Mexico Economic Crisis, Fiat Peso Currency Skating on Thin Ice

Economics / Mexico Jun 02, 2009 - 03:28 AM GMTBy: Covington_M_Wall

From the onset of the world's II GREAT DEPRESION the fiat Mexican peso has been on a roller coaster ride. Mexico officials have gone to great lengths to attribute the performance of the fiat peso to economic fundamentals. To assume such nonsense would be to believe “the tail wags the dog.” The México economy no doubt is in a tailspin along with the peso. Without vital monetary reform both will suffer greatly.

From the onset of the world's II GREAT DEPRESION the fiat Mexican peso has been on a roller coaster ride. Mexico officials have gone to great lengths to attribute the performance of the fiat peso to economic fundamentals. To assume such nonsense would be to believe “the tail wags the dog.” The México economy no doubt is in a tailspin along with the peso. Without vital monetary reform both will suffer greatly.

Recently joining the ranks of out spoken billionaires such as Warren Buffet, George Sorros and Jim Rodgers regarding the “SECOND GREAT DEPRESSION” was Carlos Slim Helú. Mr. Slim, Mexico’s home grown billionaire and the worlds 3rd, painted a bleak picture when invited to speak at a local economic forum hosted by Mexico senators.

Recently joining the ranks of out spoken billionaires such as Warren Buffet, George Sorros and Jim Rodgers regarding the “SECOND GREAT DEPRESSION” was Carlos Slim Helú. Mr. Slim, Mexico’s home grown billionaire and the worlds 3rd, painted a bleak picture when invited to speak at a local economic forum hosted by Mexico senators.

México billionaire Carlos Slim Helú

“The current international financial crisis will have negative consequences for México, among which, include high unemployment and more bankrupt companies of all sizes. Global trade will fall, employment will fall and there will be massive unemployment like we have never seen since the 1930´s.”Carlos Slim Helú; Monday February 9, 2009

“The current international financial crisis will have negative consequences for México, among which, include high unemployment and more bankrupt companies of all sizes. Global trade will fall, employment will fall and there will be massive unemployment like we have never seen since the 1930´s.”Carlos Slim Helú; Monday February 9, 2009

Sadly, shortly thereafter, Mr.Slim´s comments generated a litany of criticisms and outrage emanating predominantly from Mexico’s political leaders. Not surprisingly political leaders here in México, as in the United States, are so out of touch with reality that the truth is hard medicine to swallow.

MEXICO HAS PNEUMONIA

It has been said that when the US has a cold Mexico gets the flu. Despite the endless rhetoric and endless efforts to assuage fears among investors and public alike Mexico policy makers are at wit ends. From the outset, the depth and severity of the economic crisis in the US, was clearly underestimated. Quickly the original assessment that Mexico would experience a minor cold was proven false. With major economic figures jumping off a cliff the search is on to quickly find a remedy for pneumonia. Sadly the ability to attain such cure is beyond the reach of politicians and monetary authorities alike.

SWINE FLU THE PNEUMONIA ELIXER

Superficially México's economy appears to be immune to the effects of the economic problems plaguing the United States and the rest of the world. People still flock in mass to malls, supermarkets, restaurants, flea markets, movie theaters and virtually any other venue that caters to consumers. Consumption of everything from new cars and trucks to electronics to domestic appliances and clothing appears to be vibrant. Construction from new public works to home remodels seems to be flourishing. Any notion of an economic crisis looks anything but omniscient particularly in light of the fact that in recent weeks much of the country's attention has been focused on the swine flu epidemic. Whether hype or reality H1N1 has failed to gloss over fresh hard economic data that portrays a far more revealing picture regarding Mexico’s dire predicament. Suffice to say it would not be beyond government officials to orchestrate a fictitious distraction given looming planned elections the 5th of July

Superficially México's economy appears to be immune to the effects of the economic problems plaguing the United States and the rest of the world. People still flock in mass to malls, supermarkets, restaurants, flea markets, movie theaters and virtually any other venue that caters to consumers. Consumption of everything from new cars and trucks to electronics to domestic appliances and clothing appears to be vibrant. Construction from new public works to home remodels seems to be flourishing. Any notion of an economic crisis looks anything but omniscient particularly in light of the fact that in recent weeks much of the country's attention has been focused on the swine flu epidemic. Whether hype or reality H1N1 has failed to gloss over fresh hard economic data that portrays a far more revealing picture regarding Mexico’s dire predicament. Suffice to say it would not be beyond government officials to orchestrate a fictitious distraction given looming planned elections the 5th of July

"HE THAT CALLS THE TUNE MUST PAY THE PIPER.”

In the case of México the party has stopped and now the musicians (the MARIACHIS) must be paid. Decreasing economic activity has officials hard pressed for solutions to stimulate the economy while at the same time avoiding the risk of running fiscal budget deficits. The current deficit has been close to 30 % of gross domestic product. Goldman Sachs Group Inc. today revised its forecast for Mexico’s contraction this year to 8.5 percent from an earlier estimate of 4.8 percent. That would be the biggest decline since 1932.

In the case of México the party has stopped and now the musicians (the MARIACHIS) must be paid. Decreasing economic activity has officials hard pressed for solutions to stimulate the economy while at the same time avoiding the risk of running fiscal budget deficits. The current deficit has been close to 30 % of gross domestic product. Goldman Sachs Group Inc. today revised its forecast for Mexico’s contraction this year to 8.5 percent from an earlier estimate of 4.8 percent. That would be the biggest decline since 1932.

GDP fell 8.2% in the first quarter of this year alone directly impacting the unemployment rate officially around 5.1% in the first quarter up from 3.7% a year ago. The hardest hit segments of the economy have been the auto and maquiladora industries. Domestic auto sales have contracted close to 25% and auto exports have fallen nearly 41%. Exports as a whole have fallen sharply, by some estimates around 45%, due to the severity of the economic crisis in the US which because of NAFTA is México’s largest trading partner. The US is also the destination of nearly 80% of goods traded internationally. In addition to oil exports the US has also been the primary destination for migrant labor receiving nearly 500,000 annually but off sharply this year along with remittances sent by migrants. Remittances alone, which amount to roughly 30% of GDP, make up a large part of direct foreign investment. Direct foreign investment in the 1Q of this year totaled 2.6 billion USD and is 36% lower by some estimates compared to 2008 figures which totaled 21 billion for the entire year.

Continued deterioration of macroeconomic conditions is causing officials to frantically

try to find ways to bolster the economy in order to hedge off an economic melt down thus avoiding a repeat of the last great crisis in 1995. In past recessions revenue from petroleum sales accounting for as much as 30% of fiscal budget revenue have cushioned the effects of economic slow downs. Given, however, that the price of crude and crude out put are diminishing the government has had to consider alternative sources of funding in order to compensate budget shortfalls. Despite budget constraints spending programs continue. Mexico president Felipe Calderon recently signed into law an economic stimulus package that includes everything from spending going towards infrastructure, railroad improvement projects, wage supports, job creation and even

try to find ways to bolster the economy in order to hedge off an economic melt down thus avoiding a repeat of the last great crisis in 1995. In past recessions revenue from petroleum sales accounting for as much as 30% of fiscal budget revenue have cushioned the effects of economic slow downs. Given, however, that the price of crude and crude out put are diminishing the government has had to consider alternative sources of funding in order to compensate budget shortfalls. Despite budget constraints spending programs continue. Mexico president Felipe Calderon recently signed into law an economic stimulus package that includes everything from spending going towards infrastructure, railroad improvement projects, wage supports, job creation and even

Felipe Calderon a healthcare plan that caters to both that caters to both the employed and the unemployed. The package will amount to roughly 1% of GDP. The question remains as to who will pick up the tab.

GOVERNMENT DEBT

To date the issue of government debt, primarily bonds (both Tesebonos and Mbonos), has been one key funding element. Debt auctions have been enjoying relative success despite a recent sovereign debt downgrade by S&P. Standard & Poor’s this month cut the outlook on Mexico’s debt to negative from stable. It followed a similar move by Fitch Ratings in November.

S&P and Fitch rate Mexico’s foreign debt BBB+, the third- lowest investment grade level.

Mexican peso-denominated bonds rose for the first time in four days, pushing down the yield on the benchmark security from a more than two-month high. Yields on Mexico’s 10 percent bond due December 2024 fell 11 basis points, or 0.11 percentage point, to 8.29 percent. The bond’s price rose 1.1 centavos to 114.88 centavos per peso, according to Banco Santander SA.

WEAK FUNDAMENTALS

México Central Bank Governor Guillermo Ortiz

México's central bank has managed to keep a lid on interest rates, but, due to prevailing market conditions lending rates have been increasing reflecting perceived market risk and increased loan defaults. Several loan guarantee funding measures have been implemented and credit card rate limits have been established. Nevertheless credit card default rates and delinquencies continue to rise.

Despite grim economic data the peso, which has lost more than 32% of its value following market turmoil in September of 2008, has managed to hold some ground. USD reserves have held up so far, but, have diminished somewhat due to recent currency intervention policies. Foreign reserves have declined 9.4 percent to $76.2 billion as of May 22, according to the latest central bank data available. Mexico’s foreign reserves will likely end the year at “similar” levels reached at the end of 2008. Reserves were $85.3 billion as of Dec. 26. Such policies were viewed as necessary especially after volatile exchange rate conditions resulted in the first victims of the crisis to fold under devastating losses from collapsing derivatives markets.

Commercial Mexicana, a large supermarket chain placed bets against the dollar by purchasing derivatives. The company, now bankrupt, just recently came to terms with creditors and has effectively managed to restructure its dept. Grupo Durango, a large virgin paper pulp producer, suffered a similar fate and is bankrupt as well. The recent 47 billion IMF loan announced by Calderon following the latest G-20, designed to buoy the peso in the event of further currency fluctuations, was embraced positively by currency traders and investors alike. In addition a 30 billion USD swap line of credit from the US Fed has been arranged to be used if needed. Upon the writing of this piece, the peso jumped 1.3% to close at 13.04. So far the currency has gained 20% since its March 9th low of 15.58. This following news of a shift in currency intervention policy whereby Mexico's central bank will cease to sell US dollars on the open market. Regardless of the of peso's intermediate trends a USD peg is a detriment to its long term fundamentals particularly in the event of sustained dollar weakness. The USD dollar is now being shunned the world over as a reserve currency due to lousy monetary policy by the US government and its central bank. The downside risks for the peso as well as the economy remain which just leaves officials bewildered.

“DAMIT JIM, I’M A DOCTOR NOT A MAGICIAN”

Star Trek enthusiasts will remember this phrase coined by “Bones” the good doctor aboard the enterprise in the earlier series of Star Trek. A similar phrase struck everyone as amusing when Mexico finance minister, Augustin Carstens, stated emphatically that although he has masters in economics he is not a doctor and therefore can not be expected to remedy all of the ills facing Mexico´s economy. What a fabulous statement! If only more politicians would admit so much. Still, more remarkable, this is this same individual boasted regarding solid

Star Trek enthusiasts will remember this phrase coined by “Bones” the good doctor aboard the enterprise in the earlier series of Star Trek. A similar phrase struck everyone as amusing when Mexico finance minister, Augustin Carstens, stated emphatically that although he has masters in economics he is not a doctor and therefore can not be expected to remedy all of the ills facing Mexico´s economy. What a fabulous statement! If only more politicians would admit so much. Still, more remarkable, this is this same individual boasted regarding solid

Augustin Carstens macroeconomic fundamentals and sound currency at the height of the market mayhem last September. If only he could see the real problem.

FIAT PESO BACKED BY FIAT US DOLLAR

Solid macroeconomic fundamentals? Sound currency? Not by a long shot. Mexico, since 1995, has been floating the peso. The Mexican peso has zero intrinsic backing and consequently can be converted to nothing except for US dollars and the dollar has not been backed by anything since 1971 and as such has lost 96% of its value. What in Gods name are these people thinking? The value of the peso is not only determined by what the government dictates, but, also is subject to the whims of global currency traders and investors. History proves that countries who issue currencies that have value generally exhibit robust economies. Unfortunately most people in México, including politicians and central bankers, are oblivious to the fact that money is a medium of exchange and therefore must have the backing of something fungible such as either silver or gold. To pretend money is somehow flexible and therefore subject to market forces is just plain stupidity and is the fundamental reason why all fiat currencies are failing including the peso. Its recent gains hardly constitute a long term trend to the upside. Governments do this to their advantage so that they can print more money to fund more social programs to buy votes. This is inflation.

Solid macroeconomic fundamentals? Sound currency? Not by a long shot. Mexico, since 1995, has been floating the peso. The Mexican peso has zero intrinsic backing and consequently can be converted to nothing except for US dollars and the dollar has not been backed by anything since 1971 and as such has lost 96% of its value. What in Gods name are these people thinking? The value of the peso is not only determined by what the government dictates, but, also is subject to the whims of global currency traders and investors. History proves that countries who issue currencies that have value generally exhibit robust economies. Unfortunately most people in México, including politicians and central bankers, are oblivious to the fact that money is a medium of exchange and therefore must have the backing of something fungible such as either silver or gold. To pretend money is somehow flexible and therefore subject to market forces is just plain stupidity and is the fundamental reason why all fiat currencies are failing including the peso. Its recent gains hardly constitute a long term trend to the upside. Governments do this to their advantage so that they can print more money to fund more social programs to buy votes. This is inflation.

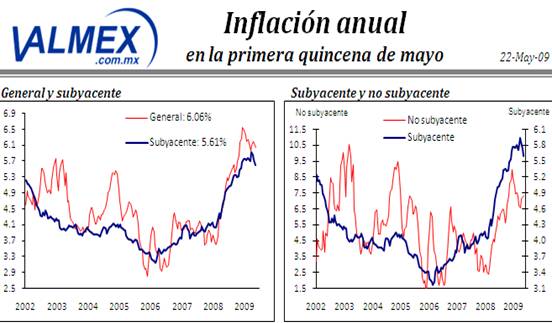

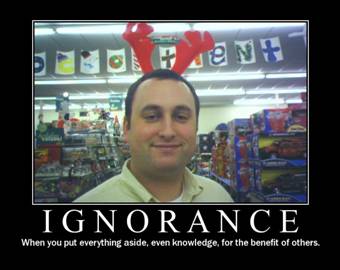

The following charts show us the rate of annual inflation up to May of this year. Official statistics are hard to obtain. When they are available they are clearly manipulated.

The above chart showed us real underlying and general inflation. The below shows us real annual underlying and general inflation and specifically how they are affecting goods, services, food, beverages, tobacco and everything else.

Goods and services Foods, beverages and tobacco

A SILVER LINING SHOWS

The peso doesn't have a snowballs chance in hell of standing on its own two feet, but, there is hope. Many private and public groups alike have been outspoken regarding the issue of monetary reform of some form or another. Groups such as The Mexico Silver Association led by prominent business leader Hugo Salinas Price have been most critical of government monetary policy and are working hard to promote the use of a dual currency where silver coinage would circulate side by side with the Fiat paper currency. This idea would be great if it were not for Gresham’s law which would cause the silver to be hoarded and the Fiat money to remain in circulation. The most feasible solution would be to simply replace USD reserves with silver. In either case monetary authorities have exhibited reluctance to act. One is compelled to ask why?

IGNORANCE IS BLISS

Meanwhile as the debate rages on and the fiat peso continues its slide down the slippery road to destruction an overhaul of Mexico's monetary system remains an out of reach goal. The public, largely uninformed thanks to the media, remains unaware of the perils posed by a fiat currency. Obviously, inflation and subsequent loss in purchasing power are the biggest dangers. Although the effects of inflation are perceived in the wallets of individuals knowledge as to its root cause escapes most.

Meanwhile as the debate rages on and the fiat peso continues its slide down the slippery road to destruction an overhaul of Mexico's monetary system remains an out of reach goal. The public, largely uninformed thanks to the media, remains unaware of the perils posed by a fiat currency. Obviously, inflation and subsequent loss in purchasing power are the biggest dangers. Although the effects of inflation are perceived in the wallets of individuals knowledge as to its root cause escapes most.

The very mention of the term even being remotely linked to the government printing too much money is considered taboo in many newspapers. So when the curtain falls on the peso parade as it most surely will under the circumstances what is to be done? Or maybe if the problem is ignored it will go away. Better yet perhaps we should simply expect the peso to be abandoned along with all the rest of the world’s fiat currencies and replaced by new ones as in the Weimar Republic?

THE AMERO

The Amero cometh. The idea of a replacement currency is not too far out in left field. Whether rumor, fact or a facet of the imagination of conspiracy theorists, word of the issuance of the Amero is all over the internet. What is the Amero? Short for NORTH AMERICAN UNION CURRENCY it would serve as the replacement currency for México, Canada and the USA all three of which will form the NORTH AMERICAN UNION. Sound far stretched? Possibly, but, so far events seem to be taking us in this direction. Since NAFTA was signed into law over a decade ago various proposals are on the table to enhance upon its effectiveness. A merger of the governments of all 3 of NAFTA member nations and the removal of sovereign boundaries are some of the plans being justified in order to streamline trade. Security issues could be addressed by the help of forced VIF chip implants containing biometric data for individuals. Microchip and biometric technologies already exist for use in digital passports. Obviously the consequences of such decisions would gravely jeopardize civil liberties, not mention, personal wealth. While a NORTH AMERICAN UNION and its currency, the Amero, are largely dismissed by government officials and media pundits the idea is being talked about by such controversial people as Hal Turner and even mainstream individuals like Steve Previs of Jefferies International. The Canada Free Press even hosts a blog site where opinion on the matter is expressed regularly.

CONCLUSION

As the II Great Depression continues its course, governments around the world are expanding exponentially. They are spending more on social welfare programs in order to do more for people instead of doing less. By trying to act as backstops for failing economies sound monetary policies are being tossed out the window. The future for fiat currencies like the peso and personal civil liberties are uncertain. The best plan of action is to stay informed. Share your concerns with others and buy plenty of silver and gold to protect any wealth you have, that is, if it hasn't been destroyed already. Until then, good luck and God Bless.

Covington M. Wall

Covington Wall lives Mexico City with his wife Eva. Both are expecting a new baby. As a full time Navistar/International heavy truck sales executive he also works as a financial consultant as an added service for his customers. Mr. Wall has lived in Mexico for a total of 10 years and provides consultation services on matters pertaining to investment, travel and business in Mexico.

© 2009 Copyright Covington M. Wall - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.