U.S. Dollar Volatile Trend Lower into End of Week

Currencies / Forex Trading Feb 12, 2009 - 04:35 AM GMTBy: ForexPros

The USD continues to trade mixed today after US data failed to inspire traders one way or the other. GBP fell to a new traded low of 1.4315 before reversing back to the 1.4370 area in lighter volumes; cross-spreaders continue to work the sell side of the rate into the New York close. Overnight UK data was also benign and remarks somewhat dovish but the rate remains firm on the 1.4300 handle ahead of more US data tomorrow. Traders expect more two-way action near-term so aggressive traders looking to buy the dip under the 1.4380 area remember to be nimble.

The USD continues to trade mixed today after US data failed to inspire traders one way or the other. GBP fell to a new traded low of 1.4315 before reversing back to the 1.4370 area in lighter volumes; cross-spreaders continue to work the sell side of the rate into the New York close. Overnight UK data was also benign and remarks somewhat dovish but the rate remains firm on the 1.4300 handle ahead of more US data tomorrow. Traders expect more two-way action near-term so aggressive traders looking to buy the dip under the 1.4380 area remember to be nimble.

EURO was unable to score a new low-print in afternoon trade and remained mired around the 1.2880 area after testing both sides of that zone; offers above the 1.2910 area capped the upside while bids around 1l2850 supported. Traders note that the rate is inside range and off the weekly lows ahead of the end of week looking very much like a technical bottom may be in for the end of week. If the lows for the week are in look for a test of the 1.3050 area near-term as the bottoming effect may attract bids on dips. Traders also note official and sovereign bids on the dip into the lows overnight.

USD/CHF failed to hold gains on the 1.1600 handle; high prints at 1.1635 in thin volume followed by a dip under the 1.1580 area. Overnight lows continue to hold around the 1.1500 area but a test of stops around the 1.1480 area looks inevitable after today’s failure to hold the 1.1600 handle.

USD/JPY held the top half of the range today making a bid for the 90.80 area but failing just under; highs at 90.77 went offered during New York trade and the rate drifted lower. Closing around 90.50 area certainly looks like the rate will continue two-way but aggressive traders can look to sell the rate around the 90.80 area as the upside is on light volume. Rounding out the day on the defensive was

USD/CAD; high prints at 1.2535 overnight went unchallenged during US trade topping out around the 1.2510 area before heading south. Lows at 1.2386 remained unchallenged but into the end of day the rate is down to the 1.2410 area suggesting the rate is losing upside momentum. Look for the USD/CAD to test the 1.2200 handle again before the end of week.

In my view, the USD is setting up for another try for the low end of the range. Expect high volatility and whipsaw but also for the USD to end lower on the week.

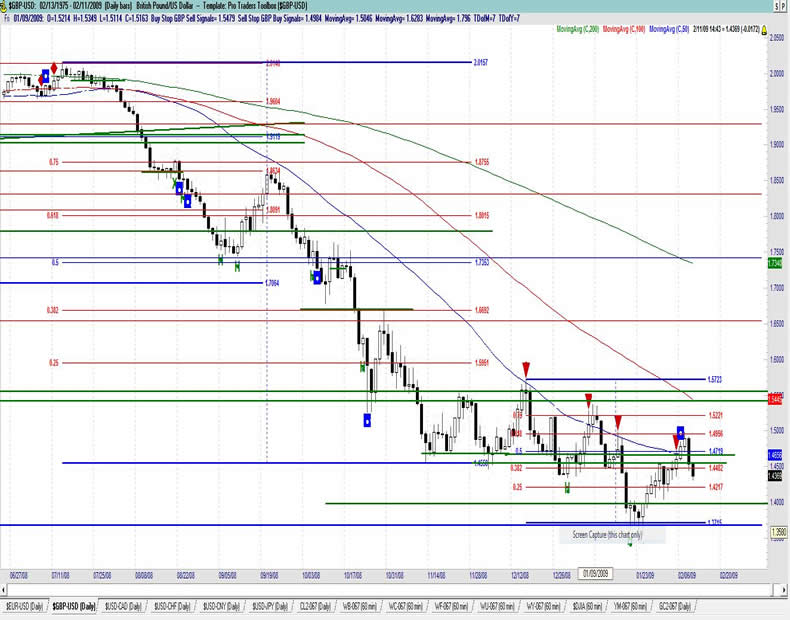

GBP/USD Daily

Resistance 3: 1.4700/10, Resistance 2: 1.4650, Resistance 1: 1.4580

Latest New York: 1.4369, Support 1: 1.4320, Support 2: 1.4250/60, Support 3: 1.4200

Comments

Rate two-way again overnight, opens New York lower and holds into next level of support around the 1.4320/30 area. Technical trade the rule to start the week with cross-spreaders on the sell side of GBP overnight. Rate needs to hold above 1.4700 area to keep bulls happy. BOE King suggests quantitative easing is on the way; traders see this as bearish. Traders note stops and active selling as the rate drops back to 1.4480 area suggesting that is becoming a pivot area. Tech resistance now at 1.5000 area likely to cap near term but stops are building above and the 1.5000 handle is a big psychological number. 23 year lows are very likely to hold on any break. Two-way action continues suggesting that shorts are aggressively adding and longs are trying to find a bottom. Rate trading on technical’s now. Spillover from EURO likely but modest.

Data due Thursday: All times EASTERN (-5 GMT)

NONE

EUR/USD Daily

Resistance 3: 1.3080, Resistance 2: 1.3020/30, Resistance 1: 1.2990/1.3000

Latest New York: 1.2884 ,Support 1: 1.2750, Support 2: 1.2700, Support 3: 1.2680

Comments

Rate holds firm while other rates whipsaw; clears more stops close-in above the market from sellers yesterday on failure to hold 1.3030. Stops and active buying over the 1.3040 area traders say; those were the late buyers I think. Rate appears to be ready to close on the 1.2900 handle; fails into end of day but holds inside range day. Aggressive sellers likely to try and cap above key 1.3030 area; failure to hold 1.2900 today likely to signal a further break back to 1.2700. The dip is a buy opp but be nimble. Cross-spreaders likely pressure as crosses are unwound. Close above 1.3030 needed for further upside until then rallies likely to be sold into support around 1.2620/30 (?).Bulls are still attempting to find a bottom. 50 bar MA failed now likely to offer resistance and a close above suggests the bottom will be in. Technical levels around the 1.2920/50 area now likely to offer resistance so expect two-way action and consolidation underneath.

Data due Thursday: All times EASTERN (-5 GMT)

4:00am EUR ECB Monthly Bulletin

5:00am EUR Industrial Production m/m

1:00pm EUR ECB President Trichet Speaks

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.