Shattered U.S. Housing Market Dreams and the Painful Process of Household Deleveraging

Housing-Market / US Housing Aug 10, 2009 - 01:01 PM GMTBy: Mike_Shedlock

Inquiring minds are reading a Comstock Special Report on Deleveraging the U.S. Economy.

Inquiring minds are reading a Comstock Special Report on Deleveraging the U.S. Economy.

We are in the process of deleveraging the most leveraged economy in history. Many investors look at this deleveraging as a positive for the United States. We, on the other hand, look at this deleveraging as a major negative that will weigh on the economy for years to come and we could wind up with a lost couple of decades just as Japan experienced over the past 20 years.

We, however, don't believe that the U.S. massive stimulus programs and money printing can solve a problem of excess debt generation that resulted from greed and living way beyond our means. If this were the answer Argentina would be one of the most prosperous countries in the world. This excess debt actually resulted from the same money printing and easy money that we are now using to alleviate the pain.

The attached chart of total debt relative to GDP shows exactly how much debt grew in this country relative to GDP (it is now 375% of GDP). The total debt grew to over $52 trillion relative to our current GDP of approximately $14 trillion. This is worse than the debt to GDP relationship in the great depression (even when the GDP imploded) and greater than the debt to GDP that existed in Japan in 1989. Even if you took the debt to GDP when the U.S. entered the secular bear market in early 2000 and compared that to 1929 and Japan in late 1989, our debt to GDP still exceeded both (by a substantial margin relative to 1929). The approximate numbers at that time were about 275% in the U.S. in early 2000, 190% in 1929, and about 270% in Japan in 1989.

In fact, the similarities between Japan's deleveraging and the U.S. presently are eerie. Japan's total debt to GDP increased from 270% when their secular bear market started to just about 350% 7 years later (1998) before declining to 110% presently. The U.S. increased their total debt to GDP from 275% of GDP when our secular bear market started (in our opinion) to 375% presently (10 years later), and we suspect the total debt to decline similar to Japan's even though the Japanese govenment debt tripled during their deleveraging.

We expect that the U.S. deleveraging will follow along the path of Japan for years as real estate continues to decline and the deleveraging extracts a significant toll from any growth the economy might experience. We also expect that, just like Japan, the stock market will also be sluggish to down during the next few years as the most leveraged economy in history unwinds the debt.

Is Deleveraging a Positive or Negative Thing?

Comstock's opening gambit was:

"Many investors look at this deleveraging as a positive for the United States. We, on the other hand, look at this deleveraging as a major negative that will weigh on the economy for years to come and we could wind up with a lost couple of decades just as Japan experienced over the past 20 years."

Given the longer we go without deleveraging the worse things get in the long run, I would suggest that deleveraging is a very positive thing as well as a necessary adjustment for the United States.

However, if one is talking about the effect on the stock market, it will not feel like a good thing because it will lower earnings.

I have talked about the concept of the lost decades and deleveraging many times myself, most recently in Effect of Household Deleveraging on Housing, Consumption and the Stock Market.

Peak Credit and Peak Earnings

Not long ago, the US was once a nation of savers. Now that the housing bubble has crashed and the stock market along with it, the US is poised to become a nation of savers again.

Peak Credit and her twin sister Peak Earnings have arrived. Here is a snip from the former.

... That final wave of consumer recklessness created the exact conditions required for its own destruction. The housing bubble orgy was the last hurrah. It is not coming back and there will be no bigger bubble to replace it. Consumers and banks have both been burnt, and attitudes have changed.

It took nearly 80 years for people to get as reckless as they did in 1929. 80 years! Few are still alive that went through the great depression. No one listened to them. That is the nature of the game. The odds of a significant bout of inflation now are about the same as they were in 1929. Next to none.

Children whose parents are being destroyed by debt now, will keep those memories for a long time.

Deflation or Inflation?

The raging debate now is when (not if) the Fed's massive printing is going to spark a huge round of "inflation" forcing up interest rates. The fears are unfounded.

The key to sorting this endgame out is simple: Financial deleveraging constitutes deflation by definition.

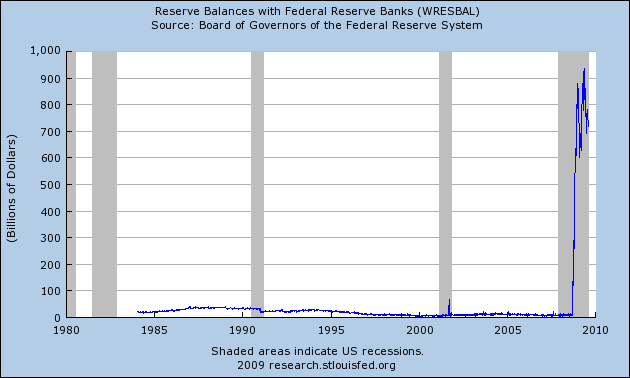

Household debt via bankruptcies, foreclosures, credit card defaults, and walk-aways is falling faster than the Fed is "effectively printing". I use the term "effectively printing" because the Fed can print all it wants and if the money just sits as excess reserves, the velocity of that money will be zero and it will not affect the economy or prices.

Moreover, savings are rising, and banks have little impetus to lend, and consumers and businesses are reluctant to borrow.

Excess Reserves

The above chart is proof enough of banks' unwillingness to lend and/or credit worthy individuals and businesses unwillingness to borrow.

Shattered Housing Dreams

In the long run, consumption cannot grow faster than income. Borrowing to support consumption only works as long as asset prices are rising. Consumers were willing to go deeper in debt and banks were willing to lend based on the now-shattered dreams of forever rising home prices.

In aggregate, consumers are now unable to service their debt, and the deflationary deleveraging process has started. Consumers will either default on debt, pay their debt down very slowly over time, or some combination of both.

Thus, the most likely result of Bernanke's printing press operation will be to drag the "job loss recovery" out for another decade, just as happened in Japan.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.