Stock Market Summer Correction Review, Crypto CRASH, Bitcoin Bear Market Initial Targets

Stock-Markets / Financial Markets 2021 May 31, 2021 - 04:27 PM GMTBy: Nadeem_Walayat

This article is an excerpt from my recent extensive analysis that concludes in my latest biotech stock picks with the potential to X10 over the coming years Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond! that has first been made available to Patrons who support my work.

Topics Include:

- Invest and Forget

- Stock Market Early Summer Correction Review

- AI Stocks Strength vs Weakness

- RAMPANT MONEY PRINTING INFLATION BIG PICTURE!

- HIGH RISK STOCK BUYING LEVELS

- RISK RATINGS

- WESTERN DIGITAL - WDC $71 - CHIA! - Risk 1

- Life Sciences Biotech Smaller Cap High Risk Stocks Investing Binge

- Biotech stock 1 - Cheap Low Risk Pharma - Risk 1

- Biotech stock 2 - HIGH RISK GENE EDITING - Risk 9

- Biotech stock 3 - Low Risk 2

- Biotech stock 4 - X10 for Max Risk 10

- High Risk Stocks Portfolio Buying Levels

- Covid India Black Mold Epidemic

- Bitcoin and Raven Coin Buying Levels

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Five more small cap high risk stocks with the potential to X10 to invest in for 2021 and beyond, which follows on from my analysis of 9th of April How to Invest in HIGH RISK Tech Stocks for 2021 and Beyond featuring 5 stocks as I am seeking to replenish my portfolio after many former small cap high risk stocks have either been taken over or migrated into becoming 'safe' stocks such as Nvidia, AMD and TSMC, where the best of the new stocks in terms of current valuations was Corsair.

DISCLAIMER - The analysis in this article is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any investing or trading activities.

INVEST AND FORGET

Firstly do check out my earlier analysis (How to Invest in HIGH RISK Tech Stocks for 2021 and Beyond) so as to understand the mechanisms of investing and holding small cap high risk stocks where the basic strategy is to allow the winners to run to X10+ so as to offset those stocks that fail to take off which means a hands off approach is a must, else huge mistakes could be made such as exiting stocks too early that take off and thus fail to capitalise upon X10 growth which means one will be left only holding those stocks that failed to takeoff.

During this process I have screened over 200 stocks in attempts to identify smaller cap stocks that I am personally seeking to invest in for the long-run at the right price. And the primary screening tool I used during this exercise was the website Simply Wall Street, which allowed me to skim through stocks at the rate of about 6 per hour to identify those that could increase their market caps by several multiples whilst also seeking to limit the risk of failure and the stocks going to zero.

Stock Market Early Summer Correction Review

The stock market is in the midst of my forecast time window for an early summer correction of approx 10% decline as illustrated by my trend forecast graph-

9th Feb 2021 Dow Stock Market Trend Forecast 2021

(Charts courtesy of stockcharts.com)

The stock market correction began shortly after my last analysis with the first down leg terminating at just under 33,500 followed by rally to the lose close of 34,,394. My expectation are for the correction to run for several more weeks so there should be at least one more down leg to below the 33,500 towards my target of 32,500.

Meanwhile the correction in tek stocks has been far more severe, which has taken the Nasdaq to a low of 13000 from its high of 14,200 for a 9% correction before the recent bounce to 13,681. The Nasdaq like the Dow should also see another leg lower to new lows to target a trend to 12600.

Bitcoin and Ravencoin Crypto's CRASH Initial Bear Market Price Targets

Whilst my in-depth analysis is pending completion, however I have been flagging for several months that the crypto's are in a bubble that will burst / crash / plunge enter into a bear market for which we received a taste of what to expect a few days ago. So my message and strategy has been NOT to hold any meaningful amount of crypto i.e. the only crypto I have is what I have mined with a couple of existing desktop PC's and even then most of the funds generated (80%) have been SPENT because I know that the price of most of not all crypto's is going to head a lot lower.

So in response to patron requests and in advance of my more in-depth analysis on the crypto space that is about 50% complete, then here are the approx range of buying levels that I have had penciled in for Bitcoin for sometime of where I would be tempted to look at actually buying Bitcoin with fiat, though attempts to fund my Coinbase account with fiat has so far failed but I will leave that for my next analysis.

So $19k to $22k is where I would consider accumulating Bitcoin which I will develop further in my next analysis that I aim to complete before the end of this month to include a strategy of what to do during an anticipated crypto bear market, of what crypto's I will be looking to accumulate at much lower prices than where they trade today with a significant amount of holdings generated via GPU mining, but for which we have plenty of time as I expect the bear market for most crypto's to run for a good year or so from peak to trough, so I am in no rush to panic buy on chaotic price action, though saying that setting limit orders at levels well below where the crypto's are trading can and did get me filled on some more raven coins that I have been seeking to accumulate as I have flagged in several preceding articles, so very volatile price action can get one crypto's much cheaper than where they are actually trading at most of the time, that is the nature of the volatile crypto space.

Imagine all of the perma bull crypto maniac traders trading on margin who just got nuked on the various wild wild west exchanges as their stops were hit!

And remember folks crypto's for me are a low priority so frequency of articles focused on the crypto space will remain low i.e. I don't see myself ever holding more than about 1% of total assets in crypto's, people talk about parking their excess funds in crypto would instead be much better served by parking excess cash in the likes of Google.

Is the Crypto CHIA a Scam for an $100 Billion IPO?

CHIA the so called GREEN crypto that is fast gobbling up all available hard disk storage space with many hundreds of thousands busily farming away 100gb plots in attempts to win the elusive CHIA coins that has in the past couple of weeks commanded prices as high as $1600 per coin so very enticing to sucker in many crypto enthusiasts into it's event horizon including me! Though I soon realised after a weeks farming / plotting that the chances of winning were virtually ZERO, so I stopped plotting Chia on the 14th of May which is where my plot count has remained static at 142 or 14tb of storage used as the maths does not stack up! Furthermore 2 weeks on my decision to stop farming proved correct as the ponzi game that CHIA is has become apparent, one of a mass of unfarmed Chia coins that will go into an IPO, CHIA INC, so as to get the fools on Wall Street to plow upwards of $100 billion into in valuation terms thus allowing the CHIA insiders to cash out with billions all without selling a single CHIA coin!

For GPU mining check out Nicehash

For managing your crypto's see Coinbase

For crypto trading and investing see Binance (includes 10% discount on trading fees)

Covid India Black Mold Epidemic

The Indian strain is fast becoming dominant in the UK which has the government implementing plans for a third booster dose later this year. Meanwhile India is seeing a new emerging nightmare consequence of covid-19 - black mold disease, an opportunist fungal disease which is related to high blood sugar levels i.e. diabetes which is at epidemic levels in India that now the black mold disease is capitalising upon due to immune system impaired covid-19 infections. Black Mold KILLs tissue and if untreated has a fatality rate of 94%! Far in excess of covid-19! Though it can be treated in the early stages with anti-fungal's but if left unchecked would require expensive specialist treatment i.e. surgical intervention to remove the dead tissue.

Hospitals in India are reporting a surge in patients infected with black mold disease across 29 states, for instance 1 large state hospital (Maharaji Yehswantrao) is reporting 185 cases during the weekend alone when the hospital was used to experiencing 2 cases per year and has become more challenging than Covid-19 in terms of hospital resources. This illustrates the broader danger of covid in that it can allow opportunist killers to gain a foothold on a population where the healthcare system has been brought to a state of collapse.

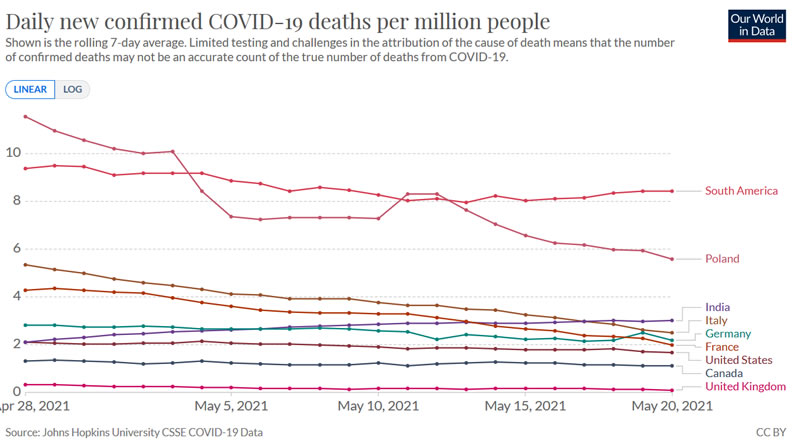

Meanwhile India continues to under report the true extent of the pandemic with actual deaths likely 5 times official numbers, so around 15 deaths per million people per day as does likely most of Africa to an even greater extent. The pandemic also continues to worsen in most of the South American nations.

So covid looks like becoming a permanent income stream for pharma's, both in terms of vaccines and treatments such as anti fungal's for the emerging consequences such as Black Mold disease.

Again this article is an excerpt from my recent extensive analysis that concludes in my latest biotech stock picks with the potential to X10 over the coming years Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond! has first been made available to Patrons who support my work.

Topics Include:

- Invest and Forget

- Stock Market Early Summer Correction Review

- AI Stocks Strength vs Weakness

- RAMPANT MONEY PRINTING INFLATION BIG PICTURE!

- HIGH RISK STOCK BUYING LEVELS

- RISK RATINGS

- WESTERN DIGITAL - WDC $71 - CHIA! - Risk 1

- Life Sciences Biotech Smaller Cap High Risk Stocks Investing Binge

- Biotech stock 1 - Cheap Low Risk Pharma - Risk 1

- Biotech stock 2 - HIGH RISK GENE EDITING - Risk 9

- Biotech stock 3 - Low Risk 2

- Biotech stock 4 - X10 for Max Risk 10

- High Risk Stocks Portfolio Buying Levels

- Covid India Black Mold Epidemic

- Bitcoin and Raven Coin Buying Levels

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Bitcoin and Crypto's Trend Forecast / Bear Market Accumulation Strategy - 50% done

- More X10 Biotech Tech Stocks - 30% done

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your investing in biotech stocks analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.