Are We Facing a Banking Crisis? Is the Gold Price About to Explode?

Commodities / Gold & Silver 2009 Aug 31, 2009 - 01:39 AM GMTBy: Brian_Bloom

FLIGHT TO SAFETY APPEARS IMMINENT

FLIGHT TO SAFETY APPEARS IMMINENT

Summary

The markets appear to be anticipating a banking crisis.

If confidence is lost in the commercial banking system, the following is a reasonable outcome:

- There will be a rush to invest “cash” money (previously held in banks) into treasury bonds backed by the government as opposed to the FDIC

- The gold price will explode upwards

- The US Dollar will not move inversely to the gold price. More likely, it will also rise, albeit less violently as the “safest” and “most liquid” treasury markets are denominated in US$.

When read together, the long term charts of all three investment categories are in fact pointing to the increasing probability that confidence in the integrity of the commercial banking system has been eroding.

************

In the past week, three pieces of information arrived my inbox, which led me to thinking about the integrity of the banking system:

- The Swedish Central Bank is about to charge negative interest rates. i.e. Commercial banks who have reserves in excess of their requirements and who do not lend this money out will be penalized for not doing so. http://www.ft.com/...

- Several articles appeared which “speculate” that up to 1,000 banks are in danger of failing and that the FDIC has insufficient reserves to cope with this. http://www.bankrate.com..

- Mathematical modeling, based on a formula developed by physicist Cesare Marchetti, when applied to bank failures, results in the following forecast:

Source: http://www.urbansurvival.com/blog/?p=1429

With the above in the back of my mind, I looked at the long term charts of the US Dollar, the Gold Price, the Bond Prices and the $SPX.

This is what I found

- US$

The monthly chart of the US$ above (courtesy decisionpoint.com) shows some weakness in the PMO. Nevertheless, there is a non-confirmation of rising bottoms in the PMO and falling bottoms in the dollar index. On balance, it seems reasonable to conclude that the US$ may stop falling. This is counterintuitive because, “obviously” if the gold price were to rise, the US$ “must” fall. The above chart provides evidence which might negate the “obvious”.

- Gold Price

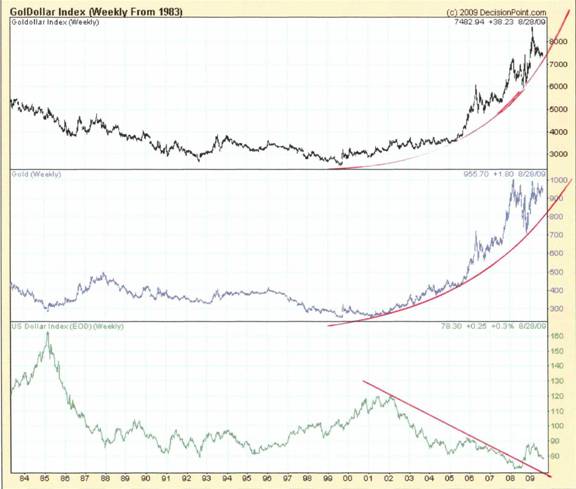

The monthly chart above (also courtesy DecisionPoint.com) shows that the GolDollar Index may be about to bounce up off an exponentially rising trend line. i.e. Within the next month or so, this trend line will either provide support (leading to an upward bounce) or it will be penetrated on the downside.

Why would it break down?

The goldollar index is derived by multiplying the gold price and the dollar index. Many proponents of the argument that the US Dollar and the Gold Price move inversely have not focused on the unarguable fact that, if this were true, the goldollar index chart would be a horizontal line. Clearly, an exponentially rising, parabolic line is not a horizontal line. Equally clearly, the chart of the US Dollar (bottom chart above) has broken UP through a falling trend line. Of course, it does not follow that, therefore, the dollar index will rise. But what it does imply is that the downward trend in the movement of the US$ has been interrupted.

Now, if we turn our attention to the middle chart above, the gold price itself has also been following an exponentially rising trend which began in 2001.

It seems highly unlikely, given the trillions of dollars of debt and new money that the partnership of the US Government and the US Federal Reserve has been creating, that this trend line will be penetrated on the downside. Arguably, as it did from mid 2006 to mid 2007, the gold price has been consolidating for around 12 months since the beginning of 2008. Arguably, the probabilities favour that the next move will be up.

What will be the timing of the next breakup?

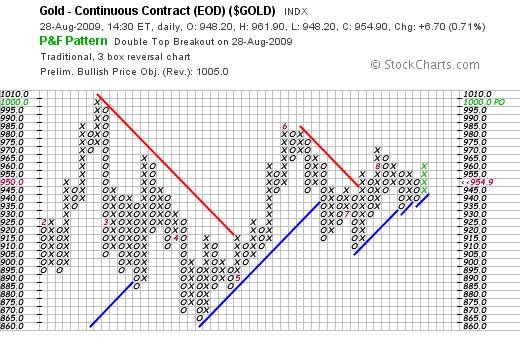

Well, in terms of the Point and Figure Chart below (courtesy StockCharts.com) the next up move has already commenced, and $1,000 is the next target destination.

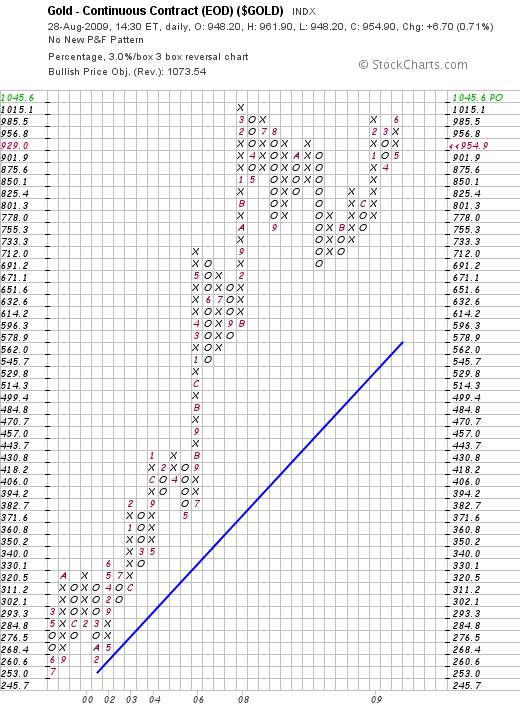

Further, if we desensitize this chart by reducing the scale to a 3% X 3 box reversal, we see that if a $1,000 level is reached this, in turn, will represent a far more significant breakout.

A measured move target – if the double top at 985.50 is penetrated – will take the gold price to a new high. In turn, this will likely be followed by an exceptionally strong rise.

- Interest Rates

Typically, those who have been arguing for a rise in the gold price have been arguing that the “driver” of this coming price rise will be inflation. The Fed has been inflating the money and credit supply and the result is likely to be price inflation.

This argument, in this analyst’s view, is too simplistic. The facts show that consumer prices, on average, have been falling because worldwide production capacity exceeds worldwide demand.

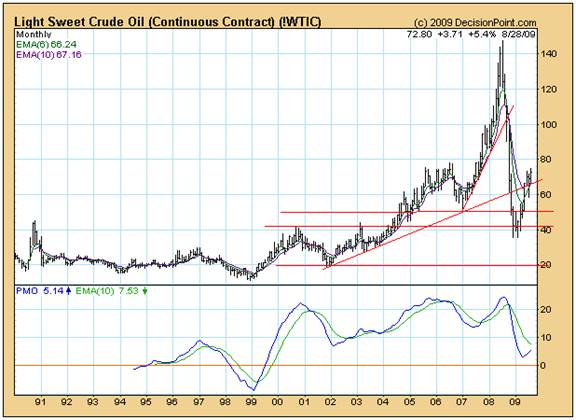

By way of example, even though we have passed peak oil, and even though trillions of dollars have been created out of thin air and even though the oil price has been rising, the chart below does not point to any probability that the oil price is likely to rise to new heights in the foreseeable future. (Chart courtesy DecisionPoint)

It follows from the above that, if the gold price were to explode upwards to new highs, the driving force behind such a move would not be confined to “monetary inflation”.

Further, if monetary inflation were in fact to be the driver then we would expect interest rates to rise to compensate for that fact. No lender in his right mind would lend money at a “price” that was below the inflation rate – because the capital, when it is eventually repaid, would be worth less than the capital which had been lent.

So “falling” interest rates in an environment of inflation is counterintuitive.

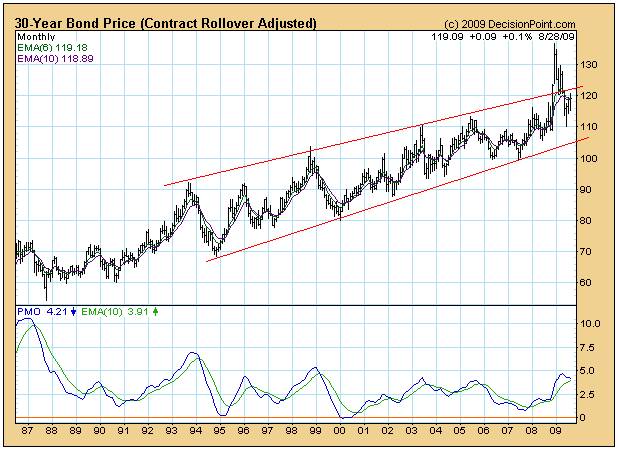

With this in mind, let’s now look at the long bond. This is a chart of 30 year yields. Arguably, the higher the inflation rate, the higher should be the premium between short term and long term interest rates.

The chart below is a WEEKLY chart of the 30 year bond yield. I have chosen this chart because it happens to be showing a PMO that appears to be rolling over from an overbought position.

The monthly chart below – of the 30 year bond price – shows that the price is still moving within the confines of a rising trend. i.e. There is no technical evidence of any fear of inflation.

All of this begs the question: If the gold price is about to explode upwards, and the driver of this is not inflation, then what is the driver?

The most likely driver, as this analyst has been arguing since 2002, is very likely the fear that the world’s economic and financial infrastructures are unraveling. If investors lose faith in the banking system there will logically be a flight to safety.

There is an old saying: “The land of the blind, the one-eyed is king”.

We might not like the US Federal Reserve and we might not like the profligate behavior of the US Government at present but, if we want to protect our investments it seems unlikely that investments in China (for example) will offer a serious option.

China is a centrally run economy where the whims of the government of that country will dictate whether or not an investment in that country will ever be recoverable. In defense of this “wild” statement, I point the reader to the following article, entitled:

“World faces hi-tech crunch as China eyes ban on rare metal exports”

The simple fact is that dealings with China are a one way street. They are primarily for the benefit of China and the Chinese government will do what suits China. If you invest in China, it seems to me (based on the above article) that you may or may not see your money again.

So, if you are losing faith in the integrity of the world’s banking system (which may soon be penalized for not lending money if the Swedish experiment is anything to go by) then where do you put your money?

- US$ Denominated Treasury Bonds

- Gold

But, if the banking system goes, what will happen to the equity markets?

Well, let’s look at that.

This analyst has been “bleating” about the question of “integrity” for some years now. In general, the evidence that it is not only politicians who have become amoral. There is a concept in accounting called Generally Accepted Accounting Principles, or GAAP. Arguably, all financial reporting of listed corporations should be in terms of GAAP, Unfortunately, GAAP accounting does not show Management in a good light when it comes to holding putting their snouts in the bonus trough. So, typically, Management “exaggerates” when it comes to underlying profit performance. With all this exaggeration, the most recent “twelve months to date” Price/Earnings ratio of the Standard and Poor Industrial Index (based on management reported earnings) 23.9X. However, when adjusted for GAAP, the “true” number 150X.

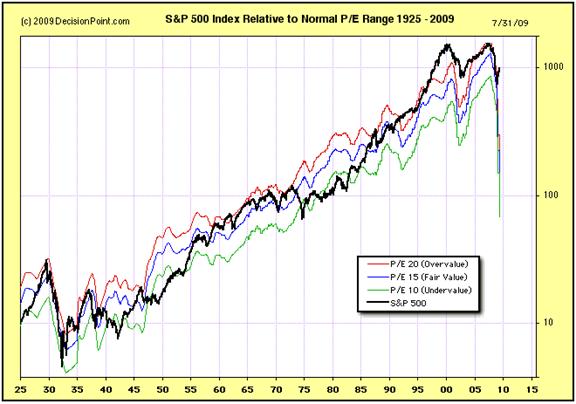

Here is a chart of the $SPX going back to 1925.

The blue line (fair value) shows that if the $SPX were to revert to the mean of 15X Price/Earnings ratio, then the $SPX would fall to 103 from its current level of 1028.93.

So this begs the question: Are we in a Primary Bull Market (where the underlying earnings of corporations will likely scream upwards in order to justify current share prices) or are we in a Primary Bear Market (where current share prices have reached cloud cuckoo land levels because of the behavior of the US Government and the US Fed spending other people’s money as if there were no tomorrow)?

Well, let’s have a look:

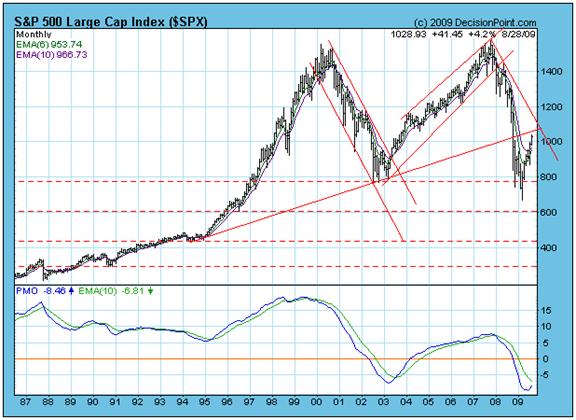

The monthly chart above is showing a breakdown through a rising trend line which occurred in 2008, followed by a technical upward reaction towards the trend line – which will now offer technical resistance to further rises.

Of course, if the price rises above the resistance level of that trend line then it will once again offer supports.

At the end of the day, investors have to ask themselves the following question:

Is it likely that the Industrial Index could re-enter a primary bull market and the gold price could rise to new heights and long dated yields could continue to fall – in the event that we are headed for inflation?

Alternatively, if we are not headed for inflation, is it likely that the Industrial Equities will re-enter a bull market.

Conclusion

The most logical explanation for what we are seeing on the markets at present is that there is an emerging fear that the commercial banking system is on the brink of unraveling. Were this to materialize, then:

- The industrial equity markets would collapse (resume their Primary Bear Market with a vengeance)

- US$ denominated bond prices would rise strongly as money flowed to the “safety” of government bonds

- The gold price would explode as investors scramble to protect themselves.

Alternatively, if the banking system does not unravel, then the bond yields will travel sideways, the Gold price will not explode upwards, the dollar might collapse, and equity prices might bumble along.

Author’s note:

The reason this analyst has gone quiet in recent weeks is that he arrived at the conclusion that could not add any further value to the discussion on finance and economics. From my perspective, society’s leaders have been making one mistake after another and have been compounding the problems. My personal view is that we have arrived at “crunch time”. The politicians either have to fish or cut bait. If they continue to protect vested interests it is virtually certain that the entire economic and financial system will collapse. The only way forward, in my view, will be to embrace an entirely new Thought Paradigm which continues to rely on Private Enterprise but encourages a greater level of social awareness and responsibility. One such Thought Paradigm is laid out in my factional novel, Beyond Neanderthal. I am now turning my attention to the possibility of writing a second novel – which will examine the possible consequences of not embracing an entirely new Thought Paradigm.

Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2009 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.