GE Needs Fed Bailout To Finance Operations; Dividend At Risk

Companies / US Auto's Oct 26, 2008 - 01:46 PM GMTBy: Mike_Shedlock

GE is struggling to get short term financing at a price it wants to pay. So what does GE do? The answer is twofold:

GE is struggling to get short term financing at a price it wants to pay. So what does GE do? The answer is twofold:

1) Borrow from the Commercial Paper Funding Facility

2) Pretend this is a good thing.

Consider this ridiculous headline: GE to Sell CP to Fed to Help Unlock Credit Markets .

General Electric Co., the biggest U.S. issuer of commercial paper, plans to use the Federal Reserve's new short-term funding facility, throwing its weight behind the central bank's efforts to unlock the credit markets.

“This is a way for us to demonstrate our support for what the Fed is doing, which is providing all-around liquidity,” Wilkerson said.

GE's Disingenuous Pronouncement

Let's translate what GE said into English:

"We desperately need short term cash and cannot get it elsewhere."

GE Sees Shrinking Economy

GE's CEO Immelt Sees Shrinking Economy for 2-3 Quarters .

The U.S. economy will have two or three quarters of “negative growth” once global financial systems stabilize, General Electric Co. Chief Executive Officer Jeffrey Immelt said.

Financial markets are experiencing the greatest disruption since the 1930s, tightening credit for corporate and consumer borrowers. GE, the biggest U.S. issuer of commercial paper, said yesterday it plans to use a new short-term funding facility from the Federal Reserve when the program starts next week, throwing its weight behind Fed efforts to unfreeze the credit markets.

Companies should be planning under a scenario of “what happen if the credit markets are half the size in 2009,” Immelt said. GE still runs the company for its debt to be rated AAA, the highest available, Immelt said. Financial companies will either become bank holding companies or have the AAA rating, he said.

“We still believe if you have low cost of funds, good origination, good risk management, there is a role” for a AAA- rated company, Immelt said. “You're either one or the other as time goes on.”

What if the credit markets are half the size? What will that do to your financing costs if you cannot get a handout from taxpayers?

GE Will Cut Costs, Jobs

GE is struggling as the following headline shows: GE Will Cut Costs, Jobs, Immelt Says.

General Electric Co. is cutting costs, preparing for a new wave of regulation from Washington and embracing manufacturing over financial services as ways out of the economic crisis, its chief executive said Friday.

"Costs will be lower in 2009 than in 2008," Chairman and Chief Executive Officer Jeffrey Immelt said in an interview. "That will be true across the board." Employment will also be lower, he said, declining to name numbers or percentages.

GE's NBC Universal business group recently announced cuts totaling $500 million, ...

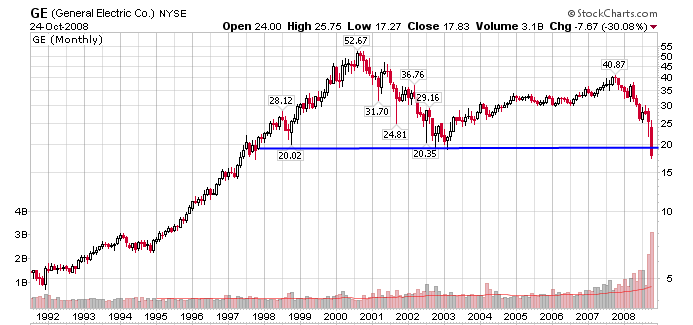

GE Monthly Chart

Technically GE is in a corrective pattern A-B-C (down-up-down) off the all time high in 2000. How low share price goes is anyone's guess, but it is already back to the same price it was at in 1997.

So much for dollar cost averaging even into the bluest of blue triple A rated chips. For more on dollar cost averaging please see S&P 500 Crash Count Compared To Nikkei Index .

GE Capital Financing Woes

I have a source at GE Capital who writes " Sales personnel are not allowed to make any more loans this year, and are being told to try to get their customers to pay off their loans. All prepayment penalties are waved for closing loans and GE Capital is about to launch a new incentive scheme for the salespeople that makes it worth their while to get their customers to agree to participate. "

A second source indicates the above statement is more than likely division by division as opposed to an across the board measure. Divisions hit by that ruling might be things like auto and boat leasing, dealer financing, etc.

In regards to the latter, think about the deteriorating asset quality of both the loans and the assets GE would pick should GE's customers default.

GE's Debt

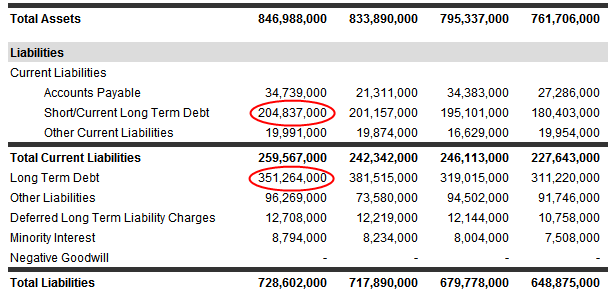

YahooFinance shows that GE has $548 billion in debt .

The above chart shows that GE has $204 billion in short term financing needs with $3.8 billion in cash and a rapidly rising debt to equity ratio of 4.866.

Other than the government (taxpayer), where is GE going to get $200 billion to keep rolling over that short term financing? At what interest rate? I have more questions:

How many billions of dollars did GE waste buying shares back over the years at $40 or greater? $35 or greater? $25 or greater? $20 or greater? Think of where GE might be if it used the money to pay down debts rather than buy shares at absurd prices.

I see that GE is paying a dividend of 6.6% while borrowing money from taxpayers to fund operations. How long can that dividend last?

Here is one final thought. The government stepping in to provide cheap financing to GE is not doing anyone any good. Paulson wants banks to lend, and by doing so is artificially driving down short term rates. Why should GE get short term financing from banks, when it can get a better deal (at taxpayer expense) from the government?

Why should banks make loans when the government is taking away opportunities in one of the few AAA rated opportunities around? This assumes of course you think GE is really deserves to be AAA. Then again, that AAA rating is something that needs to be determined by the market forces not government sponsored rating agencies or the Federal government itself.

The entire gamut of Bernanke's lending schemes are failing, and will continue to fail. GE helps explain why.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.