Filtered Equity Income Stock Growth Prospects

Companies / Investing 2009 Jun 17, 2009 - 08:20 AM GMTBy: Richard_Shaw

We are increasingly asked about low risk individual stocks that may be suitable for an equity income allocation within a portfolio. This is a general response to that question.

We are increasingly asked about low risk individual stocks that may be suitable for an equity income allocation within a portfolio. This is a general response to that question.

Before offering a prospect list in which you might find attractive ideas, we want to make it clear that diversification of sectors and individual securities is important; and that individual stocks involve more work to create and maintain in a portfolio than holding funds. Generally, individual stock portfolios have higher risk due to concentration among a limited number of issues. That higher risk could enable out-performance, but could also result lower performance than a diversified fund or index.

There are diversified equity income ETFs and mutual funds which should also be considered as alternatives to a portfolio of individual stocks.

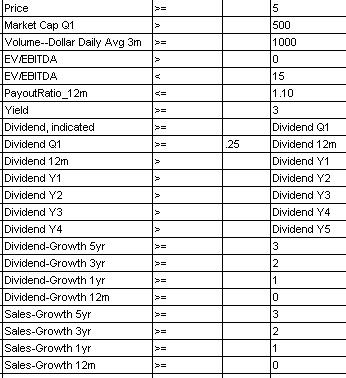

We developed a filtered list of equity income prospects in two stages: (1) selection by Standard & Poor’s or Value Line for financial strength by their proprietary process (producing 595 stocks), then (2) subjection to the following criteria focusing on minimum yield and a history of dividend increases, sales growth and other criteria (resulting in a reduced list of 26 stocks):

The first stage filter by independent research firms reduces risk of insolvency, but says nothing about price volatility risk. The second filter by QVM assures that the selections have a higher yield than the S&P 500 index, and focuses on past behavior suggesting a good chance that the dividend yield will grow over time.

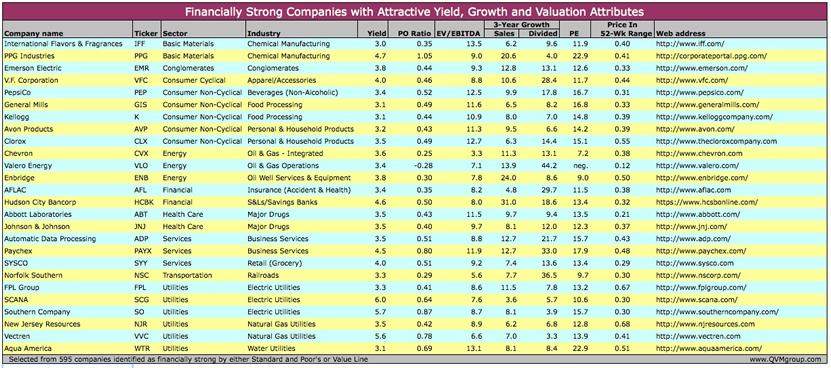

This table shows the 26 filter survivors along with certain information about them: sector, industry, yield, payout ratio, position within its 52-week price range, P/E ratio, 3-year sales and dividend growth, EV/EBITDA, and website address.

Average attributes of the list are:

- Yield 3.85%

- Payout Ratio: 48%

- 3-Yr Sales Growth 10.70%

- 3-Yr Dividend Growth 14.82%

- P/E Ratio 13.98

- EV/EBITDA 9.39

- Price in 52-Week Range 0.39

These are not recommendations for purchase, but are recommendations for further research if equity income through individual stocks is what you seek.

We own some of the stocks in this list in some managed portfolios. Individual symbols are: IFF, WTR, GIS, K, AVP, FPL, NSC, AFL, PEP, VLO, ABT, ADP, CLS, JNJ, NJR, CVX, EMR, ENB, SYY, VFC, PAYX, HCBK, PPG, VVC, SO, SCG.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.