Monetizing the U.S. Housing Market Debt

Housing-Market / US Housing Nov 12, 2009 - 04:25 PM GMTBy: Tim_Iacono

In reading the newspapers over the last eight months, since the Federal Reserve decided to print money on a massive scale in order to buy $300 billion in U.S. Treasuries along with about a trillion and a half dollars in mortgage related debt, these two groups of purchases have been viewed quite differently.

In reading the newspapers over the last eight months, since the Federal Reserve decided to print money on a massive scale in order to buy $300 billion in U.S. Treasuries along with about a trillion and a half dollars in mortgage related debt, these two groups of purchases have been viewed quite differently.

The former is seen as a particularly bad thing for a central bank to be doing as this money created "out of thin air" is used to directly fund government spending, spurring comparisons to Zimbabwe and Weimar Germany where similar efforts led to hyper-inflation.

However, the latter is viewed as something of a benign undertaking (by comparison, at least), widely perceived as providing needed support for housing in the U.S. by creating a market for housing debt that might not otherwise exist.

After all, would you buy 2003-2008 vintage mortgages that have been "securitized" by Wall Street firms or one of the two wards of the state - Fannie Mae and Freddie Mac - if the Fed wasn't buying the stuff too?

I wouldn't.

Is there really that big of a difference between these two?

Since the U.S. government and their "too big to fail" banking friends now essentially own the entire domestic mortgage market (causing understandable confusion as to which way the arrow would be pointing on a hypothetical org chart that included the U.S. government and "quasi-government" organizations like Citibank and Bank of America) is there really that much of a distinction between U.S. debt and U.S. housing debt?

By buying all this stuff, isn't the central bank effectively monetizing the housing debt?

And shouldn't a lot more people (particularly in China and Japan) be concerned?

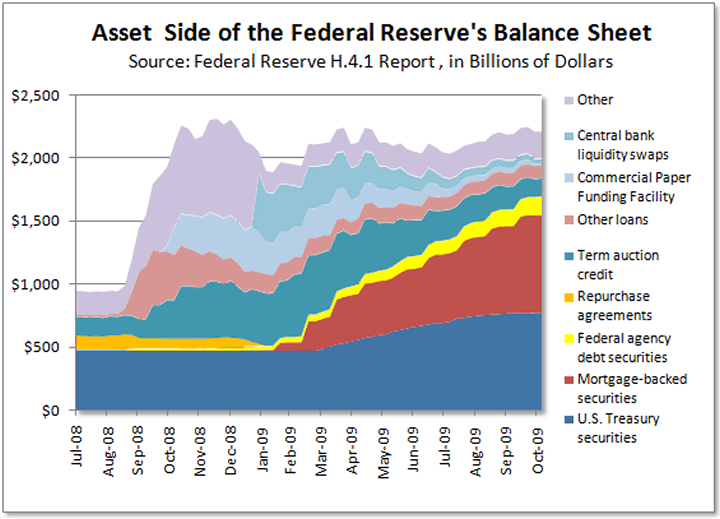

As shown below in the now familiar depiction of the Federal Reserve's balance sheet, since the financial crisis has ebbed and banks are able to pay back some of the money they had to borrow when it looked like the entire world was going to implode, the only items that continue to grow are U.S. Treasuries, mortgage-backed securities (MBSes), and agency debt in the form of loans to Fannie and Freddie.

Clearly, there are big differences between U.S. debt and these two forms of housing debt.

For example, when the government sells Treasuries to the central bank in exchange for newly printed money, it does so with the tacit understanding that the money will never have to be paid back.

But, when the Fed does the same thing in exchange for Fannie and Freddie bonds, then...

Well, actually, these two appear to be one and the same. The GSEs are fundamentally bankrupt, a characterization that, save for its ability to borrow and print money, applies to the U.S. government as well, and there would seem to be little chance of all the GSE bonds owned by the Fed being redeemed at full value unless the government steps in with borrowed money or, in the oddest of all circuitous monetary routes, with money it received from the central bank itself.

However, there is a distinction between U.S. debt and mortgage backed securities. In the case of the latter, newly created money is paid to whoever used to own the securitized loan - Fannie, Freddie, Citibank, Bank of America, etc. - and then, in theory at least, the central bank sees returns based on homeowners making their mortgage payments.

The only thing is, more and more homeowners are no longer able to make their payments and, as a result, the value of these securities would have tumbled to unknown depths if not for the central bank coming to the rescue and paying what others won't.

What is the true value of these mortgage backed securities?

In theory, we'll find out early next year when the Fed stops buying them, but, like the homebuyer tax credit, don't be surprised if this wildly popular program is extended, perhaps indefinitely as waves of foreclosures come ashore in 2010 and 2011.

Perhaps it would help to consider the similarities between the Fed using its printing press to buy Treasuries and to buy MBSes.

On the one hand, you have a government that got itself into a jam by spending more money than it could bring in or borrow at low interest rates, so the central bank had to print up money to make up the difference, trading newly created U.S. dollars for U.S. Treasuries.

On the other hand, you have a housing market that got itself into a jam, enabled by the 30-year government drive for higher rates of homeownership which was financed by the government sponsored owned mortgage giants and banks now deemed too big to fail, all of this culminating in one more in a long series of bursting asset bubbles that appears to be business as usual in recent decades for the U.S. economy.

That the Federal Reserve has to print money "out of thin air" to buy $1 trillion or so of this souring mortgage debt shouldn't come as too big of a surprise.

In both cases it's a matter of throwing good money after bad, the odds of the Federal Reserve getting anywhere near what it paid for these MBSes (if and when it ever goes to sell them) being about as good as the odds of the U.S. government running a sufficient surplus to pay back any of the $300 billion that was given to it by the central bank.

The system wasn't set up to work this way.

If the founding fathers knew that we had created yet another central bank and, not only was it printing up money to fund government spending but it was buying up home loans, they'd roll over in their graves (except maybe for Alexander Hamilton).

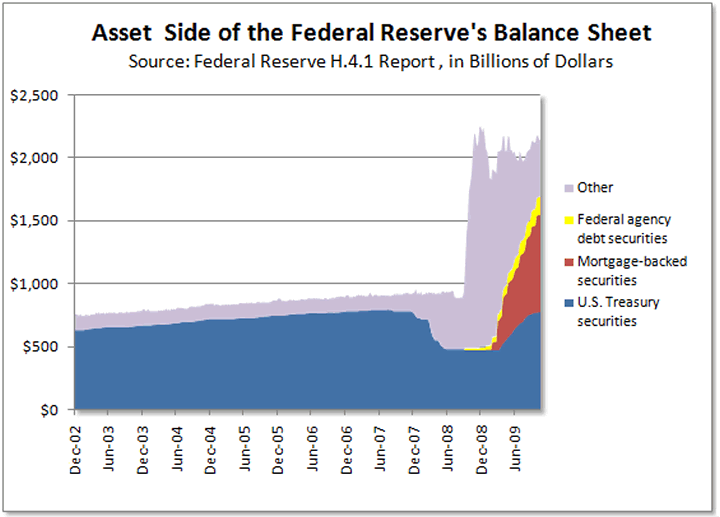

Since its founding almost a hundred years ago, the central bank has, for the most part, done its job simply by buying and selling treasuries, a fact that is clear to see in recent data below.

But, over the last year or so, there's been a radical change in what the central bank buys with money it creates with a simple keystroke and, now that housing and government activities have been so intertwined, is there any real difference between the U.S. government's finances and the finances of the nation's housing market.

It's one thing to step in and provide support for commercial paper markets and money markets, but it's quite another to step in and support the housing market that is now almost wholly owned by the U.S. government in one way or another.

You don't just "unwind" this kind of support.

Of course, if home prices zoom back to their 2005-2006 highs, it's quite possible that the GSEs will spring back to life despite being in the hole by over $100 billion with the red ink still flowing freely. In this case, the Fed could probably sell all its MBSes back into the market and all would be square.

But, that seems about as likely as the U.S. government running a surplus.

If the mortgage backed securities do get sold back into the market in the coming years at anywhere near the price the Fed paid, then all we'll have succeeded in doing is re-inflating the housing bubble, which, come to think of it, is probably the current plan.

But, more likely than not, all this new money that has and will continue to be conjured into existence to buy bad assets - be they U.S. treasuries, bonds issued by Fannie and Freddie, or home loans made against overpriced houses - will all just make the rest of the U.S. money currently in existence less valuable simply because there is more of it.

Maybe a lot less valuable.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2009 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.