Comex Gold Shock and Awe

Commodities / Gold & Silver Dec 02, 2008 - 08:57 AM GMTBy: Rob_Kirby

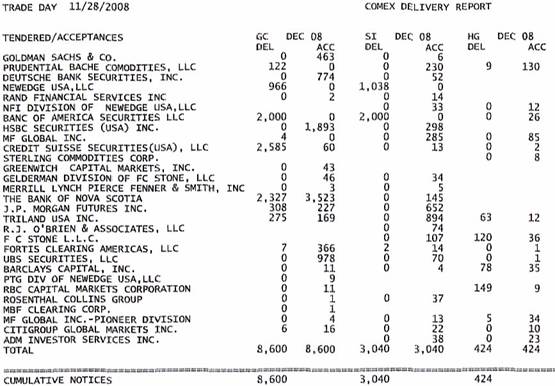

This past Friday, Nov. 28, 2008, was first notice day for delivery of the December COMEX [a division of NYMEX] gold and silver futures contracts which trade on the New York Mercantile Exchange. The chart appended below shows that on Friday, 8,600 gold futures contracts @ 100 ounces per contract [and 3,040 silver futures contracts @ 5,000 ounces per contract] were delivered. To try to give some perspective to these numbers the previous delivery month for gold futures was October, 2008 when there were 11,554 deliveries for the entire month – a “big” number by historical standards.

This past Friday, Nov. 28, 2008, was first notice day for delivery of the December COMEX [a division of NYMEX] gold and silver futures contracts which trade on the New York Mercantile Exchange. The chart appended below shows that on Friday, 8,600 gold futures contracts @ 100 ounces per contract [and 3,040 silver futures contracts @ 5,000 ounces per contract] were delivered. To try to give some perspective to these numbers the previous delivery month for gold futures was October, 2008 when there were 11,554 deliveries for the entire month – a “big” number by historical standards.

It is important for casual market observers to understand that normally, investors who are speculating on the price of gold DO NOT take delivery of the underlying commodity. Instead, whether they are “long” or “short” the future, they usually “roll” their positions into the next contract month as the current or “spot” month approaches its delivery cycle, which begins with first notice day [Friday was the 1st notice day for delivery of the Dec. Gold and Silver Futures Contracts].

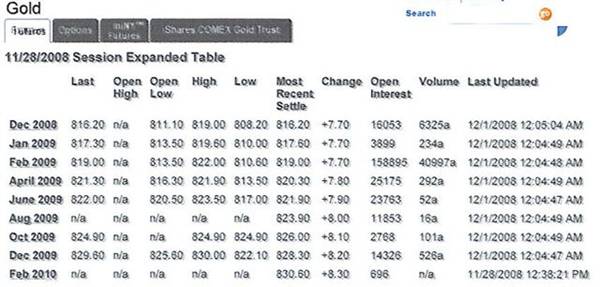

So, looking at the COMEX gold table appended below , readers can see that the Dec. contract was still registering Open Interest of 16,053 contracts as of the close of business on Friday. One can also see that “the bulk” of trading has migrated [rolled] into the next delivery month for gold futures – which is Feb., 2009 with 158,895 contracts of Open Interest .

The remaining contracts “open” in December, 2008 must either be “rolled,” covered or delivered before Dec. 31, 2008 – as per the contract termination contract termination schedule .

When deliveries of precious metal occur at COMEX, there is change in beneficial ownership of warehouse receipts representing the underlying physical metal stored in COMEX depositories :

In this regard, we can say that “elevated” deliveries – instead of market participants simply speculating on price change by “rolling” contracts - are consistent with robust or growing demand for the underlying commodity.

We know that global investment demand has, in fact, been robust and growing – because the World Gold Council has told us so :

Demand for gold at an all-time high

Demand for gold reached a record high in the third quarter as investors sought refuge from the financial crisis and volatile stock markets, according to the Wrld Gold Council.

The WGC said demand for gold reached an all-time quarterly record of $32bn between July and September as investors around the world sought refuge from the global financial meltdown. This was 45pc higher than the previous record in the second quarter of 2008.

Demand for gold via exchange traded funds (ETFs) and bars and coins was the biggest contributor to overall demand during the quarter.

The figures show investment demand from private investors rose by 121pc to 232 tonnes in the third quarter, with strong bar and coin buying reported in Swiss, German and US markets. The quarter also witnessed widespread reports of gold shortages among bullion dealers across the globe, as investors searched for a haven…

Why The Rush to Gold?

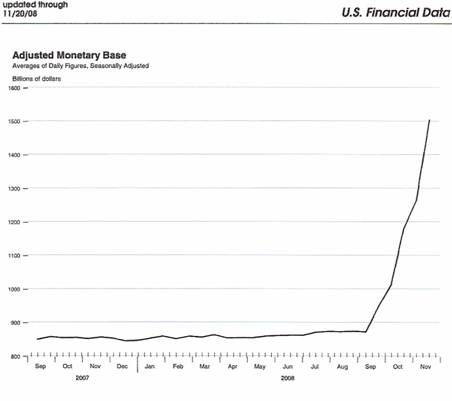

The reason that investors are flocking to gold the world over is highly understandable given that banks are failing all over the world and the U.S. Federal Reserve and U.S. Treasury are printing MASSIVE amounts of money to “bail out” many of those who remain in business. We see this empirically demonstrated by monetary aggregate data supplied by the St. Louis Federal Reserve:

While we see signs of “big money” moving into gold through machinations occuring with respect to “deliveries” at COMEX, there are other ‘tell tale' signs that demand for physical metal is in fact SOARING . This is reflected by the recent decoupling of the price of COMEX gold futures and real costs one must incur to obtain physical ounces in coin or bar form. The premiums being paid for physical ounces have decoupled to the point where leading gold web sites now routinely list current ebay pricing for gold bars and coins to achieve “accurate” real world pricing for physical metal.

Why Are People Using Ebay For Pricing Gold?

The reason that investors are turning to alternate reference sources for pricing physical precious metal is that the COMEX futures derived prices for metal are INCONSISTENT with the empirical robust demand story outlined above. In short, the COMEX pricing model appears to be FRAUDULENT, when despite overwhelming demand for the commodity we routinely and increasingly see “ BUYERS STRIKES ” in the futures markets like the one we experienced just this morning in gold and particularly in silver.

These counter-intuitive, fundamental-defying price movements are the basis for claims of market rigging on the part of the U.S. Treasury and Federal Reserve.

These shock and awe campaigns being waged against precious metals on the part of officialdom are intended to instill faith in fiat currencies which has been naturally waning in recent weeks and months in the face of unprecedented money creation being availed to officialdom's crony capitalist friends on Wall Street.

This is why everyone needs to get physical now!

The value of physical precious metal is not the same as prices being falsely derived at COMEX.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2008 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.