The Inescapable Inflationary Realities of Quantitative Easing and Economic Stimulus

Economics / Inflation Mar 27, 2009 - 03:02 PM GMTBy: Ty_Andros

$14 million, million, or stated another way $14 trillion. The annual GDP of the US is approximately $14 trillion or $46,666 for every man, woman and child in the US - either way you view it, this is the INCONCEIVABLE amount that has been spent, printed or guaranteed since January 2007 in the US; it does not include the government machinations in other G7 countries. And what have you and your family received from that $46,666 per person? MOSTLY nothing and you will get mostly nothing from the next $46,000 and the next $46,000; ut you will get one thing from it: the bill.

$14 million, million, or stated another way $14 trillion. The annual GDP of the US is approximately $14 trillion or $46,666 for every man, woman and child in the US - either way you view it, this is the INCONCEIVABLE amount that has been spent, printed or guaranteed since January 2007 in the US; it does not include the government machinations in other G7 countries. And what have you and your family received from that $46,666 per person? MOSTLY nothing and you will get mostly nothing from the next $46,000 and the next $46,000; ut you will get one thing from it: the bill.

The greatest transfer of wealth from those who hold their money in paper to those who don't has commenced. A “Crack-up Boom” approaches.

So far, the governments and central banks of the US , UK and Switzerland have embarked upon QUANTITATIVE easing, aka “printing money out of thin air,” to liquefy their financial systems, generate financial system bailout funds and devalue their currencies for competitive reasons. This is set to continue indefinitely as public serpents socialize the costs of their follies and transfer the benefits of it to their elite special interest campaign supporters.

The Euro zone shall soon be forced to do so in a defensive measure and as a practical response to the credit markets increasingly ceasing to function;and the bulk of the problems have not been addressed, so future efforts will dwarf what has gone before. The demise of the G7 financial and currency systems is, as some would say, “baked in the cake”. The only thing we do not know are the various roads we will travel in reaching the ultimate destination. It is a battle between Mother Nature, the government and banking elites. I know who will win this battle, and it is not man.

The Federal Reserve balance sheet has expanded from under a trillion dollars to over $2 trillion since September, and with last week's announcement of an additional $750 billion MBS (mortgage backed securities) and $300 billion long-dated US treasuries in the next six months, it can be expected to rise to over $4 trillion during this period. Before this crisis is over, this balance sheet EXPANSION will probably approach $15 to 20 trillion. Bill Gross of Pimco estimates another $5 trillion is needed; unfortunately, that is just what is needed in the next two years;and they will tax you to death and print it to SAVE you.

This has rightfully provoked outrage by the groups holding dollars or treasuries, most notably the Chinese, Japanese and Russians. Less than a week after Obama assured the world of the soundness of US issues, the US Fed threw another $1.3 million, million ($1.3 trillion) into the pool of FIAT US currency. An instant stealth tax on all dollar holders as their money SITS in the bank and dollar-denominated bonds. Contrary to government assertions, this $1.3 trillion of printed money and all printed money everywhere is a TAX on the poor, middle class and everyone's earnings and savings.

Of course, the Federal Reserve HAD TO, as the TIC's data (treasury flow of foreign funds data) revealed that foreign buyers of US treasuries and agency bonds went negative to the tune of approximately $149 BILLION, and signaling the growing rejection of debt offerings by increasingly INSOLVENT issuers. As the US Congress makes mincemeat of the international belief that we have the rule of law and honor our contracts, the fed will increasingly have to step in to fund the deficits and mortgage markets because no one will buy those issues. Now much of the deficit spending will be financed by printing money just as BANANA republics do. An additional note is the failure of a recent Gilt auction by the UK government, echoing a similar failure at a Bund auction in Germany . These are just anecdotes as investors increasingly shun G7 Mond offerings in FIAT currencies.

Of course, the Federal Reserve HAD TO, as the TIC's data (treasury flow of foreign funds data) revealed that foreign buyers of US treasuries and agency bonds went negative to the tune of approximately $149 BILLION, and signaling the growing rejection of debt offerings by increasingly INSOLVENT issuers. As the US Congress makes mincemeat of the international belief that we have the rule of law and honor our contracts, the fed will increasingly have to step in to fund the deficits and mortgage markets because no one will buy those issues. Now much of the deficit spending will be financed by printing money just as BANANA republics do. An additional note is the failure of a recent Gilt auction by the UK government, echoing a similar failure at a Bund auction in Germany . These are just anecdotes as investors increasingly shun G7 Mond offerings in FIAT currencies.

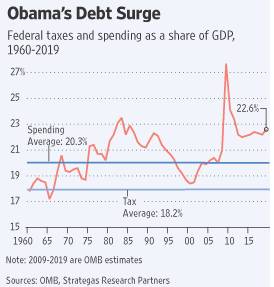

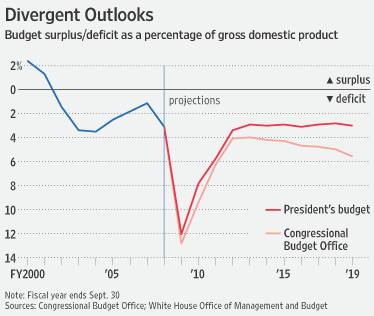

The spending excesses of the current Congress and administration in Washington DC are dwarfing any seen in the recent past. The federal government's share of the GDP is poised to explode from approximately 21% to over 28% in less than a year. Take a look at this chart outlining the explosion in government as a percentage of GDP:

Don't be FOOLED by the OMB (Office of Management and Budget,) estimations that the percentage will recede. They are predicated on an economy growing at a 3 to 4% rate, which is not going to materialize as the government agencies go to work on the private sector.

Incomes and tax receipts are plummeting, so the percentage of the deficits should rise, RELENTLESSLY. Of course, this does not include states and municipalities who are RAISING taxes and fees in draconian proportions to fund budgets created during the credit bubble; a double whammy to the incomes of the private sector. Growth WILL NOT resume in the US under these conditions. The thought that the US can grow 3% next year while government takes an additional 10% of GDP is wishful thinking and media spin for the masses.

Incomes and tax receipts are plummeting, so the percentage of the deficits should rise, RELENTLESSLY. Of course, this does not include states and municipalities who are RAISING taxes and fees in draconian proportions to fund budgets created during the credit bubble; a double whammy to the incomes of the private sector. Growth WILL NOT resume in the US under these conditions. The thought that the US can grow 3% next year while government takes an additional 10% of GDP is wishful thinking and media spin for the masses.

Additionally, the private debt markets will be significantly starved, so corporations will be starved for cash and funding on an increasing basis, which is not a recipe for economic growth.

Look no further than this “It makes me want to vomit” speech from the Senate floor by Senator Tom Colburn: http://therealrevo.com/blog/?p=5109 (do not miss watching this video). It outlines the NAKED corruption now resident in Washington , DC , that goes UNREPORTED by the mainstream media. Representative government is a pipe dream as they no longer rely on the citizens for their money; instead, they just authorize the debt to be raised, sell the bond to the fed and let the children pay for it. Immoral, obscene and fiscally bankrupt public serpents. Take a look at this fabulous video from YouTube, entitled “We The People Stimulus Package” on the same subject: http://www.youtube.com/watch?v=jeYscnFpEyA .

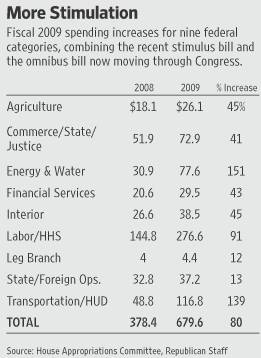

Next year, the stimulus bill increases the size of government agencies by an incredible 80% and adds the new spending to the BASELINE budgets.

Your lives are about to descend into hell and become tortured by overpaid, “brain dead” bureaucrats with virtually unlimited budgets to impose their wills and absurd ideas about what is best for you as defined by government. Do you really believe they can come up with useful things to be done with these gargantuan increases in their size? And the omnibus bill Senator Colburn speaks of increases these budgets another 8% on top of this. So the size of government is set to INCREASE in the United States by 88% in one year . This is capital destruction and misallocation of resources on an epic scale such as NOAH'S Ark.

Your lives are about to descend into hell and become tortured by overpaid, “brain dead” bureaucrats with virtually unlimited budgets to impose their wills and absurd ideas about what is best for you as defined by government. Do you really believe they can come up with useful things to be done with these gargantuan increases in their size? And the omnibus bill Senator Colburn speaks of increases these budgets another 8% on top of this. So the size of government is set to INCREASE in the United States by 88% in one year . This is capital destruction and misallocation of resources on an epic scale such as NOAH'S Ark.

These government agencies will descend like locusts on their respective parts of the private sector and the result will be the same: barren fields and destroyed economic harvests.

As former President Ronald Reagan once quipped “The nine most terrifying words in the English language are, 'I'm from the government and I'm here to help.'” We are all about to get a lesson in the meaning of his comment..

The public servants currently in power are hell-bent on codifying into law a complete transformation of the US into a European welfare state in one fell swoop, with themselves in charge of the MONEY and the details of: health care, energy and climate change (the Environmental Protection Agency is about to issue new rules which will broaden their reach immeasurably, declaring the air you exhale a public safety hazard, and before these monsters are done, Freddie Kruger will look like a choirboy), effectively banning firearms through back door means, at which point you will have no defense against public servants and their minions.

Once these laws are passed, they will NEVER be repealed. They are even planning to REGULATE livestock flatulence, also known as FARTS (yesterday, a volcano erupted in Alaska spewing forth more greenhouse gasses than have been generated in HISTORY by humans), requiring carbon permits from livestock producers. They will pass this right through to you in the cost of the meat and poultry your family needs. How absurd. It has NOTHING to do with the climate, which the governments have NO ABILITY to control; it is about taxes and regulatory control in disguise.

This economic collapse in the G7 is nothing more than the second collapse of communism and fascism. Take a look at this excerpt from a recent privateer ( www.the-privateer.com ). I urge you to subscribe; it is affordable and worth every penny.

When Governments Decide – Anti-Market Economies Are the Result

“If governments decide (directly or through rules and regulations) what shall be produced and in what quantity and quality, the nations so governed will end up with a welfare state. Inexorably, that will be followed by socialism, where all the productive tools have become public property solely owned by the government. At the end of that road is communism, where all human beings become public property, the slaves of government.

The parallel track, to the same end destination, is the one in which government leaves the facade of a free market in place and in full public view. Meanwhile, by means of massive bureaucracies and a tidal wave of regulations, taxes, fiat money and credit money, subsidies, bailouts etc., the government decides what shall be produced and in what quantity and quality. This economic system was named “Corporatism”. Its matching political system is called “Fascism”. Both of these systems were once perfectly well understood. That is not the case today.

Mussolini, who instituted “Corporatism” in Italy was quite clear. In a 1923 pamphlet titled “the Doctrine of Fascism” he wrote, “If classical liberalism spells individualism, Fascism spells government. Fascism should more appropriately be called Corporatism because it is a merger of State and corporate power.” Mussolini's politics were also clear: “All for the state, nothing outside the state, nothing against the state”. This is Totalitarianism, the goal being to make the individual subject to government.

Today, it is not the free market which has failed, but Interventionism. There has not been a genuinely free market in any western economy for generations. It is only the areas where a partial market was allowed to function for a period of time which have been responsible for the economic progress which has been made since the end of WWII. But today, even a partial market freedom is close to extinction.

Recognizing a free market is easy. THERE IS NO INCOME TAX. Gold (and/or Silver) coin circulates as money. Private property and contracts are sacrosanct, as is the total separation of state and economics.”

The last paragraph from The Privateer describes what the US was like when it was a constitutional republic, before being corrupted by PUBLIC SERPENTS, banksters and special interest elites. The quote from Mussolini could easily come from ANY G7 capital.

The parallel track sums up the G7 quite nicely, as the facade of free markets and human beings have now in REALITY become public property and slaves of the government, i.e., communist, fascist and corporatist. Just ask anyone in the United States, where the people who actually do pay taxes are now becoming the slaves of those who don't, as 53% of the people no longer pay taxes after Obama's tax cuts (actually welfare payments masquerading as tax credits).

This majority by the mob will vote for anything, and the more desperate things become in the G7, the more mischief they will endorse. The Obama Administration and Congress are deliberately destroying the economy to drive the poorest and dumbest among us into desperation, and subsequently give them the votes to do ANYTHING, as Nancy Pelosi so clearly stated when they rammed the stimulus bill through with NO republican support: we got the votes and we wrote the bill. Aka, we listen to no one!

In the G7, when citizens want to leave and take their money with them, they are chased like slaves were when they fled the plantations. Obviously, these people's savings ARE NOT theirs in the eyes of the G7 governments. These are NOT free men. In the minds of their respective governments, they are the property of their fellow citizens and collective societies . Obscene, immoral, Orwellian doublespeak where illiterate citizens are told that individually successful people are evil, greedy monsters, rather than the entrepreneurs, employers and small businessmen who built this country from the ground up for generations!

Just look at the circus over AIG that has unfolded in Washington as the mob is now in full-throated ROAR. Look no further than these words from F. William Engdahl summing it up quite nicely:

Theatre of the absurd or deflection?

“This all makes great food for tabloid headlines and popular outrage. They can write that elected politicians are finally acting in taxpayer interests. Until we look a bit more closely. Paying $165 million in employee bonuses or any amount for a company that is in the middle of a multi-trillion dollar fraud that is bringing the world economy down with it is ‘outrageous.'

The problem is the tax bailout hemorrhage will go on. The reason is the Obama Administration like its predecessor refuses to take consequent action with AIG, despite the fact today the US Government owns at least 80% of AIG stock, bought for $180 billion of, yes, taxpayer dollars. To demand AIG ‘pay back the government' is absurd as the government is in effect demanding it pay itself back with its own money. The latest claim that the Treasury will subtract the $165 million bonus money from the next $30 billion tranche it will give AIG says it all.

The political ‘outrage' expressed by the Obama Administration is an example of ‘perception management.' The population is being slyly duped into believing their officials are working in their interest. In reality the officials are channeling growing popular outrage over endless bank bailouts away from the real problem to an entirely tertiary one. The US Government has injected $180 billion since September 2008 to keep the ‘brain dead' AIG in business and honoring its Credit Default Swap obligations. In effect, they are propping up the casino to continue endless gambling with taxpayer dollars.”

As William says, this is all a deflection of the back door bailouts of financial firms worldwide. I just watched Obama's news conference and he reiterated his beliefs that the federal government must REFORM the energy, healthcare and education sectors without considering the cost. These priorities just CAN'T wait. He then explained the latest weasel words, “borrow and spend” are out and are now actually “save and invest”. So, when you hear “save and invest” he actually means borrow and spend, thus he can FOOL the vast majority of people that take the words at their original meaning. This is called doublespeak! He knows that if they wait his “socialist” agenda will NEVER pass because there is no money for it.

The government is DELIBERATELY destroying the economy to create the crisis they need to complete the nationalization of the economy to SAVE you. As the stimulus package and omnibus spending bills are implemented, business will wilt under the iron hands of the bureaucrats, public serpents and their special interests.

There is only one thing you can take from the relentless destruction of the G7 economy and the currencies: everything is mispriced and must run far to get to real values. So volatility is set to continue; and “Volatility is Opportunity ” as stocks, bonds, currencies, commodities and precious metals and all markets ZOOM up and down to price in the unfolding maelstroms in the markets. Absolute Return Alternative Investments which have the potential to make money in RISING and FALLING markets are part of the solution for any portfolio. Helping people find and implement them is what I do.

2009 Outlook - Commodities

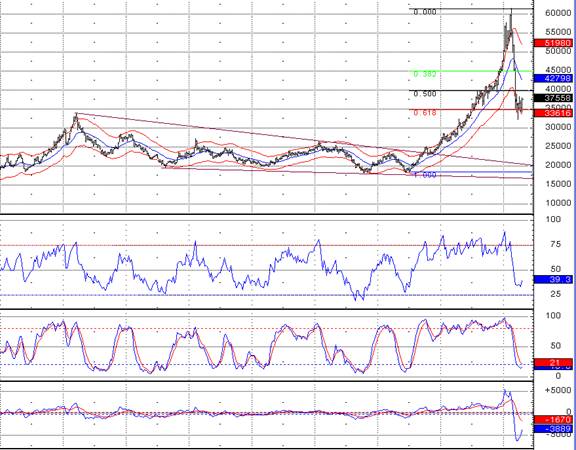

The first thing we must understand when viewing this sector is the fact that commodities and precious metals went through a 25-year SECULAR BEAR MARKET, which ended in a double bottom that was formed between 1998 and December 2001. Just in time, inventories and international shipping severely reduced the need to hold inventory. Every bit of excess capacity and stockpiles were virtually eliminated worldwide. I have created a MONTHLY chart of the continuous commodity index going back to the 1976 period to emphasize the period where anyone who tried to build a commodity business was ground to dust as every rally was false, and expansion of supply was punished in the marketplace from 1980 through 2001:

1976 1980 1984 1988 1992 1996 2000 2004 2008

Please notice how the BULL market has corrected a Fibonacci .619 of its move off the 1998-2001 lows, which implies that we have just witnessed the first wave up of a 20 to 25-year SECULAR BULL MARKET (and the first corrective wave down of the bull move), and when it turns higher and gives a buy signal, we are most probably staring at the next leg up in commodities directly ahead. The creation of commodity and energy supply is a long process, usually taking 5 to 10 years, and whatever capacity was being built up until the credit crisis began has now been shut down. So, very few new sources of commodities can be expected to emerge. Oil supplies are falling almost 10% a year; a rate faster than the rate of decline in demand.

After the relentless secular bear market and base building period, population growth and the emergence of the BRICS (Brazil, Russia, India, China), as G7 deindustrialization and new found capitalist economies based on Austrian economics, created rising incomes and middle classes in many formally impoverished regions. These societies are based on SAVINGS (as they know the government is good for nothing), producing more than you consume (as not to do so leads to personal demise), and the work ethic to provide a better future for their children. Wealth creation is alive and well in the emerging world. Once they learn to “smell the roses” of their success and consume more (as they are doing daily), these societies will become the wealthiest in the world as the wealth of the world continues to rotate from the Western developed economies to the emerging world. Any historian can tell you this long pattern of wealth rotation has been in place for centuries.

There are BILLIONS of people emerging into higher standards of living, and they live in the MOST economically competitive areas of the world. They are masters of providing “MORE FOR LESS” to their customers, and thus will be the provider of choice for income-constrained western consumers. The formerly Austrian G7 capitalist economies have evolved into quasi-socialist asset-backed economies, where wealth is an illusion of misstated inflation of assets (which we now see reverting back to the real, not nominal values.) They now live in de-industrialized shells of their former economies, incapable of producing more than they consume and creating the savings necessary for rising middle classes and capital investment, which is the seed corn of future wealth.

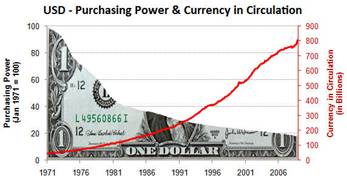

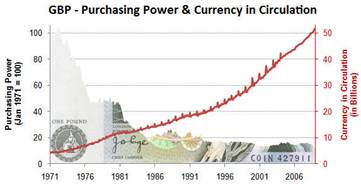

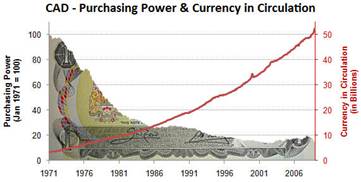

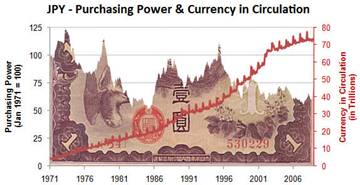

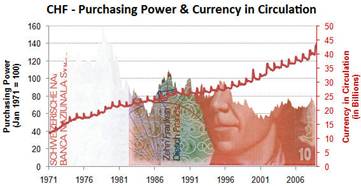

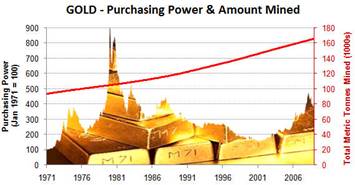

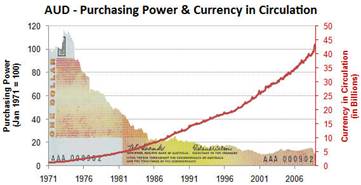

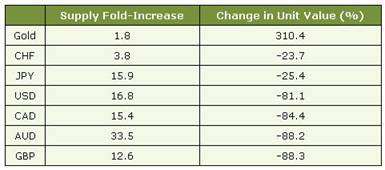

So the governments of the G7 have resorted to what all empires do as they reach the end of their histories: borrow and print money to support their spending since wealth creation no longer does so. Gold is at or near a new high against every FIAT currency in the world and that is no coincidence. It is a reflection of the declining purchasing power of the currencies in which it is denominated. Take a look at these charts of world currencies and gold (courtesy of Mike Hewitt and www.dollardaze.org ) since 1971, when Breton Woods II forever tore G7 currencies from gold and silver reserve backing:

Thank you, Mike. Notice there is only one currency which has not lost purchasing power and that is the oldest currency in the world: GOLD. As the MONEY printing in the G7 accelerates to underpin the governments and financial systems, you can expect commodities to REPRICE higher to reflect the lower purchasing power of whatever currency in which it is denominated, putting additional buying power in them as investors increasingly seek shelter from the printing presses.

Thank you, Mike. Notice there is only one currency which has not lost purchasing power and that is the oldest currency in the world: GOLD. As the MONEY printing in the G7 accelerates to underpin the governments and financial systems, you can expect commodities to REPRICE higher to reflect the lower purchasing power of whatever currency in which it is denominated, putting additional buying power in them as investors increasingly seek shelter from the printing presses.

The temporary destruction of demand for commodities has been largely PRICED into commodity prices without disturbing the longer-term bull trend, caused by supply constraints which just recently began in 2001. You can count on the debasement of the G7 currencies to accelerate as investors and G7 currency holders increasingly shun buying paper that “melts in your hand and bank accounts” in favor of? The “Indirect Exchange” (as outlined by Ludwig von Mises) into the shelter provided by tangible assets, such as commodities, precious metals and raw materials. Look no further than the Chinese to see this in action, as they have embarked on a spending spree to rid themselves of the toxic G7 currencies and exchange them for tangibles of all stripes, including commodities.

In Conclusion : The G7 governments are at war with their citizens, only the citizens are largely unaware of it. Citizens have been dumbed down and the media spins the government line to dupe the public into believing that government is for them rather than against them in this period of time. The DARWINIAN struggle to survive and grow is now a showdown between the public sectors, government elites and special interests versus the private sectors and the public at large. As the governments increasingly DESTROY the ability to create wealth in the private sector, incomes have and will continue to collapse, as will tax receipts on the endless list of taxes and fees now imposed.

As these sources of income recede, the only options will be to borrow from future generations through treasury issuance to the central banks, aka “PRINTING THE MONEY”. Since there is this little timeless truth known by non-governmental economists as “there is no such thing as a free lunch”, we are headed toward the demise of the G7 financial systems. And of course, this does not include the FREE healthcare and new energy REGULATIONS and TAXES which they are about to impose.

On another note, FASBY 157, which mandates mark-to-market accounting, has succumbed to political pressure and has been eviscerated, effectively allowing the banks to misstate their assets values to models, rather than to market prices. So expect the losses to once again be HIDDEN from view and profits to appear when marked to model, i.e., lying with numbers with government approval. The profits are ILLUSIONS, courtesy of corrupt public serpents, banksters and now the accounting OVERSIGHT board. Insolvency is not cured with the stroke of a pen, it is fixed by NEW CAPITAL!

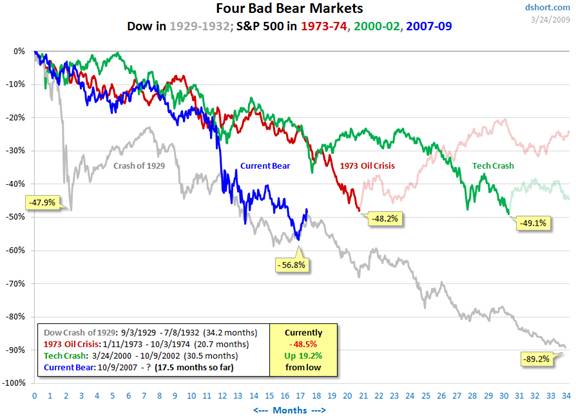

Look no further than recent LOUD outbursts by the G7's largest creditors such as the Chinese, Russians, Indians and Brazilians, illustrating their dismay. They should, because when the debasement occurs, it is a theft of the purchasing power they store in G7 currencies and bonds. The rallies in stock indexes are nothing more than bounces in ongoing bear markets. Here is an analogue chart of the 4 biggest bear markets in history:

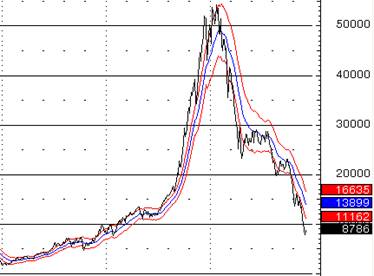

This is a powerful signpost of future price action. The only thing which may keep us from going to lows at the 3000 to 4000 level in the Dow is the rapidity of the monetary debasement process. Stocks are in many ways TANGIBLE investments and will re-price HIGHER to reflect the diminishing purchasing power of the currency in which they are priced. So the faster the G7 debases their currencies, the more buoyant NOMINAL prices will be. But don't be fooled, they are declining in real terms “purchasing power” as this chart of the S&P 500 denominated in gold illustrates:

1980 1990 2000

Notice how the rally to new highs from 2002 to late 2007 DISAPPEARS when measured in REAL MONEY. That rally was an illusion of growth provided by FIAT currency and inflation. The true picture of the value of your stocks is displayed in this chart. If you look at bonds, the picture is WORSE…

I believe the recently unveiled public/private partnerships fail because the worth of the toxic assets is ZERO (this is what investors are willing to pay if not offered loans by the government and Fed), and after last week's debacle in congress does anyone believe they can partner with the government and trust they will honor their agreements?

There is no way to avoid the unfolding, ultimately inflationary great depression because public servants are incapable of doing what is right for their constituents, rather than what is politically beneficial. But profits and opportunities will abound for the astute and informed investor. The abuse of the ability to issue debt and print money will be abused until such time that the financial, currency and banking systems collapse and are shunned by the world publics . Learn how to make money in up and down markets using absolute return alternative investments and seek the “indirect exchange” as outlined by Ludwig von Mises. So it is once again: Hi ho, Hi ho, off to the printing press they go; selling treasuries to create the money and sending you and your children the obligation to pay for it

Note: I will be appearing as a panel speaker at the Chicago Resource Expo on April 24 th and 25 th . Attendance is free and information is available at: http://www.chicagoresourceexpo.com .

Don't miss the next issue of Ted bits. Subscribe. It's free, at: www.TraderView.com

Please remember that subscribers generally receive Tedbits two to three days before it is posted on the web. Subscribers will also start receiving guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2009 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.