Investors Could Make a Fortune in the Hybrid Electric Car Market

Stock-Markets / US Auto's Aug 12, 2009 - 06:43 PM GMTBy: Q1_Publishing

It’s the single best way to make a fortune investing.

It’s the single best way to make a fortune investing.

It works in any market too.

Folks have used it to make fortunes during economically good times and during tough times like the Great Depression and the 1970’s.

Most of the wealthiest people in the world have used it. In the Forbes Top 10 you’ll see Bill Gates, Lakshmi Mittal, Karl and Theo Albrecht, and Ingvar Kamprad. They all used it to amass some of the largest fortunes in the world.

On top of that, it has nothing to do with the daily market ups and downs. There’s no complex, high-risk leveraged trading strategy which require good time and better luck. And you don have to worry about timing a “true” bottom in the markets to use it profitably.

It’s much, much simpler than that.

Sounds pretty good right?

Well it is. But still, 99% of investors never use it.

Today we’ll go over this strategy which has created the greatest fortunes in the world. How you can use this time-tested strategy too. And the one industry where you can use it to double your money and probably make a lot more in the years to come. Let me start at the beginning though.

The Key to Exponential Growth

For true long-term investors, the simplest way to make an absolute fortune is to find companies that are growing market share in a growing market.

It’s one of the few ways to score exponential gains in stocks.

Think of a market for a product that is $10 billion. It’s expected to grow to $20 billion over the next decade. There are five companies with $2 billion in annual sales each (20% market share). All of the companies’ sales will double if their market share stays the same. All is good.

Of course, that’s not how it really works. As an industry grows, there are inevitably winners and losers. And the company that is able to grow market share in the growing market will see exponential growth.

For instance, in the example above, if a company that was able to snag 30% market share would have $6 billion in annual sales. That seemingly small difference in market share is the difference in annualized revenue growth of 7.1% and 11.6%. That’s going to make a big difference when it comes to margins, earnings, and will justify a premium valuation for the company’s shares.

That’s just a hypothetical example though. In the real world, it can actually be much more exciting.

Think about how the richest entrepreneurs made their fortunes. They found a market that was growing, found a way to gain ever greater share, and made a fortune.

For example, Ingvar Kamprad, the founder of IKEA, didn’t invent furniture. He merely found a segment of the furniture market no one else was catering to. In this case, it was on the very low end. He created extremely inexpensive, yet fashionable furniture and steadily took market share away from everyone else on his way to a true fortune.

Then there’s the classic example of Bill Gates and Microsoft. When Microsoft was founded, the operating system market was highly fragmented. Most major players were working with single-digit shares. Over the next 20 years, the market for operating systems grew quickly and Microsoft became a market leader with 90%+ share of the market.

There are plenty of other examples. Think about how the leaders emerged in autos, soft drinks, razors, etc.

Now, I realize, long-time Prosperity Dispatch readers know how companies are taking advantage of this downturn to expand market share.

The key here is that this strategy is simple. It’s easy to understand. Better yet, it’s easy to execute. It’s a two-step process, 1) Find a growing industry, 2) Find the winners.

Right now, one industry is set to see exponential growth over the next three, five, and 10 years, but most investors have quit paying attention.

I’m talking about autos.

Expanding Market…Check!

That’s right cars, trucks, etc.

You see, the auto industry is going to be a massive one. It’s tough to imagine it now after GM and Chrysler fell into bankruptcy, Ford (NYSE:F) is barely hanging on, and it takes another $3 billion in government handouts to get willing buyers into dealer showrooms. But the auto industry has years of growth ahead of it.

You see, U.S. auto sales are expected to hit 10.5 million vehicles this year (with the help of the “Cash for Clunkers” deal). That’s 39.5% below the 17.35 million sold in 2000. The real opportunity - as it is in most industries - is found outside the United States.

It’s going to be the emerging markets which drive the real growth in the years ahead. Now, I realize India’s Tata Motors (NYSE:TTM) attracted a lot of attention when it unveiled its $2,500 Nano – the “Model T” of India.

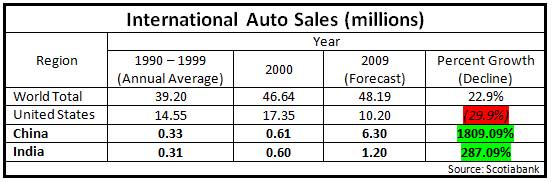

The real attention though should have been paid to the numbers. As you can see in the table below, they’re staggering:

As you can see, U.S. auto sales are in decline while auto sales in India and China are absolutely soaring. Also, with global auto sales expected to be 22% higher than 2000 levels, it’s clear to see how soaring demand in these countries can easily offset the decline in U.S. sales.

The second step is to figure out how to profit from it. Frankly, this is not 1920 and you’re not going to make a fortune investing in auto stocks. You have to find the segment within the overall auto market which is growing and go there.

Expanding Market Share…Check!

That’s going to be hybrid and electric vehicles. They’re going to be the big winners in the race for market share.

The tide is already starting to turn. In 2006, there were 384,000 hybrid vehicles sold. More than 1 million could make their way off the production line by 2012. And, according to Advanced Automotive Batteries, 2 million battery powered cars will roll off the lines worldwide in 2015.

J.D. Power estimates that “hybrids will account for seven percent of the car market in 2015—up from 2.2 percent in 2007.” That’s more than enough growth to offset the decline in the overall market in the U.S.

But that’s not the real exciting part. Consider if the7% market share J.D. Power expects hybrids and electric vehicles to reach in the United States happened across the world. Granted it would take a bit more time, but even if annual auto sales stay steady at 48.19 million (granted, not too likely, but let’s be conservative) there would be 3.3 million hybrids produced annually.

Now, I don’t expect there to be too much gains to be had from investing in the major automakers. These behemoths are too big to notice one or two winning product lines even in hybrid and electric vehicles.

The best way to profit from the growth of these vehicles will be from the battery makers. The hybrid and electric vehicle battery market has years and years of stellar growth ahead of it. It’s simply a case of expanding market share within a growing market.

Advanced Automotive Batteries expects, “The corresponding [hybrid electric vehicle]-battery market, estimated at $600 million in 2006, is expected to grow to $1.4 billion in 2010 and $2.3 billion in 2015.” That’s an annualized growth rate of 10.9% for just the U.S. and any additional international sales – which will be big – will add significantly to that double-digit growth rate.

Reality vs. Perceived Reality

Quite frankly, there isn’t too much to be excited about in the current markets. Stocks have had a good run. Shares in the companies which rallied hard because they didn’t go bankrupt are running out of gas.

Now, it’s time for reality to set in. And when it comes to reality, you have to look for the truly great opportunities. The ones you can get excited about. The ones you could truly make a fortune off of.

That’s where these batteries come in. The moderate growth in the auto industry turns off a lot of investors. Three or five percent growth just isn’t much. But when you add a technology with a growing market share to the mix, you get the kind of growth that is worth paying close attention to.

We’ve seen it happen time and time again. When a company or technology gradually takes over market share in a growing market, a fortune is sure to follow and it’s one of the big opportunities we’re tracking in our premium advisory service (Special 60% off introductory offer still available).

So when the whole financial world eagerly awaits the Fed’s next move and over-analyzes every word from Bernanke, they’re likely passing up some of the truly great opportunities.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2009 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Q1 Publishing Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.