Derivatives Interest Rate Swaps, The Elephant In the Room: More Pieces of the Puzzle

Interest-Rates / Credit Crisis 2009 Aug 04, 2009 - 01:06 PM GMTBy: Rob_Kirby

This following article was an address by Rob Kirby at the Gold Anti-Trust Action Committee Inc., GATA Goes to Washington -- Anybody Seen Our Gold?, at the

This following article was an address by Rob Kirby at the Gold Anti-Trust Action Committee Inc., GATA Goes to Washington -- Anybody Seen Our Gold?, at the

Hyatt Regency Crystal City Hotel, Arlington, Virginia, Saturday, April 19, 2008. The original address has been updated and added to since new information has come to light.

My name is Rob Kirby – proprietor of Kirbyanalytics.com, proud GATA supporter and frequent contributor to Bill Murphy’s LeMetropolecafe.com. I would like to extend a warm welcome to GATA delegates from all over the world to Washington, D.C.

I’d like to delve into the numbers, or math, showing how J.P. Morgan’s derivatives book cannot be ‘hedged’.

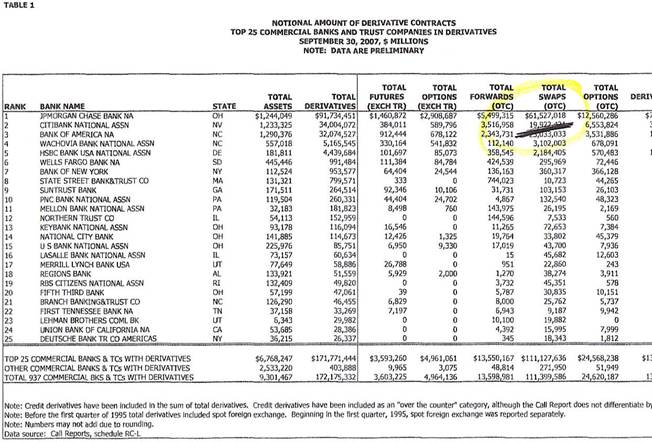

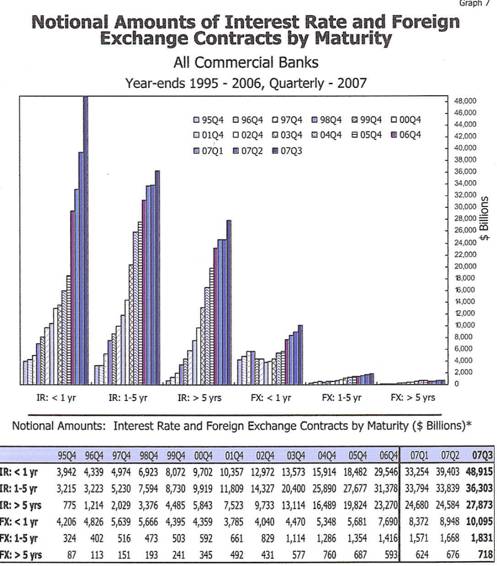

As per their call reports filed with the Comptroller of the Currency’s Office, we know J.P. Morgan’s derivatives book grew by a cancerous 12 Trillion from June 07 to Sept. 07. The OCC’s Quarterly Derivatives Report serves as the public’s only peek into the opaque and murky world of derivatives-flim-flammery.

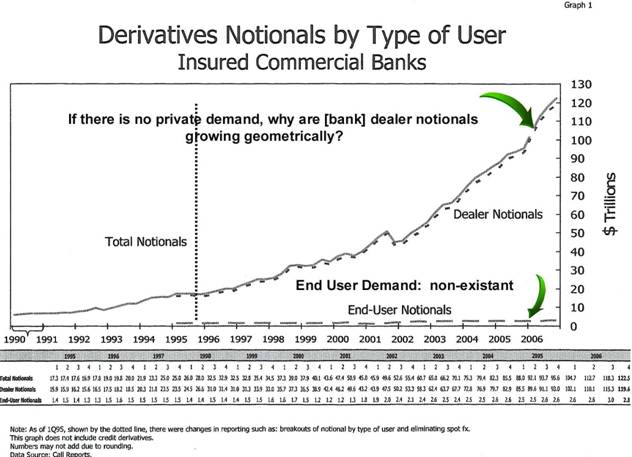

Flim Flammery is the understatement of the century. In fact, dealer notionals have EXPLODED parabolic-ally in recent years while END USER demand has been static and virtually non-existent.

J.P. Morgan’s derivatives book is epitomized by the chart above; it clearly serves no observable or commercially productive purpose, it’s pyramidal in structure and its elephant-sized interest rates derivative composition exerts pressure on the global interest rate complex.

Let’s look at the composition of their book:

We’re shown that 65 %, or, 61.5 Trillion of the total is IRS [on page 22 of 32].

Hedging Mechanics of Interest Rate Swaps > 3 yrs. Duration

Interest rate swaps > 3 yrs. in duration customarily trade as a "spread" - expressed in basis points - over the current yield of a corresponding benchmark government bond. That is to say, for example, 5 year interest rate swaps [IRS] might be quoted in the market place as 80 - 85 over. This means that the 5 yr. swap is "bid" at 80 basis points over the 5 yr. government bond yield and it is "offered" at 85 basis points over the 5 year government bond yield. Let's assume that 5 year government bonds are yielding 1.90 % and the two counterparties in question consummate a trade for 25 million notional at a spread of 84 basis points over. Here are the mechanics of what happens: The payer of fixed rate pays [1.90 % + 84 basis points =] 2.74 % annually on 25 million for 5 years. The other side of the trade - the floating rate payer - pays 3 month Libor on 25 million notional, reset quarterly - typically compounding successive floating rate payments at successive 3 month Libor rates so that actual cash exchanges are settled "net" annually.

To ensure that the trade remains a "true spread trade" [and not a naked spec. on rates] and to confirm that 1.90 % is a true measure of where current 5 year government bond yields really are - the payer of the fixed rate actually buys 25 million worth of physical 5 year government bonds - at a price exactly equal to 1.90 % - from the receiver of the fixed rate at the front end of the trade. So, in this regard, we can say that 25 million IRS traded on a spread basis creates a "need" for 25 million worth of 5 year government bonds - because it has a 5 year bond trade of 25 million embedded in it.

- Interest rate swaps of duration < 3 years are typically hedged with strips of 3 month Eurodollar futures instead of government bonds.

In recent years the Chicago Mercantile Exchange [or CME] has developed an interest rate swap - futures based hedging product for the 5 and 10 year terms. I acknowledge the existence of these products but due to their 200k contract size and amounts traded, as reported in archived CME volume data, they do not materially impact the numbers in this presentation.

As demonstrated, Interest Rate Swaps create demand for bonds because bond trades are implicitly embedded in these transactions. Without end user demand for the product – trading for “trading sake” creates ARTIFICIAL demand for bonds. This manipulates rates lower than they otherwise would be.

I learned these basics – first hand - over 15 years as a broker in Capital Markets. My largest client at that time was Citibank Canada – who pioneered these instruments for Citibank worldwide. For the bulk of the 1980’s, Citibank Canada was the largest interest rate derivatives player in the world.

Here’s the breakdown of 12 Trillion in derivatives growth in 3 months:

65 % of 12 Trillion, or, 7.8 Trillion of it is Interest Rate Swaps

35 % of 7.8 Trillion, or, 2.73 Trillion requires bond hedges

2.73 Trillion / 66 days per quarter = 41.4 billion in bonds per day

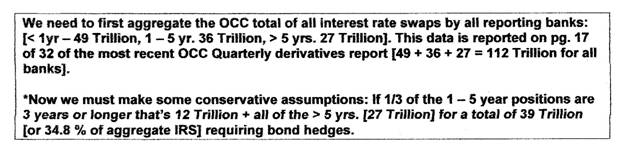

Here’s the math showing that 35 % of interest rate swaps require bond hedges:

So, in the latest quarter it took 41.4 billion in bonds per day JUST TO SATISFY HEDGING OF THE GROWTH in their SWAP BOOK.

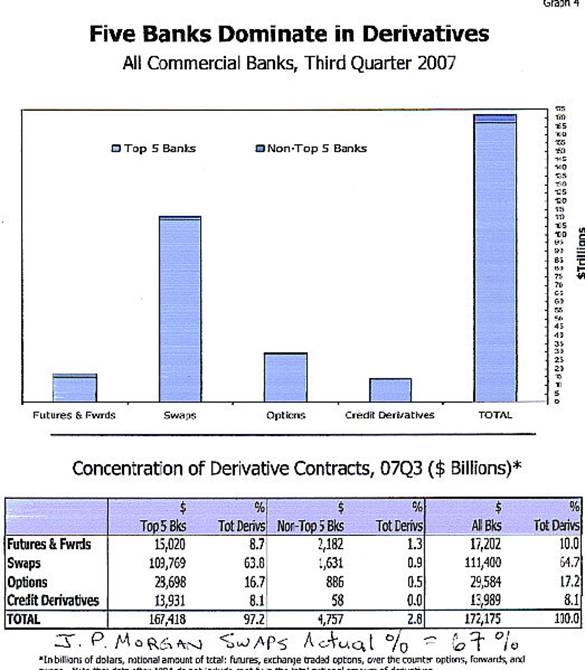

The existing book minus the growth, or 80 Trillion, - 52 Trillion of that is IRS. 65 % of the 52 Trillion figure - 33.8 Trillion - matures in 3 yrs. or less with the lion’s share of that in under1 year as you can see here:

Assume a conservative average maturity of 18 months [6 quarters] then one sixth of 33.8 Trillion, or 5.63 Trillion worth of Swaps roll off and need to be replaced every 3 months.

35 % of 5.63 Trillion, or 2 Trillion, required bond hedges to keep the book static.

2 Trillion / 66 days = another 30.3 billion bonds required per day.

So, In Aggregate: J.P. Morgan required more than 71.7 billion worth of bonds each business day – from Jun. 30 to Sept. 30 / 07 - JUST FOR THEIR SWAP BOOK – if it is hedged.

Some, like the OCC themselves, might argue that ‘netting’ – or balancing short against long internally within J.P. Morgan’s book – reduces the amount of bonds required to hedge. Over time netting would have some effect – but “netting” generally occurs at day’s end. This math does not even work intra-day:

According to the U.S. Treasury:

“During the July – September 2007 quarter, Treasury borrowed $105 billion of net marketable debt….”

J.P. Morgan is but one of 20 primary dealers of U.S. treasury securities.

50 % of all Treasury Securities auctioned over this period were 2 yr., 20 yr, or 30 yr. – so they were not used to hedge swaps. This leaves a balance of around 50 billion bonds suitable for hedges.

Treasury also tells us foreign participation in U.S. bond auctions typically tops 20 %. So you’re now left with 40 Billion in “net new” U.S. Treasury Securities – suitable for hedges - to distribute among all domestic players for an entire quarter. The growth component of J.P. Morgan’s book alone, if it’s hedged, requires more than 1.4 billion more than this amount every day!

Bonds required to hedge the growth in Morgan’s Swap book are 1.4 billion more in one day than what is mathematically available to the entire domestic bond market for a whole quarter?

This interest rate swap book is not hedged. J.P. Morgan is the FED.

If you believe the yeomen’s work of John Williams of Shadow Gov’t Stats – this helps explain how we get bogus inflation reports from officialdom in the 2 % range when in reality it is running “double-digits”.

Historically, bond vigilantes would have spotted the ruse and sold bonds raising rates of interest to levels commensurate with real inflation rates at 10 % plus the historic premium of 250 points or 12 – 14 % nominal market rates.

If you’re wondering where the bond vigilantes have gone:

They have all lost their jobs. Long ago, the last of the true bond vigilantes sold bonds – intuitively correct I would argue – not realizing that J.P. Morgan’s Swap Book was a “black hole” of stealth artificial demand. They lost their shirts along with their jobs.

Nowadays – bond traders who have chosen to remain employed – resemble trained monkeys and play the game the way their masters intend them to:

Monetary authorities have long been pursuing expansionary monetary policies while attempting to cloak their actions by suppressing rising interest rates and other natural market reactions.

This has completely perverted our whole banking and monetary system.

This is why false values have been assigned to a host of financial instruments.

This explains why the gold price has been suppressed. It’s another canary in the coal mine that was vigorously and nefariously silenced.

If you’re wondering why J.P. Morgan never seems to get caught up in any sort of hideous mark-to-market losses concerning their derivatives or hedge book – consider that back in the spring of 2006, Business Week’s Dawn Kopecki reported,

“President George W. Bush has bestowed on his intelligence czar, John Negroponte, broad authority, in the name of national security, to excuse publicly traded companies from their usual accounting and securities-disclosure obligations. Notice of the development came in a brief entry in the Federal Register, dated May 5, 2006, that was opaque to the untrained eye.”

So do any of you think that J.P. Morgan gets a pass? I would suggest to you that if they had not – our whole financial system would already have collapsed in a heap.

You see folks; hubris has been cast upon us in an attempt to have us believe that wealth is really created on a printing press and on trading desks in N.Y. at J.P. Morgan or Goldman Sachs.

Remember, real wealth really comes from the earth – like gold – just as it always has.

Much more for subscribers including an Update, a section on our current interest rate environment, a section on unintended consequences of these actions and where we’re headed in the near term.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.