trades in bigger trends. 2021 is going to be full of these types of trends and setups. Quite literally, hundreds of these setups and trades will be generated over the next 3 to 6 months in various sectors and our BAN Trader Pro technology can help you find the best setups. The BAN Trader Pro technology does all the work for us.

As traders begin to realize the upward price potential as they watch this rally momentum build, we believe a shift in thinking will take place. Once multiple sector averages break above recent highs and the Transportation Average breaks higher, then a broad sector confirmation of this renewed rally phase will drive traders back into the markets. As some sectors fail, others will begin to trend higher. We watch these sectors to determine what are the best sectors to trade based on relative strength and momentum and then trade their respective ETFs. I call this my Best Asset Now, or BAN, strategy.

My subscribers and I are loving the strategy – we took out three ETF trades in the three hottest sectors and one Index trade and all are moving up nicely after only 2.5 days. We hit our 7%, 15%, and 20% targets for one of our trades within 48 hours, and continue to ride the remainder of our position in that trade up until we are stopped out! This is how we make money while still getting that awesome, excitable feeling from being in an explosive, possibly parabolic, trade!!

Don’t miss the opportunities in the broad market sectors over the next 6+ months, which will be an incredible year for traders of the BAN strategy. You can sign up now for my FREE webinar that teaches you how to find, enter, and profit from only those sectors that have the most strength and momentum. As some sectors fail, others will begin to trend higher. Learn how BAN Trader Pro can help you spot the best trade setups; staying ahead of sector trends is going to be key to success in these markets.

For those who believe in the power of trading on relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you. In addition to trade alerts that can be entered into at the end of the day or the following morning, subscribers also receive a 7-10 minute video every morning that walks you through the charts of all the major asset classes. For traders that want more trading than our 20-25 alerts per year, we provide our BAN Trader Pro subscribers with our BAN Hotlist of ETFs that is updated each day. We issued a new trade alert for our subscribers today and all four trades are well on their way to great returns!

Have a great weekend!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.