Goldman Sachs, Hazardous to Underweight Brazil, But Hold the Big Mac

Stock-Markets / Brazil Oct 27, 2009 - 06:12 PM GMTBy: Trader_Mark

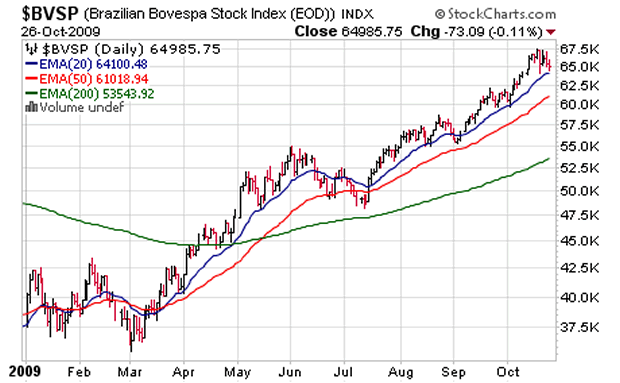

Despite a 73% increase in the Bovespa this year and the country raising taxes to try to keep out an avalanche of Western central bank liquidity [Oct 20, 2009: Ben Bernanke's Money Printing Parade Forces Brazil to Slap a Tax on Outside Investors], Goldman Sachs still says the shares are cheap. Certainly if EPS can grow 40%+ next year they might have a point, and who can argue against the fact this is one of the most attractive markets in the world.

Despite a 73% increase in the Bovespa this year and the country raising taxes to try to keep out an avalanche of Western central bank liquidity [Oct 20, 2009: Ben Bernanke's Money Printing Parade Forces Brazil to Slap a Tax on Outside Investors], Goldman Sachs still says the shares are cheap. Certainly if EPS can grow 40%+ next year they might have a point, and who can argue against the fact this is one of the most attractive markets in the world.

Via Bloomberg

- Brazilian stocks are inexpensive even after a 73 percent rally for the Bovespa index this year and cutting allocations may be “hazardous” for investors, Goldman Sachs Group Inc. said. “Forward valuations suggest it is hazardous to be underweight Brazil,” Stephen Graham, a Sao Paulo-based analyst wrote in a note to clients. “Brazilian sovereign risk and interest rates are at or near record lows, while prospects for sustainable economic growth are possibly better than at any period in the last few decades.”

- The Bovespa may top 85,000 by the middle of next year, he wrote. That represents a 31 percent gain from the close on Oct. 23. The index trades at 16.5 times estimated earnings, compared with 17.16 times for the MSCI Latin America Index, according to Bloomberg data.

- Earnings per share will likely grow 46 percent next year and 23 percent in 2011, meaning that forward valuations will remain steady even as the index climbs to 85,000, Graham wrote.

We often cite the credit expansion in both Asia and South America, but the analyst makes an interesting demographic point as well. As he has we mentioned the potential infrastructure upgrades coming from both the 2014 World Cup, and 2016 Olympics - although those are obvious quite long term benefits, not necessarily short term stimuli. [Oct 2, 2009: Brazil Rallies Upon Winning 2016 Olympics]

- A “baby boom” in the 1980s means consumers in their 20s are now entering the market with “credit volumes never before available,” driving up demand in Brazil’s domestic market, he wrote.

- The growth of the population may lift Brazil to the world’s third-biggest market for computers and telephones next year, Graham wrote. the country’s “financial stability” has led to 77 percent growth in bank accounts over seven years and 18 percent growth in the number of credit cards since 2001, the strategist wrote.

- Preparations for the 2014 World Cup and 2016 Olympic Games will likely speed up financing for needed infrastructure projects, Graham wrote. Brazil is seeing “some of the largest build-outs in the world underway in power transmission, pipelines, hydropower, and telecom,” as global attention from the sporting events puts pressure on the government to accelerate the pace of construction, he wrote.

- Latin America’s biggest economy is also at an advantage to other commodity-producing nations because it sells to “fast- growing” China instead of relying on sales to slower-growing markets in the U.S. and Europe, Graham wrote.

However, in unfortunate news (at least for American visitors to Brazil) the real's appreciation (see Ben Bernanke's campaign above) has made a Big Mac an expensive proposition.

- The Brazilian real’s 34 percent, world-beating rally this year pushed up the price of a Big Mac in Sao Paulo above that in New York and London, a measure that would indicate the currency is overvalued.

- Buying McDonald’s Corp.’s flagship hamburger costs 8 reais in Sao Paulo, or $4.62, compared with $3.99 in New York and 2.29 pounds in the U.K. capital, or $3.74.

- While President Luiz Inacio Lula da Silva and Finance Minister Guido Mantega say the currency’s strength threatens exports and jobs and imposed a tax last week to curb the gains, analysts such as Goldman Sachs Group Inc.’s Paulo Leme says the real will continue to appreciate.

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2009 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.