Commodities Trading Analysis for Gold, Silver, Crude Oil and Natural Gas

Commodities / Commodities Trading Jul 20, 2009 - 02:23 AM GMTBy: Chris_Vermeulen

The rising tide lifts all boats, and that is exactly what we saw last week. Gold, silver, oil, natural gas, and stocks all put in a solid bounce last week.

The rising tide lifts all boats, and that is exactly what we saw last week. Gold, silver, oil, natural gas, and stocks all put in a solid bounce last week.

All our funds put in solid moves with GLD, SLV and GDX all breaking out of their down trend channels which is bullish. While they have generated breakout buy signals we continue to wait for more price action to unfold before putting our hard earned money to work. Each of these funds currently have over 3% down side risk so no position will be taken at this time.

During breakouts is when “Breakout Trader’s” take positions which surges prices higher once the resistance level is broken. While this method can produce big gains, I tend to avoid this method because of two critical points. First, downside risk is generally 8+%, and second breakouts have a high failure rate.

That being said we continue to let our funds/commodities unfold so we can enter when risk is below 3% and the odds are more in our favor.

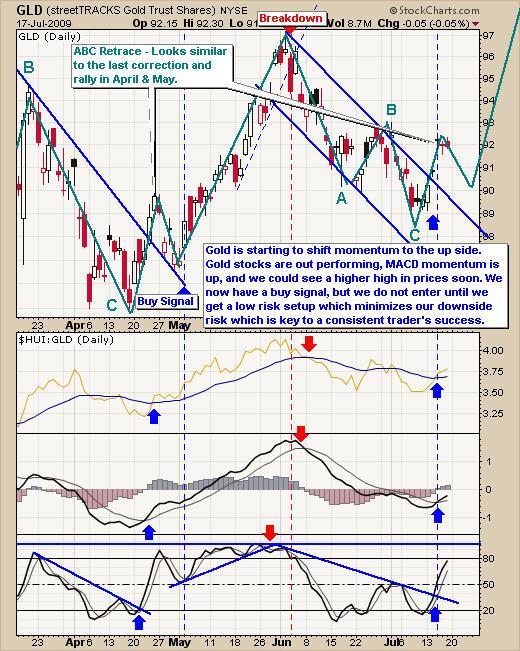

GLD – Gold Trading ETF

GLD broke out last week generating a buy signal. While this is great to see, I continue to wait for a test of the breakout which should set us up with a low risk entry point similar to the one we had in May. We have 4 Blue arrows and are waiting for my signature low risk setup.

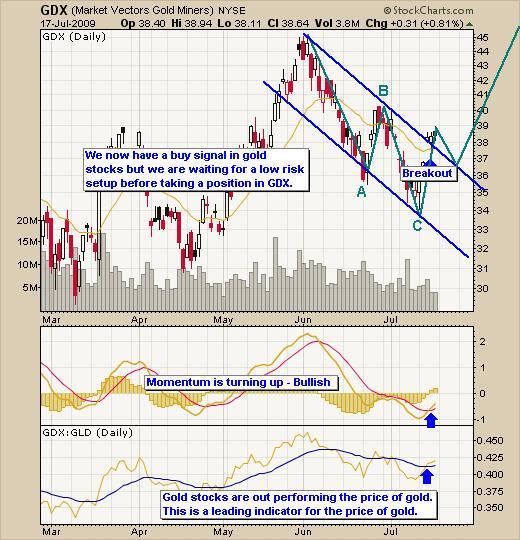

GDX – Gold Stocks ETF

Gold stocks have bounced and are currently out performing the price of gold which is bullish for gold. Gold stocks like the gold miners typically are a leading indicator for gold bullion. We are now waiting for a low risk entry point.

SLV – Silver Trading ETF

Silver is in the same position as gold and gold stocks. We are now waiting for a low risk entry point.

USO – Crude Oil Trading ETF

The crude oil etf pulled back to the support zone which we expected a few weeks back. We are now seeing a bounce off this support zone but oil is currently trading at resistance which is the 50 day moving average. Momentum is still down therefore we must give this fund more time to fully correct before pulling the trigger and taking a position.

UNG – Natural Gas Trading ETF

Natural gas had a big technical breakdown a couple weeks ago and it needs more time to build a foundation/bottom before a low risk entry setup will be generated.

Technical Trading Conclusion:

Precious metals broke out to the up side which we have been expecting. Precious metals and PM stocks are now on a buy signal but at the current prices, risk is much too high. We continue to wait for my low risk setup which provides the best odds for the commodity/ETF to follow through with its breakout. We could get a buy signal for these funds within 4 days if we are lucky but I expect it will take longer than that.

Oil and gas are farther away from a buy signal. Both broke down hard in the past couple weeks and a lot of damage was done. These commodities/ETFs need some time to build a new foundation/bottom before we can start looking for a low risk entry point.

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

If you would like more information on my trading model or to receive my Free Weekly Trading Reports - Click Here

If you have any questions please feel free to send me an email. My passion is to help others and for us all to make money together with little down side risk.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.