Time To Breakup Goldman Sachs

Politics / Credit Crisis 2009 Apr 13, 2009 - 06:20 AM GMTBy: Mike_Shedlock

It's time to breakup Goldman Sachs, Citigroup, and for that matter any bank or holding company deemed too big to fail. It's not just the "too big to fail" hazard that is troubling, it's also the power these corporations have and the potential to abuse that power that is also troubling.

It's time to breakup Goldman Sachs, Citigroup, and for that matter any bank or holding company deemed too big to fail. It's not just the "too big to fail" hazard that is troubling, it's also the power these corporations have and the potential to abuse that power that is also troubling.

Please consider the article Incredibly Shrinking Market Liquidity as posted on the Zero Hedge blog.

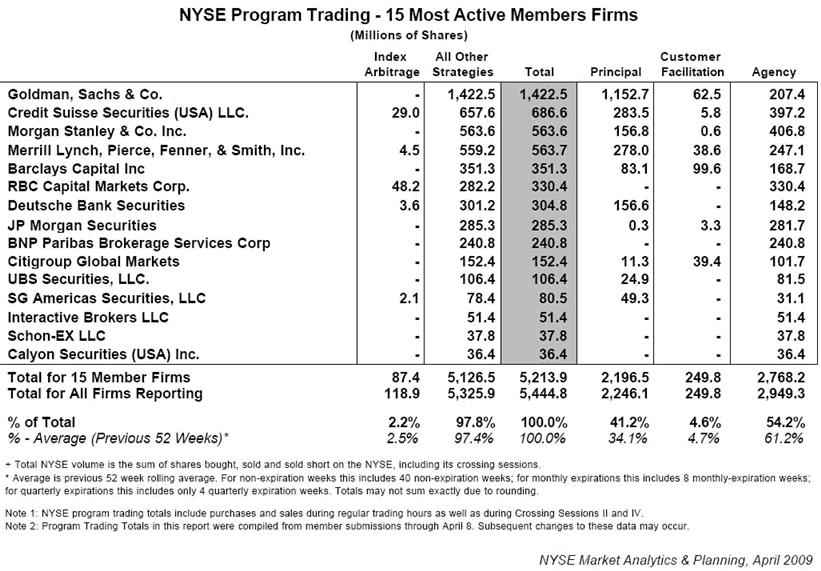

A very interesting data point, also provided by the NYSE, implicates none other than administration darling Goldman Sachs in yet another potentially troubling development. The chart below demonstrates the program trading broken down by the top 15 most active NYSE member firms. I bring your attention to the total, principal, customer facilitation and agency columns.

Key to note here is that Goldman's program trading principal to agency+customer facilitation ratio is a staggering 5x, which is multiples higher than both the second most active program trader and the average ratio of the NYSE, both at or below 1x. The implication is that Goldman Sachs, due to its preeminent position not only as one of the world's largest broker/dealers (pardon, Bank Holding Companies), but also as being on the top of the high-frequency trading/liquidity provision "food chain", trades much more often for its own (principal) benefit, likely in tandem with the other top dogs on the list: RenTec, Highbridge (JP Morgan), and GETCO.

In this light, the program trading spike over the past week could be perceived as much more sinister. For conspiracy lovers, long searching for any circumstantial evidence to catch the mysterious "plunge protection team" in action, you should look no further than this.

Readers know that I am not a subscriber to Plunge Protection Team (PPT) theory. However, I am open to the idea that it is possible for Broker Dealers or Bank Holding Companies to be trading their own accounts ahead of customer accounts and/or advising clients (or the public) one way (and trading the other), on purpose.

That is not a direct accusation. Instead it is a statement of what is possible due to lack of sufficient separation between trading groups, advisory groups, and a myriad of hedge funds sponsored by the broker dealers and bank holding companies.

That Goldman, Citigroup, and the now defunct Bear Stearns and Lehman, etc, could ever be in a position to front run trades based on analysis they know they are going to publish, and/or to purposely make recommendations to ignite short squeezes or selloffs based on positions they hold is simply wrong.

Citibank to Investors: We Suggest You Bet Against Us

Please consider the following horrendous advice last week by Citigroup. Flashback March 31, 2009 Citibank to Investors: We Suggest You Bet Against Us.

March 31 (Bloomberg)Investors should buy put options on financial companies because derivatives-market trading suggests the industry will retreat after a 43 percent surge since March 6, Citigroup Inc. said. He recommended puts giving the right to sell the Financial Select Sector SPDR Fund [XLF], an exchange-traded fund that tracks a basket of bank stocks, for $8 before May 15.

XLF Daily Chart

With Citigroup, one should never rule out sheer incompetence as the most likely answer for anything it says or does, but one also cannot help but wonder if Citigroup was on the winning side of that recommendation as a market maker.

Inquiring minds will note that Citigroup's advice came out just before a ruling on mark-to-market accounting that was expected to be (and was) very favorable to every company in the XLF. The chart shows that XLF exploded North.

Was this sheer incompetence by Citigroup or something more sinister? What about recommendations from Goldman? Can anyone say for sure? Even if someone thinks they can, are the answers believable?

Goldman Harasses Mike Morgan

Blogger Mike Morgan of MorganFlorida and owner of website GoldmanSachs666 is being threatened by Goldman Sachs. Please consider Goldman Sachs hires law firm to shut blogger's site.

Goldman Sachs is attempting to shut down a dissident blogger who is extremely critical of the investment bank, its board members and its practices.

The bank has instructed Wall Street law firm Chadbourne & Parke to pursue blogger Mike Morgan, warning him in a recent cease-and-desist letter that he may face legal action if he does not close down his website.

Florida-based Mr Morgan began a blog entitled "Facts about Goldman Sachs" – the web address for which is goldmansachs666.com – just a few weeks ago.

In that time Mr Morgan, a registered investment adviser, has added a number of posts to the site, including one entitled "Does Goldman Sachs run the world?". However, many of the posts relate to other Wall Street firms and issues.

According to Chadbourne & Parke's letter, dated April 8, the bank is rattled because the site "violates several of Goldman Sachs' intellectual property rights" and also "implies a relationship" with the bank itself.Foolish Tactics By Goldman Sachs

I am not a lawyer but I suggest Goldman is about to make fools out of themselves. To allege the site "implies a relationship" with Goldman Sachs is complete nonsense. The opening statement on Morgan's website is "This website has NOT been approved by Goldman Sachs, nor does this website have any affiliation with Goldman Sachs."

If I was the judge handling this case, I would throw out the lawsuit, chastise Goldman's lawyers for wasting court time, order Goldman to reimburse Mike Morgan, and fine Goldman for good measure to make sure they do not do this again to anyone else.

If nothing else, Goldman's tactics are going irritate others into digging into what Goldman is doing and publicizing it. In fact, Goldman's ridiculous harassment of Mike Morgan, is what inspired this post.

I hope Karl Denninger at The Market Ticker, Yves at Naked Capitalism, and Barry Ritholtz at the Big Picture Blog all chime in on both aspects of this post:

1) The potential for improprieties at the Broker Dealers and Bank Holding Companies.

2) The ridiculousness of Goldman's lawsuit against Mike Morgan and various (equally ridiculous) lawsuits against Aaron Krowne at Mortgage Lender Implode-O-Meter. Please see Scrappy Mortgage Blogger Fights Bad Court Ruling as well as New Hampshire Court Tramples on Constitution for details.

Citigroup, Goldman, etc, all maintain their trading units are adequately separated from their research units and those units do not talk to each other. Really? Even if it is true, who can believe it? The only way to permanently get rid of allegations of improprieties is to break up the corporations so that it is physically impossible for such improprieties to occur. Goldman Sachs and others need to be broken up.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.