Bank of England Plays Interest Rate Catch-up as Sterling Suffers

Interest-Rates / UK Interest Rates Nov 09, 2008 - 06:40 AM GMTBy: Ashraf_Laidi

The Bank of England's shocker 150-bp cut to 3.00% (lowest level since 1955) against expectations of 50-bp cut is the biggest rate cut since the central bank acquired operation independence 11 years ago. The Swiss National Bank also surprised with an unscheduled 50-bp rate cut to 1.75%. The European Central Bank stuck with a widely expected 50-bp cut to 3.25%. ECB president JC Trichet says the bank does not rule out further rate cuts and cannot rule out sharp decline in inflation next year.

The Bank of England's shocker 150-bp cut to 3.00% (lowest level since 1955) against expectations of 50-bp cut is the biggest rate cut since the central bank acquired operation independence 11 years ago. The Swiss National Bank also surprised with an unscheduled 50-bp rate cut to 1.75%. The European Central Bank stuck with a widely expected 50-bp cut to 3.25%. ECB president JC Trichet says the bank does not rule out further rate cuts and cannot rule out sharp decline in inflation next year.

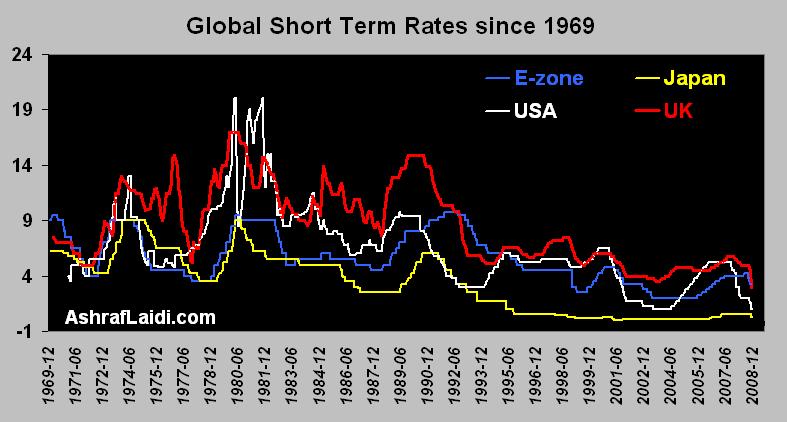

UK interest rates are now below those of the Eurozone for the first time in the life of the euro. Today's 150-bp cut is a serious assault to the British pound's central bank reserve currency role . After the BoE announcement, GBPUSD collapsed by a full 2 cents in less than 3 minutes to $1.5710 before jumping back by more than 3 cents towards $1.6020 and later dropping back towards $1.5850s, as surging volatility widens price spreads and impacts liquidity. We now expect GBPUSD to gradually find its way down towards $1.58 and onto $1.57. There lies more downside towards $1.5350, even in the event of further gloom in tomorrow's US jobs report.

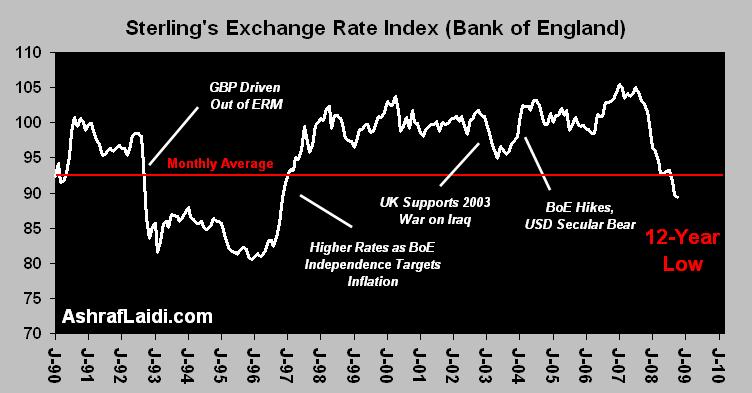

The chart below shows sterling's trade weighted index hiting its lowest level since November 1996. Just yesterday, the UK's National Institute of Economic and Social Research estimated Q3 GDP to have contracted by 0.5% from an initial estimate of a 0.2% contraction, expecting the downturn will last into 2010.

The magnitude of today's interest rate moves from UK and Switzerland not only reflects the gravity of the financial and economic dangers in Europe and their impact on the rest of the world, but also manifests the lateness of UK central bank policy makers, whose inflation-focus had clouded their ability to weigh the depth of the recession. Despite having acquired operational in May 1997, the Bank of England remains bound to a government-imposed inflation target (not ceiling as in case of ECB), now at 2.0%.

Pre-Jobs Central Bank Action? The global fallout from yesterdays 5% slump in Wall Street ought to have played a role in forcing the hand of the BoE into making todays historic move. Tomorrows US non-farm payrolls for October are expected to show a loss of more than 220K (biggest since November 2001), while the unemployment rate hitting a fresh 5-year high of 6.3%. A rate above 6.3% would be the highest since 1994. Yesterdays ADP report on private payrolls showed a decline of 157K in October (highest since Nov 2002). The impact on US and global markets of such a report could be of escalating volatility, favoring the lower yielding currencies.

By Ashraf Laidi

CMC Markets NA

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.