AI Stock Buying Levels, Ratings, Valuations and Trend Analysis into Market Correction

Stock-Markets / AI Jun 17, 2021 - 06:06 PM GMTBy: Nadeem_Walayat

This is part 3 of my recent extensive analysis focused on updated buying levels for my AI tech stocks portfolio going into the summer stock market correction, of what I will be looking to accumulate at what price levels.

Part 1 covered Tesla, ARK Funds and more - TESLA! Cathy Wood ARK Funds Bubble BURSTS!

Part 2 covered The Top 5 AI stocks trend analysis - Top 5 AI Tech Stocks Trend Analysis, Buying Levels, Ratings and Valuations

Whilst the whole of this extensive analysis AI Stock Buying Levels, Ratings, Valuations and Trend Analysis into Market Correction was first been made available to Patrons who support my work.

Contents:

- TESLA

- Cathy Wood ARK Funds CRASH!

- India Apocalypse Heralds Catastrophe for Pakistan and Bangladesh

- Covid-19 in Italy in August 2019!

- Stock Market Early Summer Correction Trend Forecast

- Stocks Expensive or Cheap Indicator (EC)

- AI Stock Buy % Rating Review

- 1. GOOGLE - $2398

- 2. AMAZON - $3312

- 3. MICROSOFT - $252.5

- 4. APPLE - $130

- 5. FACEBOOK - $320

- 6. NVIDIA - $592.5

- 7. AMD - $78.8

- 11. IBM - $145.5

- 12. INTEL - $57.7

- AI Stocks Buying Levels Update May 2021

- So what am I going to do

- GPU Mining FREE MONEY!

- CHIA Crypto Farming with Your Hard Drives Insanity!

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including access to my recent analysis: Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond!

- Invest and Forget

- Stock Market Early Summer Correction Review

- AI Stocks Strength vs Weakness

- RAMPANT MONEY PRINTING INFLATION BIG PICTURE!

- HIGH RISK STOCK BUYING LEVELS

- RISK RATINGS

- WESTERN DIGITAL - WDC $71 - CHIA! - Risk 1

- Life Sciences Biotech Smaller Cap High Risk Stocks Investing Binge

- Biotech stock 1 - Cheap Low Risk Pharma - Risk 1

- Biotech stock 2 - HIGH RISK GENE EDITING - Risk 9

- Biotech stock 3 - Low Risk 2

- Biotech stock 4 - X10 for Max Risk 10

- High Risk Stocks Portfolio Buying Levels

- Covid India Black Mold Epidemic

- Bitcoin and Raven Coin Buying Levels

And access to my latest analysis - Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

DISCLAIMER - Investing in the stock market is HIGH RISK. The analysis in this article is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any investing or trading activities.

6. NVIDIA - $592.5

Nvidia is experiencing price volatility in large part due to too attempts to digest ARM, most recent news being the UK government citing national security concerns prompting investigation into the $40 billion acquisition, just prior to which Nvidia announced 3 new ARM processors focused on server AI , data processing unit, and an autonomous vehicle system on a chip. Whilst the crypto mania continues to result in extremely high demand for Nvidia GPU's. Nvidia's EC level gyrates along with it's stock price to currently stand at 127, against 107 in Feb. The stock currently is over valued which means don't expect Nvidia to rocket higher anytime soon, unless Nvidia gets an early ALL clear regarding it's takeover of ARM.

Nvidia is another stock that is in the process of digesting it's 2020 gains and thus recent breakouts higher have failed with the stock resolving into a wide 20% trading range of between $500 and $600, where Nvidia is a buy at just over $500 and then again at just under $500. Therefore the high probability Buy Level for Nvidia is $505. But again upside appears very limited and so Nvidia is definitely not a good buy at $592.

7. AMD - $78.8

AMD has been the weakest performing stock on my list, down 13% on the year, why? AMD is trading on an EC of 55 which is fairly priced especially when one compares it to the likes of Nvidia (127). So it should be a good buy? Unless there is something going on I am not aware of. The Zen 3 and Epyc processors are Good, GPU's hmm, not quite knocking on Nvidia's door yet, though still has Intel on the ropes, though Intel is priced for armageddon! Maybe it's the market fearing what Nvidia ARMED with ARM could do to AMD? Still compared to it's recent valuations AMD is cheap but that does not mean it can't get cheaper! Especially when one can pick up Intel for peanuts. Something does not seem right, down 13% on the year. Are there tech funds out there in trouble offloading AMD stock on the quiet just as Cathy Wood is probably selling Tesla on the quiet? Something is afoot and I don't know exactly what it is.

AMD stock chart looks toppy, it appears AMD could take a tumble to the next support area of $55 to $60, which would make AMD very cheap! I think we maybe in for one of those market gets the jitters moments, as it appears to me the market is looking for an excuse to sell AMD lower. So on the one hand we have strong fundamentals and on the other hand we have a toppy price chart. If AMD falls then how can Nvidia that is far more expensive not fall further? This is definitely puzzling but not worrying, as in the long-run both AMD and Nvidia will trade to new all time highs. Normally I would say the buying level is $75. But there is a better than 50/50 probability that AMD is going to break the low and tumble to next support in the $55 to $60 area. Therefore the buying level for AMD in this analysis is $60, as the markets appear to want to see at least AMD take a tumble, that's what the chart and the valuation suggests. The alternative (less probable) is that $75 holds during the correction. In terms of buy % then it will have to be a neutral 50%.

The bottom line the company is continue to move in the right direction in terms of fundamentals regardless of what the price chart suggests for it's near term fate. AMD is a GOOD long-term hold, and current valuation is fairly reasonable so maybe $75 will hold for a trend back towards $100.

11. IBM - $145.5

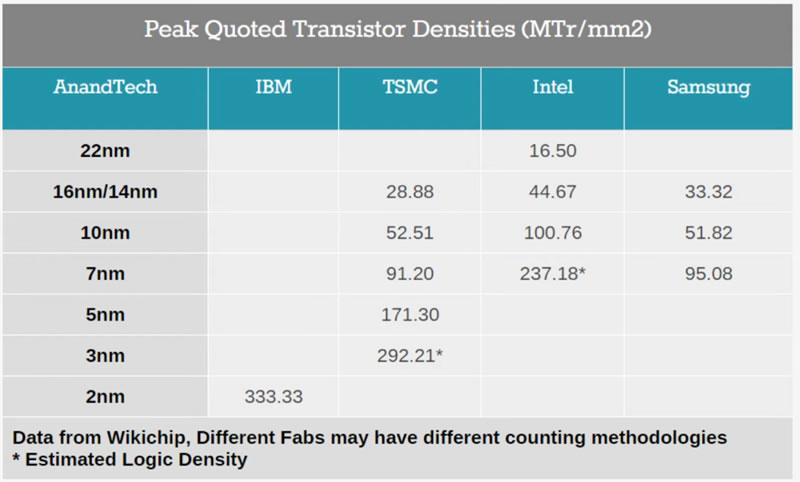

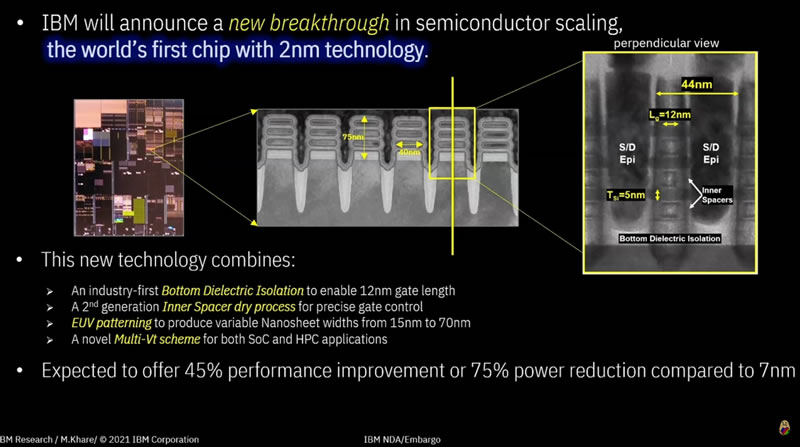

If Intel is Cheap and then IBM is even more so, this tech sleeping giant is trading on an EV of .just 7. Whilst Intel is still stuck on 14nm for desktop / workstation cpus, just managing to make it to 10nm on server chips. whilst AMD is onto it's 2nd generation of 7nm processors and next year will make the move to 5nm courtesy of TSMC, with Intel forced to seek TSMC to produce it's 13th Gen processors in 2023. Of course not all nanometres are the same but Intel's latest 11th Gen processors really are garbage no matter how many ++++ Intel adds on to the end of 14nm.

So where do you does IBM the sleep giant stand in processor nm terms? 10nm? 7nm? 5nm? 3nm? Think again, 2nm! That's what you call cutting edge! Though of course IBM does not produce processors but it does do R&D. But is it true 3nm or is it one of the ++++ tricks that Intel try's to pull? What counts is transistor density per mm2 rather than gate size.

Well yes, it looks like IBM is leading the pack, you may ask what's the big deal if IBM does not produce processors, the answer is PATENTS! IBM licences it's technology to others to produce and IBM got there first! Little of this is priced into the stock price, for if it where IBM would probably be trading at double it's current price.

In technical terms it confirms what I have been stating for several years that MOORES LAW IS NOT DEAD! Transistor shrinkage is going to go to well under 1 nm, probably down to 0.5nm! Also IBM has been busy buying a string of small cap tech stocks over the past 12 months, at least 10 purchases.

So you should not be surprised that whilst most other stocks have been drifting lower, IBM has soared towards recent highs. However before you pop the corks, understand that IBM has been stuck in a decade long trading range of about $150 to $100. Currently the stock is trading near the upper end of this trading range. Of course we are invested to capitalise upon an eventual breakout higher, so the strategy for many years has been to accumulate IBM between $110 and $100 for which there tends to be opportunities most years. Unfortunately one cannot say WHEN IBM will break to new highs, for it has been here at $150 many times before over the past 10 years.

The market remains blind to IBM because it has been asleep for so long that few take notice of what IBM is upto! All eyes are on the FAANG's, few care to take a peek at IBM despite the fact that it is dirt cheap! IBM is a sleeping giant with flickering eyelids, perhaps this is the time when it wakes up and soars into the stratosphere to join it's brethren such as AMD, Nvidia and TSMC. One things for sure all those who sell IBM at $148 will regret in years to come! The buying level has to be based on technical's that suggest the next stop for a stock in a trading range should be to target support at $115 and $103, therefore the Buying Level is $116 and a Buy rating 45% given that it is at the top of it's trading range, which means probability favours a correction.. Mean while bank that 8% dividend (on purchases at $116 or better).

12. INTEL - $57.7

What if you could buy TSMC for about 1/3rd the price? We'll that's INTEL! It's cheap and has been cheap for a while because of BAD management! The guy or gal at the top really does matter!

Intel trades on an EC of 7 whilst TSM is on 59! But everyone's focused on buying TSM! This illustrates how the market has it's FAVOURITES and its Dogs, today's favourites are the likes of TSMC and Tesla, of course the market focus on TSMC at least is for GOOD reasons, still that does not distract from the fact that Intel is CHEAP in terms of valuation. It's NOT going to go BUST! There are a lot of pros and cons to investing in Intel many of which I have covered over the past couple of years. but the bottom line is that Intel is an american chip manufacturer so is in US strategic interests for it to not only survive but prosper to offset the threat from China, Taiwan and other asian chip manufacturers. Intel could become what TSM is to the markets today.

I am sure I mentioned last year that in a few years time I would not be surprised if Intel trades as high as $200 a share, so there is a LOT of upside with little downside risk. AND it pays a dividend!

Clearly Intel is in a trading range of between $66 and $44, a level that it tends to frequent often though does not stay below 50 for long. Therefore the buying level is 48. I think in a few years time many people will be kicking themselves for not having had the foresight to invest in Intel when it was dirt cheap. Especially given that there is a chip shortage so even Intel's Rocket lake garbage is in high demand!

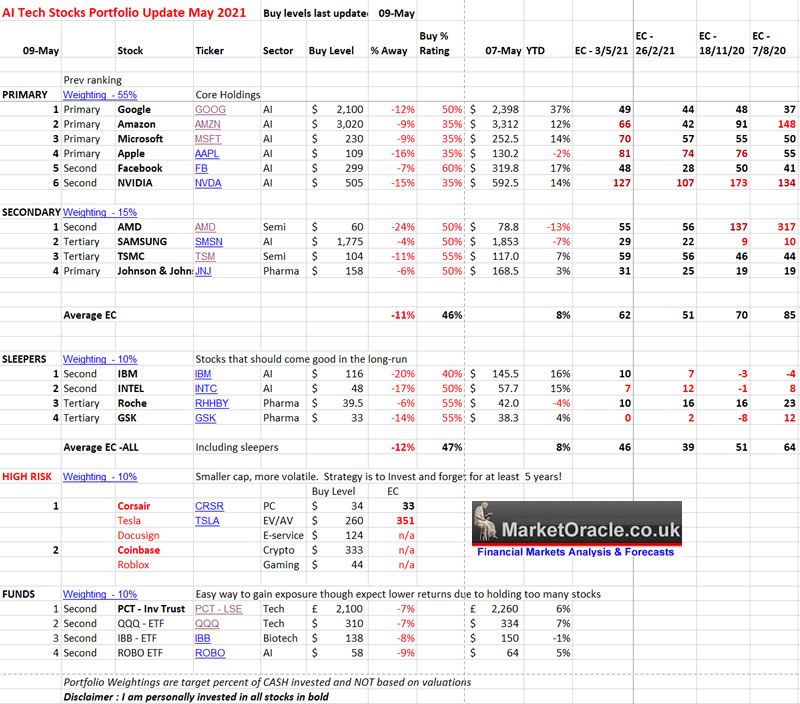

AI Stocks Buying Levels Update May 2021

Here is my updated AI stocks table with buying levels to capitalise upon during the anticipated stock market correction. In terms of overall valuations the portfolio is a little more expensive today than at my last update with some individual stocks very overbought so should be primed for a correction during May as I first flagged to expect in my analysis of 9th of Feb.

The buying levels average to a 12% drop in tech stock prices with the average buy % below 50%, so overall portfolio expectations are for weakness ahead. The strongest stock of the lot is probably Facebook, then TSM. Weakest stocks are likely to be Apple, Nvidia, then Amazon and Microsoft. So I am expecting stock prices to typically fall by between 10% to 15%. As given the valuations and neutral to negative buy %'s. So I am not seeing how the stocks can just continue trending higher.

So what am I going to do

As I view any sell off in GOOD stocks as being temporary then I am not selling anything. It's not worth the risk of exiting and then desperately trying to get back in, as I illustrated in my last exclusive to Patrons analysis, so if you have not already done so do read that first to get into the right mindset for investing LEARN TO INVEST - When to Buy and Sell AI Tech Stocks Such as GOOGLE. Off course everyone's circumstances are different, so if I was looking to sell for cash then I would probably cash in the more expensive holdings such as Amazon, Microsoft, Apple and Nvidia. But I'm not so I won't.

So if the market corrects and stock prices approach their buying levels what's' at the top of buy list?

I would buy Google at $2100. Microsoft at $230, Amazon on a dip below $3000. Nvidia below $500, probably around $485, I would definitely buy AMD at $60. I already own a lot of IBM so doubt would buy more. I would buy more Intel at $48. In terms of funds I would buy ROBO at $58.

GPU Mining FREE MONEY!

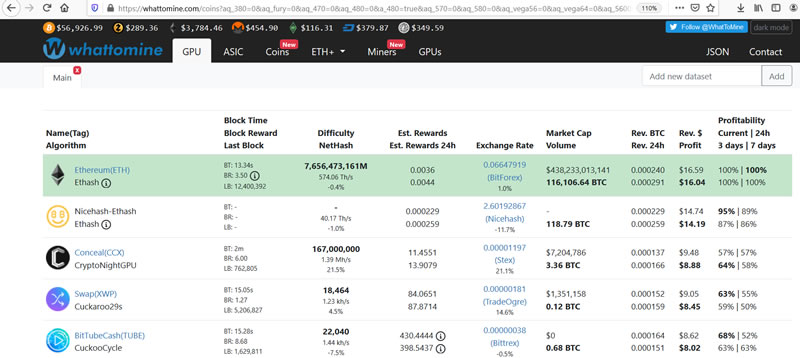

Meanwhile crypto mining in the background on ones desktop PC with Nice Hash Quick Miner (payout's in Bitcoin), continues, yielding about £160 cash per month after electricity costs, the requirement being an Nvidia GPU with at least 6gb of vram. Whilst AMD GPU's can use the regular Nice Hash miner though that uses third party algorithms so is higher risk to install and use.

Whilst all those who think is too late then consider this, the yield in bitcoins keeps increasing as the Ethereum price goes up! Remember one mines in Ethereum and gets paid in bitcoin. Here's what a RTX 3080 currently yields on Nicehash, $14.74 per day! That' is a good 30% higher then a month ago! So it's not too late to start crypto mining in the background with ones GPU.

Again the current state of affairs of being able to get FREE money is time limited i.e. I can not see it lasting for more than a couple more months, especially as EIP 1559 is coming in July 2021 when ethereum mining payout's are expected to fall by about 50%. So profit from the crazy crypto mania bubble free money bonanza while you can, and just as I do, don't hold on to your crypto's! What I do is transfer from Nicehash to Coinbase which is pretty straight forward to do and does not incur any fees (minimum payout from Nicehash to Coinbase is about £21 / $29), and from there I can spend the bitcoins, convert to other crypto's or withdraw to my bank account, whilst US users can also withdraw to their paypal accounts, but for now I mostly spend the crypto's given that a number of services offer discounts when paying in BTC, in fact over the past couple of months I have mined and spent £370 in BTC generated from one desktop pc, at $3 per month that would be enough to cover my patreon fee for the next 14 years!

So if you have an Nvidia GPU with at least 6gb of vram then you are literally throwing free money away by not mining in the background with Nicehash. Note I do not advocate buying hardware specifically to mine with as GPU prices are double to triple what they should be, just if ones existing hardware is upto speed then well you are passing up free money.

Step 1 - Mine with Nicehash

Step 2 - Transfer bitcoins to Coinbase

Step 3 - SPEND IT!

CHIA Crypto Farming with Your Hard Drives Insanity!

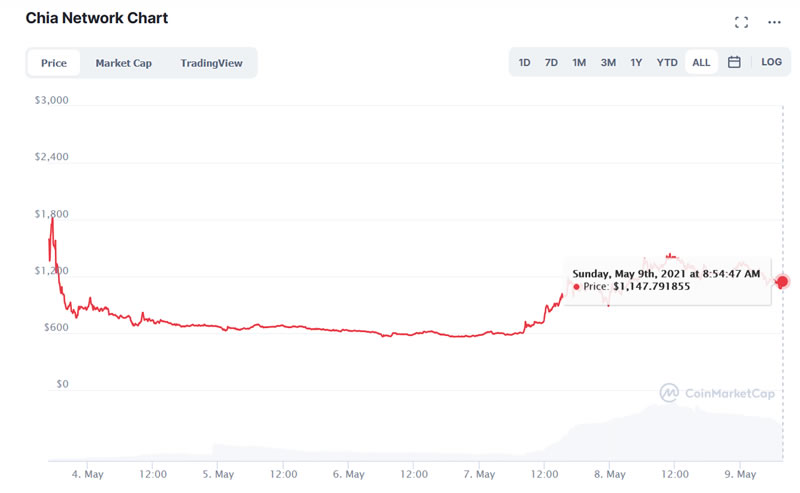

The crypto mania has now expanded to allow one to FARM the free space on ones hard drives! The CHIA coin went public only on the 3rd of May following which the price has seen explosive growth, fast blowing away the opening estimate of $20, instead to currently trade at $1140.

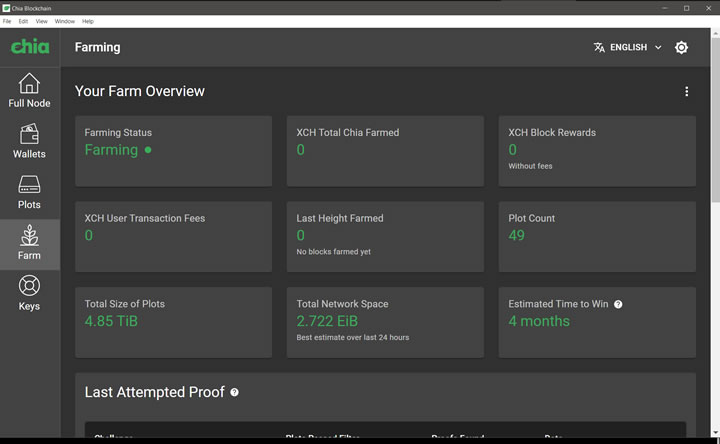

I too decided to give Chia farming a go by seeking to commit upto 20tb of my free hard drive space to see what happens. However, the network has seen explosive growth that until the pooling of farms materialises then I don't think it's going to be possible for any ordinary farmer with their small 10tb to 20tb farms to make any CHIA coins.

The growth has been that EXPLOSIVE, and as you can imagine, large hard drives that first doubled in price and then vanished form the likes of Amazon all in a few short days (luckily I stocked up on my storage needs in March, so I am good for at least a year) as crypto miners reacted to the high opening price of CHIA and virtually bought up the whole worlds stock of large capacity hard drives ! So you can imagine I am NOT going to suggest to any of my Patrons to consider start farming with CHIA because it is already TOO LATE - THIS IS REALLY INSANE! The governments are going to act to regulate the crypto space because of the current loony toons state of affairs!

In fact one of the stocks I have selected in my forthcoming analysis on high risk tech stocks to invest in for the long run is Western Digital, so it might be worth gaining exposure to due to the surge in demand for what they primarily manufacture.

What's going to be the next piece of hardware that's going to get it's supply wiped out by crypto mania?

Maybe they should create a carbon block chain coin where the more carbon ones pulls out of the air into small cubes then the more carbon coins one gains. Given what I have seen witness happen with CHIA then that WOULD SOLVE the carbon aspect of climate change within a few short months!

Anyway for now I will continue to plot my farm towards planned capacity of 20tb (current 5tb) and see what happens. Though it is very doubtful that I am going to make any money given the expansion in the network space over the past few days so would not suggest anyone else go down this path and it is highly probable that I will soon cut my experiment with CHIA short.

This extensive analysis AI Stock Buying Levels, Ratings, Valuations and Trend Analysis into Market Correction was first been made available to Patrons who support my work.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including my most recent analysis: Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond!

- Invest and Forget

- Stock Market Early Summer Correction Review

- AI Stocks Strength vs Weakness

- RAMPANT MONEY PRINTING INFLATION BIG PICTURE!

- HIGH RISK STOCK BUYING LEVELS

- RISK RATINGS

- WESTERN DIGITAL - WDC $71 - CHIA! - Risk 1

- Life Sciences Biotech Smaller Cap High Risk Stocks Investing Binge

- Biotech stock 1 - Cheap Low Risk Pharma - Risk 1

- Biotech stock 2 - HIGH RISK GENE EDITING - Risk 9

- Biotech stock 3 - Low Risk 2

- Biotech stock 4 - X10 for Max Risk 10

- High Risk Stocks Portfolio Buying Levels

- Covid India Black Mold Epidemic

- Bitcoin and Raven Coin Buying Levels

My analysis schedule includes:

- Bitcoin and Crypto's Trend Forecast / Bear Market Accumulation Strategy - 80% Complete

- More X10 Biotech Tech Stocks - 50% done

- UK House Prices Trend Analysis - 15% done

- How to Get Rich! - 70% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

A taste of my latest Crypto Analysis: Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

For crypto trading and investing see Binance for 10% discount on trading fees - Disocunt Code LZ728VLZ

For managing your crypto's see Coinbase

For GPU mining check out Nicehash (affiliate links).

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Your unloved biotech stocks investing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

| Subscription |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.