Technical Speculator - US Dollar Nearing the $0.80 barrier, Now What?

Currencies / US Dollar Jun 02, 2007 - 03:21 PM GMTBy: Donald_W_Dony

In this months issue, the topics are:

- Currencies: Nearing the $0.80 barrier. Now what?

- Commodities: Slowly moving up in June

- Economy: Expanding on schedule

- Global equities: Possible short-term pullback

- Equities: Small dip within main up trend

Also, there are two pages of timely stock recommendations under HotCharts.

Here is the first page of the June issue. Go to www.technicalspeculator.com and click on member login to download the full 16 page newsletter.

Currencies : US Dollar Nearing the $0.80 barrier. Now What?

KEY POINTS:

• US$ holds in flat range as momentum builds

• $0.80 provides support again for frail

greenback

• CDN$ target of $0.9495

• Euro maintains upward trend to $1.40

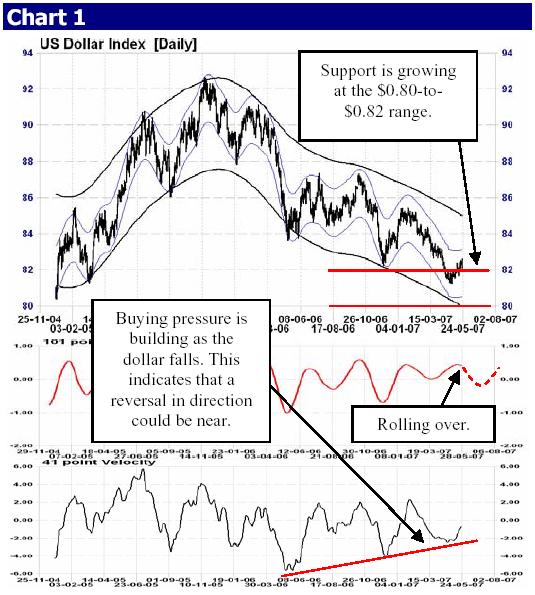

The U.S. dollar is in a long-term downward slide. Of course. Few people would argue that fact. But it is also rolling straight into a psychological barrier that will very likely stop its descent for awhile. I am talking about the solid $0.80 price point.

Uncharted ground

The U.S. dollar (Chart 1) is slowly but relentlessly moving closer to an area it has never previously broken through.

The greenback has always traded above $0.80, and the few times this currency has attempted to breach that line,

step in and forced Uncle Sam’s dollar higher.

Well, here we are again, moving closer to the cliff edge

and looking at the real possibility of a sub-$0.80 greenback

But let’s step back for a moment and quickly analyze what

First, a plunging dollar would push up the Canadian dollar

to par, which it has not seen in more than 30 years. Other

major world currencies will also advance to new levels.

Most countries do not want their currencies too high,

because it erodes some of the competitiveness of their

Gold, priced in U.S. currency, will continue to escalate, as

will base-metal prices. The dollar breaking through the

$0.80 level will only help prolong the current bull market in

all commodities and send tangible prices higher still.

As commodities are a leading indicator to bond yields, higher raw-material prices will continue to apply downward pressure on bonds and extend the current bear market that began in mid-2003. Last month’s newsletter (page 3) included a chart showing just how tightly commodities and yields correlate. It is worth having another look at that one.

Sixth bounce coming

The U.S. dollar has played with the critical $0.80 barrier

five times in the past: first in 1978, then in late 1990, again two years later, then in 1995, and the last embrace was in late 2004. Each time, it was repelled. As I discussed in the

May newsletter, the greenback is approaching this decisive zone again in late June and July.

Now the big question: will the U.S. dollar respond to this line in the sand as it has in the past, or will this time be the

crossing into the uncharted ground of sub-$0.80? The fundamentals on the dollar have not changed

significantly over the last six to nine months. And the deficit

is an ever-deepening quagmire from which current policymakers

will likely not be able to extricate themselves.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.