How to Profit Goldman Sachs Evil Genius

Companies / Market Manipulation Dec 14, 2009 - 09:49 AM GMTBy: Money_Morning

Jon D. Markman writes: When references are made to the world's "oldest profession," I sometimes wonder if we're not exactly referring to market manipulation. In this country alone, market operators have been employing all sorts of market manipulations for more than 100 years.

Jon D. Markman writes: When references are made to the world's "oldest profession," I sometimes wonder if we're not exactly referring to market manipulation. In this country alone, market operators have been employing all sorts of market manipulations for more than 100 years.

What may surprise you is that most of it isn't illegal or even improper; in institutional circles, it's actually viewed as shrewd business.

One such manipulation was put on display this week - a news development that had me howling in disbelief and left me in awe of the evil genius of Goldman Sachs Group Inc. (NYSE: GS).

One such manipulation was put on display this week - a news development that had me howling in disbelief and left me in awe of the evil genius of Goldman Sachs Group Inc. (NYSE: GS).But if we step back, there's a lesson here - a lesson that points to real potential profits if we stop to understand what's about to happen before our very eyes. It's a lesson that I preach to investors - that the institutions that operate the market and maintain its very framework, also "influence" that market's movements. In fact, this real-market "case study" confirms the profit strategy that I've set out in this special report.

These machinations are completely legal. But they do happen and those who understand that also have the opportunity to profit from that knowledge. And you don't even have to be part of the institutional elite to do so if you know what to look for.

Let me explain...

Surely you have heard by now that the Goldman partners have decided to pay their top brass in stock instead of cash bonuses this year. So do you think it is any coincidence that Goldman shares have mysteriously declined recently? After one of the most profitable years of all time due to the company's involvement in dozens of sovereign and corporate debt and equity deals, and its successful prop-desk trading of the recent volatility?

If you had the ability to drive down the shares of stock that you were about to receive, wouldn't you do it? Goldman doesn't actually have to sell its stock to drive its value down; all its treasury department needs to do is stop supporting it during the day with buybacks.

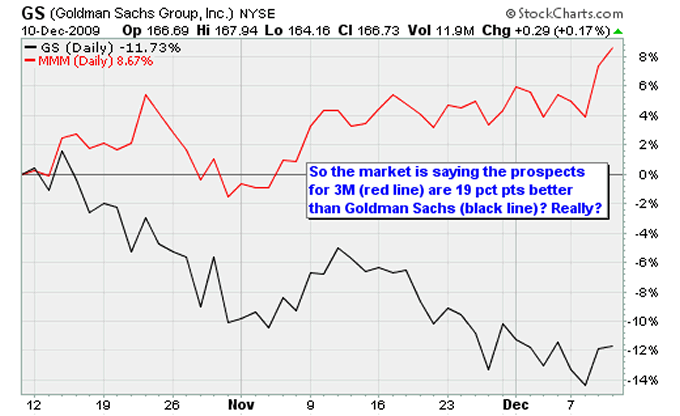

As noted, it's not improper, it's just smart business. You can see how much Goldman's stock has fallen - compared to an industrial company like 3M Co. (NYSE: MMM) in the chart above. Since mid-October, Goldman shares are down 12% while 3M is up 9%. I seriously doubt that the pounding of Goldman's stock relative to the shares of 3M is occurring on the basis of fundamentals; it's most likely all structural.

You can be sure that some of Goldman's financial-industry cronies will be announcing the same sort of stock-based compensation too, and it will turn out to be no coincidence that their shares have fallen dramatically while most other sectors of the market have been buoyant.

Once those bonuses have been paid and the prices recorded, expect the prices of these shares to levitate, as if by magic. My guess is that this will happen at the start of the New Year, if not late in December.

Be ready to swoop in and take advantage.

Week in Review

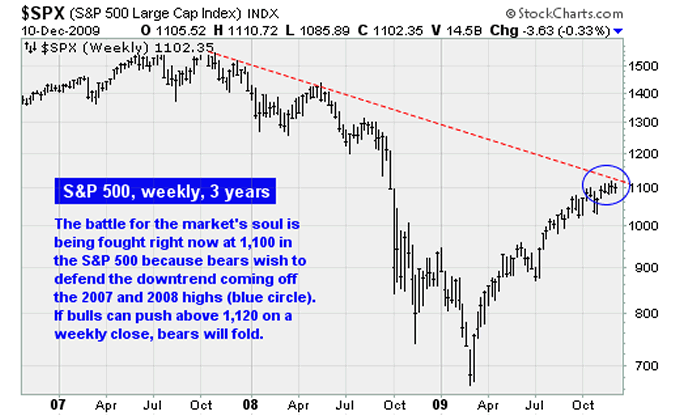

The past week amounted to a series of messy, choppy sessions that reflect normal, structural change that goes on at this time of year: Some fund managers engage in end-of-year tax-loss selling; other managers tidy up their accounts so that they look all nice and pretty for customers' last account statements of the year; and still others prey opportunistically on the prior two groups.

The choppiness occurs because of the meeting of these two opposite forces: Stocks that have been super-strong, like Apple Inc. (Nasdaq: AAPL), come under some pressure as investors rebalance their winners into other stocks. And of course others take advantage of those dips to add those winning names if they don't own them already. In short, there is just a ton of gamesmanship in the first two weeks of December that makes for uneven, seesaw action.

After the first two weeks are over, the month can get down to business. I expect that to be a renewed move to the upside that will leave pessimists, skeptics, naysayers and doom-n-gloomers wondering what hit them.

If that doesn't happen, you are welcome to wag your finger mockingly at the screen. But I'm not too worried. And just in case, don't start wagging your finger until the month is entirely done.

This week featured renewed strength in the dollar, more weakness among the banks, a weekly jobs claims report that was weaker than expected, and basically a bunch of pangs of potential nastiness that would have crushed a fragile market. And yet stocks shrugged off these items like a dog shaking off water after a jump in a cold lake. That is a sign of strength.

Breadth was quite good, and the decline of small stocks was really just a minor concern. There have been plenty of entire years in which small stocks suffered almost every single day and it did not matter one bit to the big dogs in the major market benchmarks. The year 1999 comes to mind, as the Russell 2000 was only up 10% that year going into the second week of December back then, while the big-cap tech stocks of the Nasdaq 100 were already up 75% year to date.

Across the whole market, there were 10 times more new highs than new lows, including book publisher John Wiley & Sons Inc. (NYSE: JW.A, JW.B), and one of my favorite health care values, Medicare specialist WellCare Health Plans Inc. (NYSE: WCG).

I am pretty sure that Wiley hit a new high in anticipation of the publication of my new book project, the first annotated edition of "Reminiscences of a Stock Operator." I just received my first copy hot off the press last week, and if I do say so myself it does look great. I am too chicken to actually read it because I am sure that I will find a typo, but I am told by reliable sources that it's really good. In fact, famed hedge fund trader Paul Tudor Jones, who wrote the foreword, said he got his copy early this week and "loved it." So really, if Jones liked it, you will too, don't you think? You can buy it at Amazon.com now (link above), and it will be in bookstores very soon.

"Reminiscences" is the best book ever written about the stock market, and considering it was published in 1923 about events of the 1860s-1920s, there has been plenty of time for someone to top it. My annotations provide the historic context for the action, as well as profiles of key characters, notes on the gambling slang with which the book is suffused, analysis of the trading strategies its main characters employ, deep thoughts on the hidden meaning of the book, and much more. Whether you are a trader, an investor, someone who is interested in American financial history, or are fascinated by the psychology of the markets, you will find it a gripping read. Not to mention an outstanding gift.

I have read the "Reminiscences" text 100 times, now, and I still find it fascinating. The author, Edwin Lefevre, was a master of creating scenes in which the agony and ecstasy of trading -- outwitting brilliant competitors, being outwitted, creating deceptions and figuring out when you're being deceived -- are described in forceful but colorful language that is immediately accessible.

As far as the instruments to use to effect this idea, here's my strategy: If you decide to be invested, then generally it pays to be invested in riskier assets -- i.e. at this time, emerging markets in Latin America and Asia. That's why we are over-weighted internationally now. The non-USA markets are in a bit of a soft spot right now, but don't be alarmed. Sitting through these kinds of relatively minor fluctuations is the way to go.

The Week Ahead

December 14:

Nothing scheduled

December 15:

Producer Price Index (11/09)

Empire State Manufacturing Index (11/09)

Industrial Production (11/09)

December 16:

Federal Reserve Open Market Committee announcement

Consumer price index (11/09)

Housing Starts (11/09)

December 17:

Conference Board's index of leading indicators (11/09)

Philadelphia Fed's Business Outlook Survey (11/09)

Jobless claims (week ending 12/11)

December 27:

Equity, commodity and futures options expire

[Editor's Note: For the first time in 70 years, U.S. T-bills are paying 0% interest, while U.S stocks are continuing to rise. According to Bloomberg News, this last happened in 1938, when T-bill yields fell from 0.45% to 0.05%. Then came 1939, when stocks began a three-year slide that took the Standard & Poor's down 34% after the U.S. Federal Reserve prematurely boosted borrowing costs to battle phantom inflation.

Sounds eerily like the present, doesn't it?

Very few market columnists see the parallels. And even fewer see the differences. But as this column demonstrates, veteran portfolio manager, commentator and author Jon Markman sees it all. And that's why investors subscribe to his Strategic Advantage newsletter every week.

To navigate today's markets, investors need a guide. Markman is the ideal choice.

For more information, please click here.]

Source: http://moneymorning.com/2009/12/14/how-to-profit-from-the-evil-genius-of-goldman-sachs/

Money Morning/The Money Map Report

©2009 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.