What the Stock Market "Fear Index" VIX May Be Signaling

Stock-Markets / Volatility Jan 31, 2024 - 04:18 PM GMTBy: EWI

"Note the succession of higher closing low relative to higher highs in..."

First, just a quick basic fact about the CBOE Volatility Index (VIX) -- also known as the stock market's "fear gauge": the lower the reading, the higher the complacency among investors. Higher readings indicate increased investor nervousness.

With that in mind, let's look at a revealing chart from our Jan. 24 U.S. Short Term Update. As the thrice weekly Elliott Wave International publication notes:

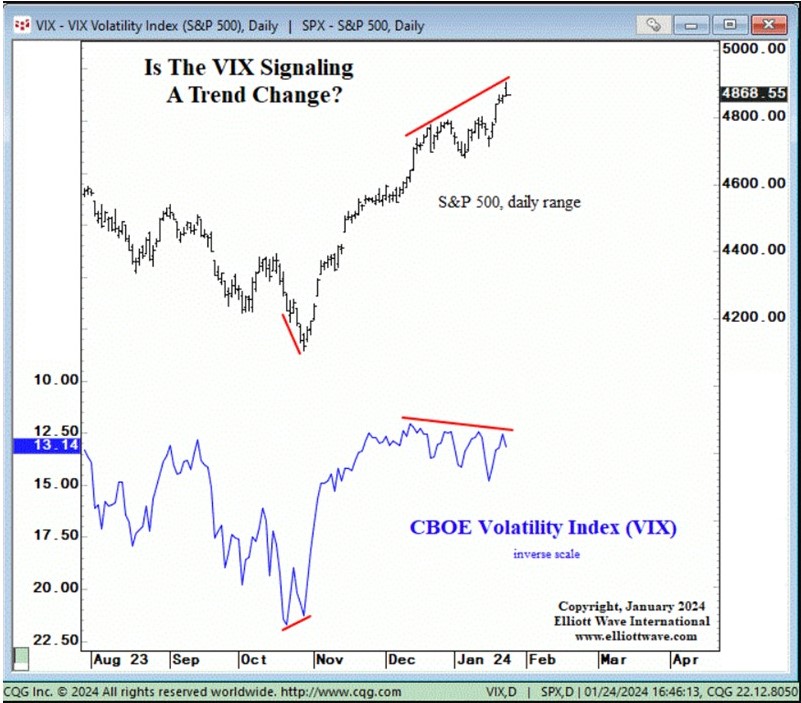

The bottom graph shows the CBOE Volatility Index (VIX), which we have inverted to align with the S&P index at the top. The VIX made a closing low of 12.07 on December 12. Since then, note the succession of higher closing lows relative to higher highs in the S&P 500. Is this subtle sign of a loss in investor optimism a signal that the market is about to change trend?

Only time will tell, of course, but some recent headlines are already reflecting the message of the chart (CNBC, Jan. 16):

[Financial TV show host] says the market is ready for a pullback

The well-known pundit goes on to say that he's not a bear -- just that some stocks which have risen parabolically may be due for a correction.

So, yes, some worry is beginning to creep into some financial articles about the stock market. Yet, make no mistake, optimism is still largely dominant -- just not quite as dominant as it was during the first half of December.

As the Jan. 24 Elliott Wave Theorist Interim Bulletin notes:

The stock market continues to sport historically high valuations and elevated optimism, as recorded throughout dozens of sentiment and valuation indicators.

So, indeed, the VIX's succession of higher closing lows is a "subtle" indicator -- which by no means diminishes its value. By the time a stock market gauge becomes overwhelmingly obvious, well, damage to portfolios may have already occurred.

Here's what you need to know: Elliott Wave International's publications show dozens of market indicators which can put you ahead of the crowd.

As you might imagine, we also employ Elliott wave analysis. As Frost & Prechter's book, Elliott Wave Principle: Key to Market Behavior, notes:

After you have acquired an Elliott "touch," it will be forever with you, just as a child who learns to ride a bicycle never forgets. Thereafter, catching a turn becomes a fairly common experience and not really too difficult. Furthermore, by giving you a feeling of confidence as to where you are in the progress of the market, a knowledge of Elliott can prepare you psychologically for the fluctuating nature of price movement and free you from sharing the widely practiced analytical error of forever projecting today's trends linearly into the future.

Would you like to read the entire online version of this Wall Street classic for free? You may do so by becoming a member of Club EWI -- the world's largest Elliott wave educational community. Membership is free.

Get started now by following this link: Elliott Wave Principle: Key to Market Behavior.

This article was syndicated by Elliott Wave International and was originally published under the headline What "Fear Index" VIX May Be Signaling. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.