Obama Following UK Disastrous Economic Inflationary Policies of Printing Money

Economics / Quantitative Easing May 11, 2009 - 01:12 PM GMTBy: Gerard_Jackson

If there is one institution that is in desperate need of a stress test it's the US government. On 7 May the government auctioned $14 billion of 30-year bonds. The yield was 4.28 per cent, much higher than predicted by analysts. When the result became known Treasuries immediately dropped. For those readers who are unaware of the link between bond prices and yields, when the latter rises bond prices fall. This event followed closely behind the UK's failed bond issue. It sure as hell seems that the markets are worried by these governments' financial incompetence. And so they should be.

If there is one institution that is in desperate need of a stress test it's the US government. On 7 May the government auctioned $14 billion of 30-year bonds. The yield was 4.28 per cent, much higher than predicted by analysts. When the result became known Treasuries immediately dropped. For those readers who are unaware of the link between bond prices and yields, when the latter rises bond prices fall. This event followed closely behind the UK's failed bond issue. It sure as hell seems that the markets are worried by these governments' financial incompetence. And so they should be.

The British Labour Government has driven the UK to the brink of bankruptcy. Taxes are rising, the public debt will 80 per cent of GDP this year and unemployment is inexorably rising. And what is Brown's solution? To have the Bank of England flood the country with pound notes. What should unnerve Americans is that Obama's economic policies are basically the same as Brown's: massive spending, massive borrowing and massive monetary expansion. This is what these people and their economic advisors call sound economics. The classical economists must be spinning in their graves.

I believe that the tepid response to the Treasury's auction has greater significance for the future of the economy than the stock market. Obama and those vulgar Keynesians who advise him are going to spend trillions of dollars in a futile effort to promote economic growth while simultaneously planning policies that will -- if implemented -- lead to an immense amount of capital consumption and hence falling living standards. Unfortunately Americans have yet to grasp the fact that there is no way direct borrowing from the public can increase the rate of capital accumulation, otherwise known as economic growth.

On the contrary, not only can it retard this process it can actually put it into reverse. The whole idea that taxing Paul to spend on Peter, because Paul earns more money, will raise aggregate demand because it will reduce Paul's level of savings is so absurd that one can only marvel at the extent to which congressional Democrats are intellectually challenged. John Stuart Mill could very well have had Obama and Brown's spending frenzy in mind when he scathing observed

The utility of a large government expenditure, for the purpose of encouraging industry, is no longer maintained. Taxes are not now esteemed to be 'like the dews of heaven, which return in prolific showers'. It is no longer supposed that you benefit the producer by taking his money, provided that you give it to him again in exchange for his goods. There is nothing which impresses a person of reflection with a stronger sense of the shallowness of the political reasoning of the last two centuries, than the general reception so long given to a doctrine which, if it proves anything, proves that the more you take from the pockets of the people to spend on your own pleasures, the richer they grow; that the man who steals money out of a shop, provided that he expends it all again at the same shop, is a public benefactor to the tradesman whom he robs, and that the same operation, repeated sufficiently often, would make the tradesman a fortune. (John Stuart Mill, Essays on Economics and Society, Collected Works of John Stuart Mill, Vol. I, University of Toronto Press 1967, pp. 262-63).

This is the kind of wisdom that Harvard economists mock. Yet it made Great Britain the financial centre of the world. With respect to the current stock market situation the Bespoke Investment Group noted that since 1900 there have been only seven other periods that had similar surges for the Dow. Of those, three came before the Great Depression and three during the Depression. Of particular interest is that the successful one came in 1982. But this was the Reagan presidency and the most actively pro-business administration since the 1920s. On the other hand, Obama's rhetoric and policies have been the most hostile to business since the Roosevelt administration of the 1930s.

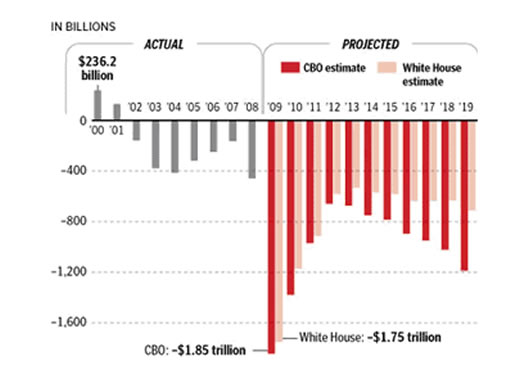

Potential bond buyers know that Bernanke's monetary policy is criminal and will inevitably lead to surging inflation if not halted. I strongly suggest that this realisation combined with Obama's gigantic borrowing proposals and his irresponsible deficits has made these would-be buyers especially cautious with the result that they just raised the cost of Obama's reckless fiscal policy. Once inflation begins to accelerate expect interest rates to steadily rise. The following chart was produced by the Heritage Foundation and should cause any reasonable American -- which unfortunately does not include hardcore Democrats, particularly in the media -- cause for alarm.

Three things can be deduced from this chart. Firstly, federal borrowing at this rate is unsustainable. As interest rates rise the cost of servicing the debt will also rise forcing the government to cut spending. The apparent alternative is to monetise the debt, which Bernanke seems perfectly willing to do. But this is an inflationary policy that would greatly aggravate the situation in more ways than Bernanke evidently understands.

Democrats being Democrats will always resort to their favourite option -- higher taxes, but the kind their billionaire friends can avoid. However, one would have to be a complete innumerate to believe that higher taxes would solve the problem. In addition, inflation is also a tax and a very destructive and capricious one at that. I fear that America could very well end up with a nasty dose of stagflation.

Finally, Obama's fiscal lunacy will have the effect of greatly weakening American military power by crowding out defence spending. Remember, this is the man who thinks government spend generates investment except when it is directed at defending the country. Hence his indecent haste in cancelling the F-22 and his endeavours -- despite public opinion to the contrary -- to abandon missile defence even as North Korea and Iran accelerate their own missile programs. In the meantime, China is rapidly modernising and expanding its own military, particularly its blue-water navy.

Obama is shaping up to be a disaster in more ways than one.

By Gerard Jackson

BrookesNews.Com

Gerard Jackson is Brookes' economics editor.

Copyright © 2009 Gerard Jackson

Gerard Jackson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.