Credit Crisis Freeze Thawing Following Massive Reflation Efforts

Interest-Rates / Credit Crisis 2009 May 19, 2009 - 06:43 PM GMT Are the various central bank liquidity facilities and capital injections having the desired effect of unclogging credit markets and restoring confidence in the world’s financial system? This is precisely what the “Credit Crisis Watch” is all about - a review of a number of measures in order to ascertain to what extent the thawing of credit markets is taking place.

Are the various central bank liquidity facilities and capital injections having the desired effect of unclogging credit markets and restoring confidence in the world’s financial system? This is precisely what the “Credit Crisis Watch” is all about - a review of a number of measures in order to ascertain to what extent the thawing of credit markets is taking place.

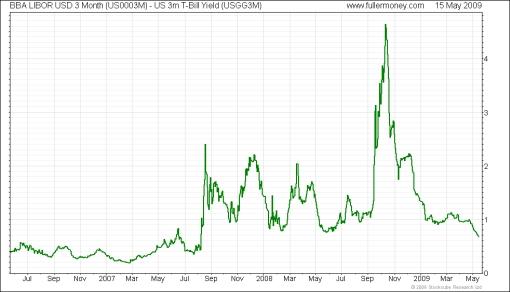

First up is the LIBOR rate. This is the interest rate banks charge each other for one-month, three-month, six-month and one-year loans. LIBOR is an acronym for “London InterBank Offered Rate” and is the rate charged by London banks. This rate is then published and used as the benchmark for bank rates around the world.

Interbank lending rates - the three-month dollar, euro and sterling LIBOR rates - declined to record lows last week, indicating the easing of strain in the financial system. After having peaked at 4.82% on October 10, the three-month dollar LIBOR rate declined to 0.83% on Friday. LIBOR is therefore trading at 58 basis points above the upper band of the Fed’s target range - a substantial improvement, but still high compared to an average of 12 basis points in the year before the start of the credit crisis in August 2007.

Source: StockCharts.com

Importantly, US three-month Treasury Bills have edged up after momentarily trading in negative territory in December as nervous investors “warehoused” their money while receiving no return. The fact that some safe-haven money has started coming out of the Treasury market is a good sign.

Source: The Wall Street Journal

The TED spread (i.e. three-month dollar LIBOR less three-month Treasury Bills) is a measure of perceived credit risk in the economy. This is because T-bills are considered risk-free while LIBOR reflects the credit risk of lending to commercial banks. An increase in the TED spread is a sign that lenders believe the risk of default on interbank loans (also known as counterparty risk) is increasing. On the other hand, when the risk of bank defaults is considered to be decreasing, the TED spread narrows.

Since the peak of the TED spread at 4.65% on October 10, the measure has eased to an 11-month low of 0.67% - still above the 38-point spread it averaged in the 12 months prior to the start of the crisis, but nevertheless a strong move in the right direction.

Source: Fullermoney

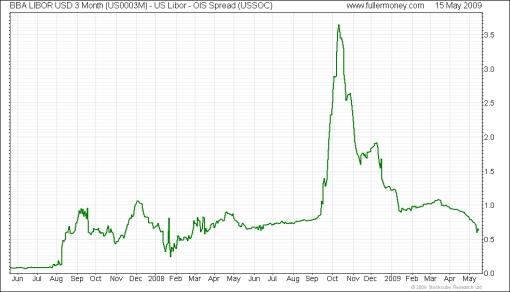

The difference between the LIBOR rate and the overnight index swap (OIS) rate is another measure of credit market stress.

When the LIBOR-OIS spread increases, it indicates that banks believe the other banks they are lending to have a higher risk of defaulting on the loans, so they charge a higher interest rate to offset that risk. The opposite applies to a narrowing LIBOR-OIS spread.

Similar to the TED spread, the narrowing in the LIBOR-OIS spread since October is also a move in the right direction.

Source: Fullermoney

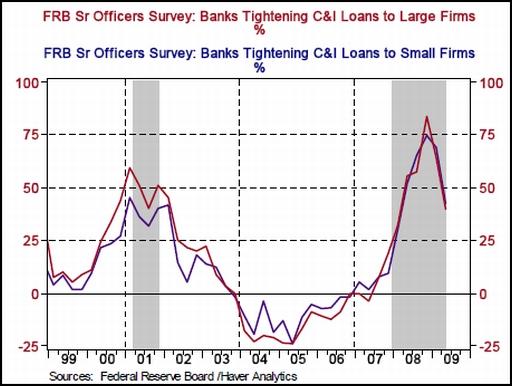

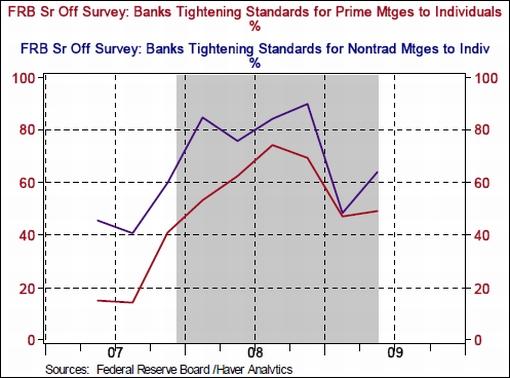

The Fed’s Senior Loan Officer Opinion Survey of early May serves as an important barometer of confidence levels in credit markets. Asha Bangalore (Northern Trust) said: “The number of loan officers reporting a tightening of underwriting standards for commercial and industrial loans in the April survey was significantly smaller for large firms (39.6% versus peak of 83.6% in the fourth quarter) and small firms (42.3% versus peak of 74.5% in the fourth quarter) compared with the February survey and the peak readings of the fourth quarter of 2008.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, May 4, 2009.

“In the household sector, the demand for prime mortgage loans posted a jump, while that of non-traditional mortgages was less weak in the latest survey compared with the February survey. At the same time, mortgage underwriting standards were tighter for both prime and non-traditional mortgages in the April survey compared with the February survey,” said Bangalore. In other words, more needs to be done by the lending institutions to revive mortgage lending.

Source: Asha Bangalore, Northern Trust - Daily Global Commentary, May 4, 2009.

The spreads between 10-year Fannie Mae and other Government-sponsored Enterprise (GSE) bonds and 10-year US Treasury Notes have compressed significantly since the highs in November. In the case of Fannie Mae, the spread plunged from 175 to 26 basis points at the beginning of May, but have since kicked up to 38 basis points on the back of the rise in Treasury yields.

Source: Fullermoney

After hitting a peak of 6.51% in July last year, the average rate for a US 30-year mortgage declined markedly. However, the rise in the yields of longer-dated government bonds over the past eight weeks - 57 basis points in the case of US 10-year Treasury Notes - resulted in mortgage rates creeping higher since the April lows. Also, the lower interest rates are not being passed on to consumers, as seen from the 414 basis-point spread of the 30-year mortgage rate compared with the three-month dollar LIBOR rate. According to Bloomberg, this spread averaged 97 basis points during the 12 months preceding the crisis.

Fed Chairman Ben Bernanke said on May 5 that “mortgage credit is still relatively tight”, as reported by Bloomberg. This raises the possibility that the Fed will boost its purchases of Treasuries to keep the cost of consumer borrowing from rising further. [The Fed has so far bought $95.7 billion of Treasury securities from $300 billion earmarked for this purpose. Similarly, purchases of agency debt of $71.5 (out of $200 billion) and mortgage-backed securities of $365.8 billion (out of $1.25 trillion) have taken place.]

Source: Fullermoney

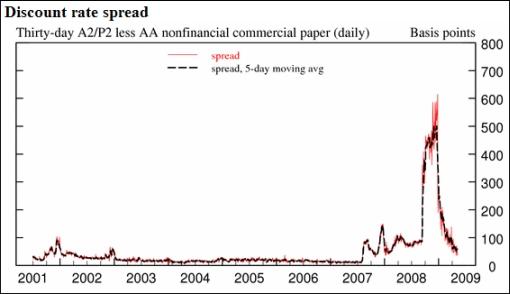

As far as commercial paper is concerned, the A2/P2 spread measures the difference between A2/P2 (low-quality) and AA (high-quality) 30-day non-financial commercial paper. The spread has plunged to 46 basis points from almost 5% at the end of December.

Source: Federal Reserve Release - Commercial Paper

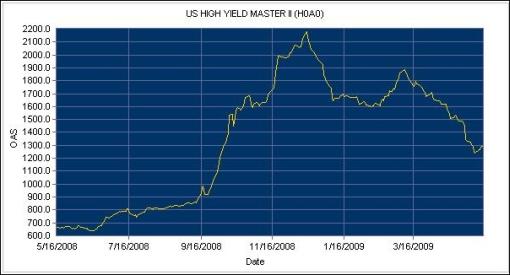

Similarly, junk bond yields have also declined, as shown by the Merrill Lynch US High Yield Index. The Index dropped by 40.8% to 1,291 from its record high of 2,182 on December 15. This means the spread between high-yield debt and comparable US Treasuries was 1,291 basis points by the close of business on Friday. With the US 10-year Treasury Note yield at 3.13%, high-yield borrowers have to pay 16.04% per year to borrow money for a 10-year period. At these rates it remains practically impossible for companies with a less-than-perfect credit status to conduct business profitably.

Source: Merrill Lynch Global Index System

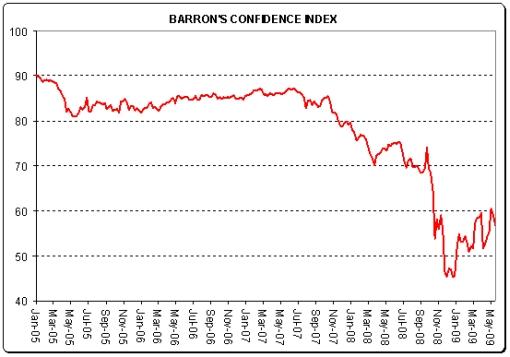

Another indicator worth monitoring is the Barron’s Confidence Index. This Index is calculated by dividing the average yield on high-grade bonds by the average yield on intermediate-grade bonds. The discrepancy between the yields is indicative of investor confidence. There has been a solid improvement in the ratio since its all-time low in December, showing that bond investors are growing more confident and have started opting for more speculative bonds over high-grade bonds.

Source: I-Net Bridge

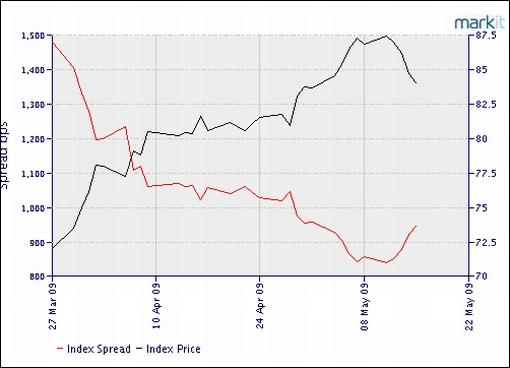

According to Markit, the cost of buying credit insurance for American, European, Japanese and other Asian companies has improved strongly since the peaks in November. This is illustrated by a significant narrowing of the spreads for the five-year credit derivative indices. By way of example, the graphs of the North American investment-grade and high-yield CDX Indices are shown below (the red line indicates the spread).

CDX (North America, investment-grade) Index

Source: Markit

CDX (North America, high-yield B) Index

Source: Markit

In summary, the past few months have seen impressive progress on the credit front, with a number of spreads having declined substantially since their “panic peaks”. The TED spread (down to 0.67% from 4.65% on October 10), LIBOR-OIS spread (down to 0.63%% from 3.64% on October 10) and GSE mortgage spreads have all narrowed considerably since the record highs.

In addition, corporate bonds have seen a strong improvement, although high-yield spreads remain at elevated levels. Credit derivative indices for companies in all the major geographical regions have also shown a marked tightening since the November highs.

Most indications are that the credit market tide has turned the corner on the back of the massive reflation efforts orchestrated by central banks worldwide and that the credit system has started thawing. However, although the convalescence process seems to be well on track, it still has a way to go before confidence in the world’s financial system is restored and liquidity starts to move freely again.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.