What ETFs Are Up Intermediate-Term?

Stock-Markets / Exchange Traded Funds Apr 10, 2009 - 04:46 PM GMTBy: Richard_Shaw

With all the concern about what's surging up and what's spiraling down in the short-term, what ETFs are showing strong intermediate-term trends (based on 200-day moving average)?

With all the concern about what's surging up and what's spiraling down in the short-term, what ETFs are showing strong intermediate-term trends (based on 200-day moving average)?

Scanning the larger ETFs (those in the upper quartile by assets), we find four that are priced at or above $5.00 with at least 100,000 shares traded on average each day for the past month, and that meet these moving average price criteria:

- 200-day SMA of Close today > 200-day SMA 5 days ago

- 200-day SMA of Close 5 days ago > 200-day SMA of Close 10 days ago

- 200-day SMA of Close 10 days ago > 200-day SMA of Close 15 days ago

- 50-day SMA of Close today > 200-day SMA of Close today

- 20-day SMA of Close today > 50-day SMA of Close today

- 5-day SMA of Close today > 20-day SMA of Close today

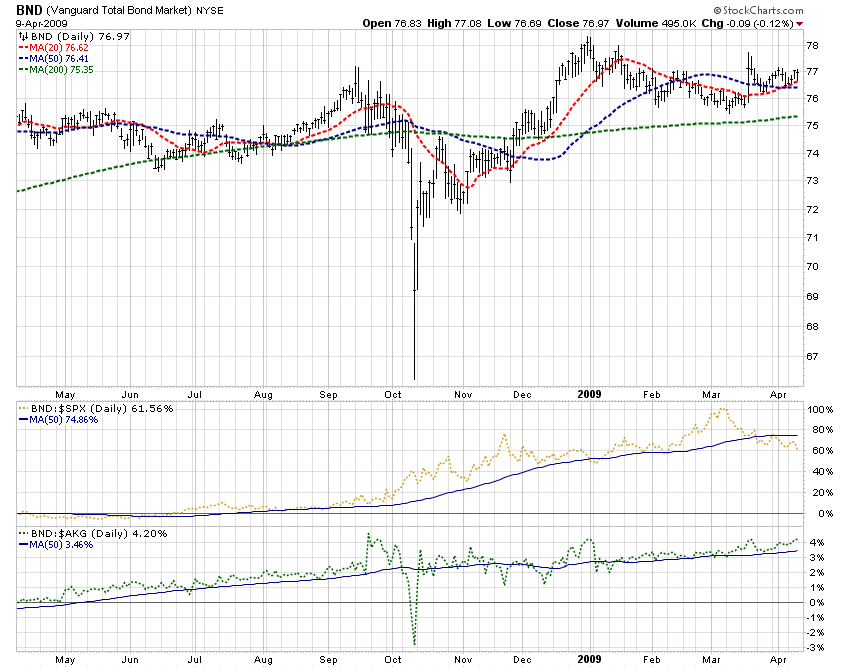

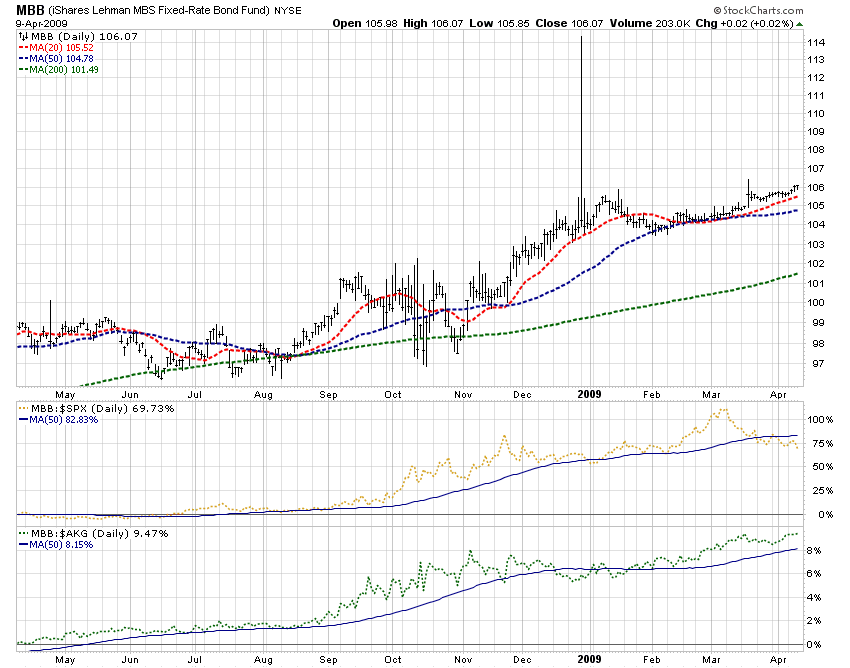

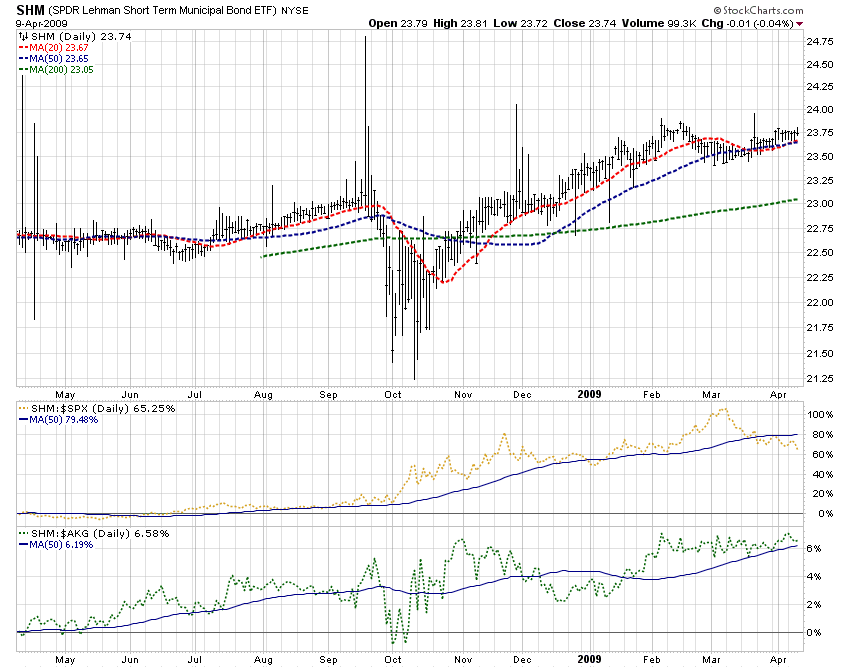

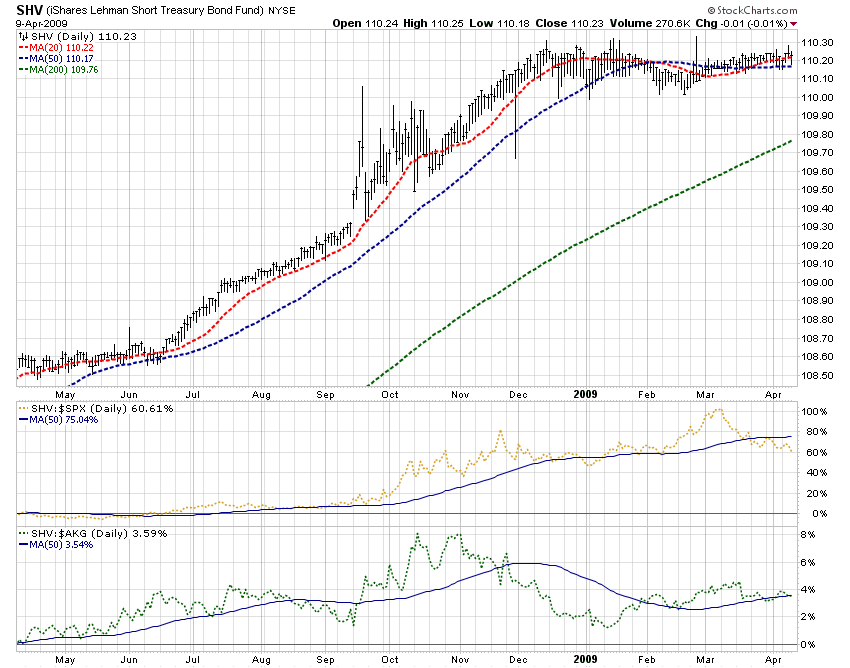

They are aggregate US Bonds (BND), agency backed mortgage securities (MBB), short-term municipal bonds (SHM) and short-term Treasuries (SHV).

Key data for each fund: (expense ratio in basis points / average duration in years / credit quality / 30-day SEC yield / distribution yield / sponsor)

- BND: (11 / 4.1 / AA / 4.31% / not reported * / Vanguard)

- MBB: (25 / 1.6 / AAA / 0.01% / 3.07% / iShares)

- SHM: (20 / 1.5 / AA2 / 1.46% / 4.37% / iShares)

- SHV: (15 / 0.4 / AAA / 0.27% / 0.56% / SPDRs)

[* Vanguard reports the distribution amounts]

Each price chart below shows the 20-day, 50-day and 200-day moving average of the price, as well as two panels below. One panel shows the ratio of the percentage price performance of the fund to the percentage price performance of the S&P 500 index. The other shows the ratio of the percentage price performance of the fund to the percentage price performance of the Aggregate US Bond index.

BND

MBB

SHM

SHV

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.