U.S. Jobs Losses Mount As Recession Deepens

Economics / Recession 2008 - 2010 Oct 24, 2008 - 03:00 AM GMTBy: Mike_Shedlock

Regardless of how much money Paulson and Bernanke waste on bailouts, this economy simply is not going to recover with the unemployment picture looking as bleak as it does. Let's start off with a look at initial claims then some announcements from today about layoffs.

Regardless of how much money Paulson and Bernanke waste on bailouts, this economy simply is not going to recover with the unemployment picture looking as bleak as it does. Let's start off with a look at initial claims then some announcements from today about layoffs.

Initial Claims

Once again, Unemployment Insurance Weekly Claims are up although the 4 week moving average is down slightly.

In the week ending Oct. 18, the advance figure for seasonally adjusted initial claims was 478,000, an increase of 15,000 from the previous week's revised figure of 463,000. It is estimated that the effects of Hurricane Ike in Texas added approximately 12,000 claims to the total. The 4-week moving average was 480,250, a decrease of 4,500 from the previous week's revised average of 484,750.

The effects of Ike will be diminishing over time, they should be already, but don't expect those initial claims to start dropping any time soon. Here are a few recent headlines.

Xerox to Cut 5 Percent of Staff

In response to businesses slowing equipment purchases, Xerox will Cut 5 Percent of Staff .

Xerox Corp. plans to cut 3,000 jobs, or 5 percent of its work force, because a slowdown in orders from large U.S. companies has dragged down the printer and copier maker's profit margins. "We're assuming more of the same ... deterioration in the economic markets," Anne Mulcahy, Xerox's chief executive, said on a conference call with analysts. "That's why we're being so aggressive in terms of the cost reductions, so we can be assured of delivering the earnings growth that we expect in 2009."

GM Suspends Employer Match, Cuts Jobs

With consumer spending dropping like a rock and inventory piling up at dealers, this headline should not be a surprise: Job cuts, carmakers' woes deepen recession fears .

Bleak outlooks from world carmakers and a barrage of job cuts by major U.S. companies including Chrysler and Xerox deepened fears of an extended global recession and kept market nerves on edge on Thursday.

A dive in car shipments to the United States and slowing demand from emerging economies hurt Japanese exports. Sony Corp slashed its operating profit forecast, citing reduced demand for flat TVs and digital cameras.

U.S. carmaker General Motors said it was temporarily suspending the company match for its retirement savings program to preserve cash. It also said it planned involuntary cuts in its salaried and contract workforce starting this year.

Chrysler to Cut 1,825 Jobs

Bloomberg is reporting Chrysler to Cut 1,825 Jobs on Early Plant Closure, Output Trim .

Chrysler LLC, now in merger talks with General Motors Corp., will cut 1,825 jobs as it shuts a Delaware factory a year early and pares output at an Ohio plant because of slumping sport-utility vehicle sales.

The Delaware-made SUVs "are simply not selling," said Aaron Bragman, a product analyst at Global Insight Inc. in Troy, Michigan. "It reached a certain point where it simply doesn't make sense to keep the plant open."

Stuart Schorr, a Chrysler spokesman, declined to comment on whether the Durango and Aspen would be canceled, whether the Delaware production would be shifted elsewhere, or how output at the Ohio factory might be affected. There is a 180-day supply of Durangos and a 106-day supply of Aspens, Schorr said. Analysts consider a 60-day inventory to be the industry standard.

The point at which it made sense to close the plant came long ago. Instead, Chrysler kept making SUVs that no one wanted and now they are piling up on dealer lots where they will not be sold for a profit. Both dealers and the Chrysler home office were hurt by this.

Goldman Sachs to cut about 10% of staff

In response to the credit crisis Goldman Sachs will cut about 10% of staff .

Goldman Sachs Group is planning to reduce staff by about 10% because the financial crisis has dulled activity in several of the investment bank's markets, a person familiar with the situation said Thursday.

The cuts will bring the number of Goldman (GS) employees down to roughly 29,340 from a peak of about 32,600 earlier this year. The reductions will be across product lines and geographies and will leave staffing at 2006 and 2007 levels, the person said on condition of anonymity.

"There are significantly lower levels of business activity," said Michael Williams, dean of the Graduate School of Business at Touro College in New York City. "This is the primary drive behind the layoffs. These are not the last job cuts you will see," he added in a statement that was emailed to MarketWatch.

Massive Mutual Fund, Hedge Fund Job Cutbacks

Cutbacks are mounting in all segments of the financial services market including banks, brokerages, hedge funds, and now mutual funds. Today Janus and AllianceBernstein Announced Jobs Cuts .

Janus Capital Group Inc. and AllianceBernstein Holding LP are firing workers to cut costs as the global bear market erases investor assets and profits across the mutual-fund industry.

Janus will eliminate about 115 jobs, or 9 percent of the workforce, in a plan to save $45 million a year, the Denver- based company said today in a statement. AllianceBernstein, the New York-based fund affiliate of French insurer Axa SA, said yesterday it will fire an undetermined number of workers.

The layoffs are the first of what will be the most severe round of job cuts in the fund industry, said Henry Higdon, managing partner of Higdon Partners LLC, a New York-based search firm specializing in financial services.

"A lot of other publicly owned money managers will be forced to follow suit because of market depreciation and withdrawals,'' Higdon said in an interview. "It's going to get a lot worse.''

The fund industry is hunkering down as more than 130,000 jobs already have been eliminated by banks, brokers and other financial firms since mid-2007, the result of losses in subprime mortgages that ballooned into the worst financial crisis since the 1930s.

Hedge-Fund Cutbacks

Hedge funds have already cut 3,000 to 5,000 jobs and may eliminate 10,000 by year's end as they cope with their biggest losses in two decades, according to estimates by executive search firm Options Group. The industry employs about 150,000 worldwide.

Asset-management job cuts will surpass layoffs during 2001 and 2002, the last bear market, Higdon said.

Jobs Are Not Coming Back

Everyone of the above headlines is from today. I did not have to look too far to find them. Day in and day out someone is announcing job cuts. It's depressing.

And unlike 2001-2003, the bulk of those financial and auto sector job cuts are never coming back. Lehman and Bear Stearns are both out of business, and now that brokers are under direct Fed regulation leverage will be reduced to 10-1 from a current 30-1 or even 50-1. The Auto sector is about to undergo more consolidation and those jobs too will be gone forever when it happens.

I expect the reported unemployment numbers to rise to 7.5% to 8% in 2009 and keep rising into 2010. If so, expect credit card losses, foreclosures, bankruptcies, and corporate bond yields to rise. Expect retail sales, corporate profits, and government bond yields to drop.

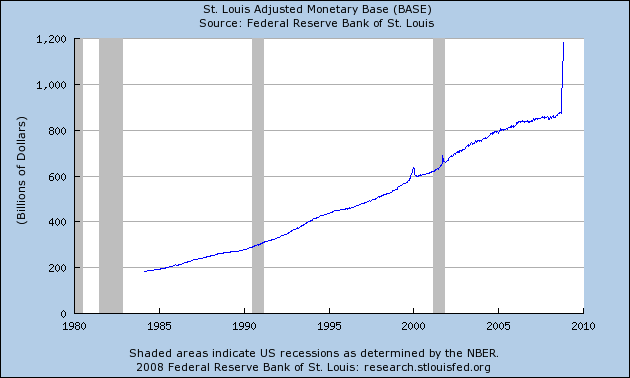

In regards to government bond yields: Yes, I know all about the massive amount of printing taking place. People send me a chart of it every day. Here it is.

Monetary Base

Eventually that will matter.

Yet as massive as that looks, the destruction in credit in housing, credit card defaults, commercial real estate, and all sorts of other malinvestments still exceeds that monetary printing. Banks are reluctant to lend, and rightfully so. Consumers are becoming increasing frugal.

The so-called monetary stimulus of the Fed and Treasury is not having its intended effect. In fact, the stimulus is extremely counterproductive.

Counterproductive Measures

I spoke on why these measures were counterproductive in:

- Fed Attempting To Prevent "Great Depression II"

- Keynesian Claptrap From PIMCO

- Something For Nothing vs. Paradox of Deleveraging .

Bernanke has to be pulling what little hair he has left, right out of his head, as his stimulus programs die on the vine. And if you are shorting treasuries, especially the long bond, you might be pulling your hair out too.

In my opinion, it is still too early for all but the nimble (taking quick profits) to be shorting treasuries. You may not like it and you may think treasuries are a huge bubble, but secular lows in treasury yields are still on the horizon. The economic horizon is simply that bleak.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.