Financial Times Lexx Favours Platinum Over Gold, Is the FT Right?

Commodities / Gold & Silver 2009 Feb 10, 2009 - 06:06 AM GMTBy: Mark_OByrne

Profit taking saw gold fall yesterday but continuing very robust demand for physical bullion and gold ETF’s for safe haven purposes means that this is likely another period of consolidation.

Profit taking saw gold fall yesterday but continuing very robust demand for physical bullion and gold ETF’s for safe haven purposes means that this is likely another period of consolidation.

There is a dawning realization that we are in the early stages of a severe global recession and possibly even a global Depression. In this uncertain climate for the global financial system and the global economy itself, risk aversion is set to remain elevated and thus demand for physical gold bullion will also remain elevated. As it will for silver but less so for the purely industrial precious metals of platinum and palladium.

In the short term gold awaits the possible passage of the Obama stimulus package. Obama himself has warned of “catastrophe” if the package is not passed. The real question is if this latest humungous $800 billion spending package will be sufficient to arrest the sharp decline in progress of the US financial system and economy. Even more pertinent is the real risk that while it may be another short term panacea, it will likely lead to significant inflation or stagflation in the coming months.

Bond markets are already sensing this and thus the 10 Year bond has fallen in value and seen its yield rise from 2% to over 3% since the start of the year. The dollar is also likely to come under severe pressure in the coming weeks as the ramifications of huge US government deficits, money printing and monetization of debt are realized.

The Financial Times reports today of continuing huge demand for physical bullion. The FT reports today that “Investors are buying record amounts of gold bars and coins, shunning risky assets for the relative safety of bullion amid renewed fears about the health of the global financial system. The US Mint sold 92,000 ounces of its popular American Eagle coin last month, almost four times that which it sold a year ago and more than it shipped during the whole of the first half of 2007. Other countries’ mints have also reported strong sales.”

Is FT's Lex Right to Favour Platinum Over Gold?

The usually excellent Lex column in the Financial Times has made a bold prediction regarding gold – gold is “already high” and thus investors should look to platinum.

While Lex is normally excellent there is a peculiar irrationality, lack of knowledge and indeed ignorance that takes over when writing about gold as an asset class.

Lex has been very biased against and very wrong on gold for a number of years. In September 2005 it said gold was overvalued at $475/oz and “ may rally further, but it is driven by funds chasing price momentum. Such bets are often quickly reversed.” How wrong it was.

For some reason Lex engages in a lot of unbalanced, pejorative language about “irrational goldbugs” being “notorious zealots”. Any rational observer now knows that those who prudently diversified into gold in recent years were very rational. The world of leveraged Ponzi finance had many adherents who were “notorious zealots” who were more than a little irrational and they have got us into this terrible financial and economic mess. Not prudent savers and investors who decided to diversify and not to have all their eggs in the stock and property baskets of the leveraged global casino.

Platinum’s fundamentals are interesting and we believe the precious metals component of a properly diversified portfolio should have an allocation to gold, silver and platinum. However, platinum is not a safe haven asset like gold and silver, and because it is an industrial metal its fundamentals are less certain.

As usual the old reliables of macroeconomic risk (in 2009 this includes deflation currently, inflation likely later, monetary/currency and systemic risk) and geopolitical risk will be the main drivers of the gold and silver market. The platinum group metals (not having the safe haven qualities of gold and silver) are likely to be more influenced by the decline of industrial demand and other supply demand issues.

Industrial and jewellery demand for platinum will fall this year. The question is whether investment demand might pick up considerably and negate the falling demand from industry and jewellery. ETF demand and investment demand for coins, bars, certificates and unallocated and allocated accounts is a wild card which will likely result in sharply higher prices in all precious metals, including platinum. But gold and silver will likely benefit more from safe haven demand.

Also, gold and silver have huge short positions that are being investigated by the newly invigorated Commodity Futures Trading Commission (CFTC) for possible market manipulation. There is now much evidence to suggest that there has been market manipulation by some of the large players in the futures market (more evidence then was presented to the SEC regarding Madoff prior to those revelations) and this could lead to a massive short squeeze in both gold and silver.

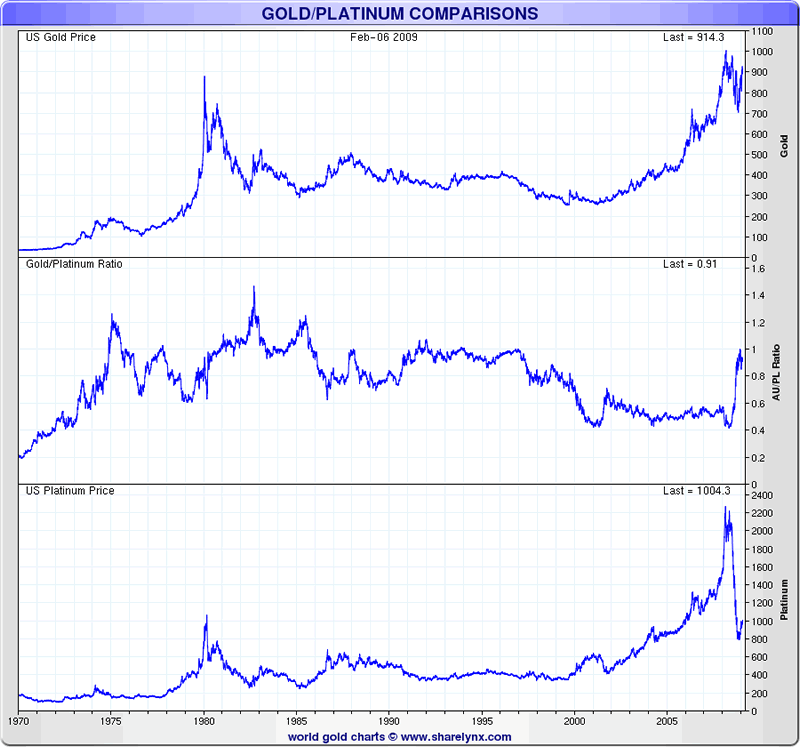

Lex says that the gold platinum ratio would suggest that platinum is cheap vis-à-vis gold:

“Go back 20 years, and platinum has traditionally traded at 1.5 times the cost of gold. Now that ratio is 1.07 times; in relative terms, platinum is therefore cheap. Platinum also has a range of uses, in iPods, computers, car catalysts, anti-cancer drugs and spark plugs, to name a few. That also makes it a cheap option on economic recovery. “The only metal fit for a king,” Louis XV declared about platinum. And, perhaps, for investors too.”

However, 20 years is a very short time frame and in these historic times with comparisons being made to the 1970’s stagflation, the 1930’s Great Depression, the 1920’s Weimar hyperinflation, it would be wise to look back further than the recent past performance.

The last time that gold and precious metals were in a bull market was in the 1970’s and during this period gold was often more valuable than platinum and indeed was as much as 1.2 times more valuable and for a very brief period over 1.5 times more valuable.

Today’s ratio of around 1:1 is close to the average of the last 40 years (as seen in the chart above) – a more representative sample as it includes the entire period since the U.S. went off the Gold Standard in 1971.

With increasing concerns about near zero percent interest rates, unprecedented money printing, quantitative easing, monetization of debt and debasement of currencies internationally, the safe haven, monetary metals of gold and silver look set to continue to outperform platinum. (As Milton Friedman pointed out “The major monetary metal in history is silver, not gold.”)

It has been shown in numerous academic studies including by the highly respected portfolio and asset allocation experts, Ibbotson and Associates, in a June 2005 study, ‘Portfolio Diversification with Gold, Silver and Platinum’, how gold, and indeed precious metals, are the only one of the seven asset classes with a negative average correlation to the other asset classes. It is also worth noting that the authors showed that, excluding cash, precious metals are the only asset class with a positive correlation coefficient with inflation, which is further evidence that precious metals act as a hedge not just against macroeconomic and systemic risk but also against the long term threat of inflation.

Indeed Ibbotson and Associates determined that holding between 7.1 percent and 15.7 percent in precious metals bullion reduces portfolio volatility and improves returns over the long term.

Ignore Lex and continue to diversify and remain diversified with gold, silver and some platinum bullion

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold and Silver Investments Limited No. 1 Cornhill London, EC3V 3ND United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.