An Unwelcome Guest Has Appeared At Our Bull Market Party

Stock-Markets / Financial Markets Jul 20, 2007 - 07:38 PM GMT

The punchbowl has been refilled several times. The party seems to be going strong. But, what is this? An unwanted guest has walked in and the punchbowl is doesn't look as full as it had just a while ago. Who is this unwanted guest? His name is Collateralized Debt Obligations (CDO). CDO normally lives on the other side of the tracks, so what is he doing at your party?

The punchbowl has been refilled several times. The party seems to be going strong. But, what is this? An unwanted guest has walked in and the punchbowl is doesn't look as full as it had just a while ago. Who is this unwanted guest? His name is Collateralized Debt Obligations (CDO). CDO normally lives on the other side of the tracks, so what is he doing at your party?

CDO is threatening to take away the punchbowl and bring the party to an unhappy conclusion. Here's where CDO has just shown up . Gosh, you say. This is one of those darned government reports. Please bear with me a moment. If you scroll down to page 13, you will see assets held by large commercial banks. If you follow line 34 across the page, you will see the unwanted guest. As far as the eye can see, the unwanted guest has been absent, until July 4, 2007 . The appearance is shocking because of the suddenness and its magnitude. $1.211 trillion dollars worth of “securitized real estate loans,” otherwise known as CDOs has suddenly appeared on the balance sheets of large commercial banks.

Page 7 of the same report shows that total assets of large commercial banks are $5.399 trillion and total liabilities are $4.799 trillion. That leaves net assets of $600 billion. Now look at the size of our unwanted guest. Remember, last week I reported that Merrill Lynch halted its auction of CDOs seized from Bear Stearns after selling only $220 million of the $850 million it had recovered. The reason? The bids were too low.

You may draw your own conclusions. I suggest that the party on Wall Street that was funded by easy money is now over. Not only is the punchbowl empty, CDO may have backed up a wrecking ball to your home.

How did we get where we are, anyway?

Let's start with the concept of cycles and negative feedback. It has been known for a very long time that the Federal Reserve has been doing its mightiest to abolish the business cycle. The reason? You might call it pain avoidance. The business cycle has an important function, however. It helps to clear out the deadwood in our economy.

Observe the massive brushfires in the western states. Fires occur normally in nature. They remove dead flora and allow a renewal of new growth. However, man's incursion in many naturally scenic areas has put a halt to these natural fires. As a result, we now have fires that are uncontrollable in the western states.

The business cycle does the same. It allows weaker, unprofitable businesses to die and be replaced by more modern and efficient companies. This may seem uncaring, but we can observe this in the United States throughout its history. Since the 1980's, the Federal Reserve has been attempting to “manage” the business cycle. On can imagine why, since the memories of the recessionary 70s was still on peoples' minds. This was the advent of the junk bond days, when “rust belt” companies were taken over by aggressive managers, slashing and burning these businesses back to profitability.

Each time a crisis struck, the Federal Reserve made sure there was ample credit to revive the sinking economy. Like a drug addiction, it took larger loans and lower interest rates to avert the next crisis. Until, in 2001, we hit the lowest interest rates since the Great Depression. And interest rates stayed low for nearly five years, until 2006. Now, interest rates are rising, but the addiction to easy money is in full bloom and not easily cured.

This brings us to the second concept, negative feedback. How many parents have warned their children, “Don't touch that stove!” That is an example of negative feedback. Another example is a guided missile system. Any engineer will tell you that it's guidance system tells it where the target is not, and allows corrections in mid flight until it hits the target.

By allowing easy money to pervade the economic system, the Federal Reserve has stilled the voice of negative feedback. In the 70s, it took high fuel costs, a recession and high interest rates to encourage American auto manufacturers to make smaller, more fuel-efficient cars. But not before the Japanese automakers claimed a foothold on our soil. You would think we learned.

Since the 1980s, the Fed's willingness to throw easy credit at any al all crises has taken away the appearance of risk. The business cycle appears to be tamed. In the last decade, we have a new expression for this. It's called the Goldilocks Economy . This has been expressed in the stock market by mild declines, seldom exceeding 8%. The historical norm is that the market sees declines of 10% or more every eight months.

This has encouraged dangerous behavior, such as investing in assets with higher volatility, excessive borrowing against market assets, having too little cash reserves and depending on the market (and home equity) to make up for a lack of savings. Bad behavior on Wall Street has now spread risk throughout our financial system, including banks, insurance companies and pension funds. What you see in the bank report above is just the tip of the iceberg.

The Nikkei's uptrend weakening…

…and today's sell-off in the U.S. markets may push it over the edge on Monday, if it hasn't already succumbed today. Last night's 1.1% sell off (not shown) may have broken the up-trend for good in the Nikkei. The reason for the selling? Japanese banks may have provided the financing for the Bear Stearns hedge funds that were in trouble.

While the Shanghai Composite finishes an a-b-c rally.

Both the Hong Kong and the Shanghai markets were up last night, but with a difference. Hong Kong followed the lead of the Dow Jones Industrials, making a new all-time high. In the meantime, the Shanghai index continues to under-perform. Elliott Wave identifies this most recent rally as an a-b-c partial correction of the most recent 10% decline. The outlook? The next decline should be a doozy.

Both the Hong Kong and the Shanghai markets were up last night, but with a difference. Hong Kong followed the lead of the Dow Jones Industrials, making a new all-time high. In the meantime, the Shanghai index continues to under-perform. Elliott Wave identifies this most recent rally as an a-b-c partial correction of the most recent 10% decline. The outlook? The next decline should be a doozy.

The S&P 500 may have met its goal.

The S&P 500 rallied this week to close for the first time above 1553, it's former high in 2000. There is an important technical reason for having the S&P 500 exceed its former high. The reason is, if it hadn't, it would be virtually assured that the next four-year cycle low (due now) would be lower than the last, in October 2002. This achievement has only lowered the probability that such an event might happen.

The S&P 500 rallied this week to close for the first time above 1553, it's former high in 2000. There is an important technical reason for having the S&P 500 exceed its former high. The reason is, if it hadn't, it would be virtually assured that the next four-year cycle low (due now) would be lower than the last, in October 2002. This achievement has only lowered the probability that such an event might happen.

Bonds are still rallying, but not for long.

Bonds continue a counter-trend rally that has yet awhile to complete. Yields dipped today while the dollar is plumbing its lows. This has helped the rally in bonds, but it doesn't appear that it will last. The reason is that the Federal Reserve has a dilemma. Either it can support the dollar and keep foreign investors buying our debt or it can lower interest rates to rescue the market. This is not a savory choice to make.

Bonds continue a counter-trend rally that has yet awhile to complete. Yields dipped today while the dollar is plumbing its lows. This has helped the rally in bonds, but it doesn't appear that it will last. The reason is that the Federal Reserve has a dilemma. Either it can support the dollar and keep foreign investors buying our debt or it can lower interest rates to rescue the market. This is not a savory choice to make.

Housing Exec sees decline into 2008.

NEW YORK, July 19 (Reuters) - The chief executive of KB Home (KBH.N: Quote , Profile , Research ), the No. 5 U.S. home builder, said on Thursday he does not expect the overall U.S. home market to bottom out until the end of next year and that prices will not increase until well into 2009.

This outlook has repercussions not only for homeowners, but also builders and suppliers.

The dollar slump is raising more questions about risk.

The U.S. housing market and subprime troubles are increasing the concern about the dollar. The downtrend is still firmly in place. Last week I wrote that the chart “…suggests that the prospects for the dollar couldn't be rosier!” I have to admit that I was being slightly tongue-in-cheek with that comment, for those who were a bit put off. I will modify that statement to say that the dollar has a chance sometime in the future of rallying, based on the same technical pattern.

The U.S. housing market and subprime troubles are increasing the concern about the dollar. The downtrend is still firmly in place. Last week I wrote that the chart “…suggests that the prospects for the dollar couldn't be rosier!” I have to admit that I was being slightly tongue-in-cheek with that comment, for those who were a bit put off. I will modify that statement to say that the dollar has a chance sometime in the future of rallying, based on the same technical pattern.

Gold continued to rally on the dollar's weakness.

This is one of the reasons for the rally. Other reasons include safe-haven buying and the concerns bout the subprime debacle. Brian Lundin, editor of the Gold Newsletter thinks that there will be a pull-back in gold and a bounce in the dollar. “ Longer-term however, "we're seeing a growing disdain for the U.S. dollar, and an erosion of its status as the world's reserve currency," he said in e-mailed comments. ‘The big beneficiary of this trend ... will be gold and, to a lesser extend, the rest of the metals complex.'"

This is one of the reasons for the rally. Other reasons include safe-haven buying and the concerns bout the subprime debacle. Brian Lundin, editor of the Gold Newsletter thinks that there will be a pull-back in gold and a bounce in the dollar. “ Longer-term however, "we're seeing a growing disdain for the U.S. dollar, and an erosion of its status as the world's reserve currency," he said in e-mailed comments. ‘The big beneficiary of this trend ... will be gold and, to a lesser extend, the rest of the metals complex.'"

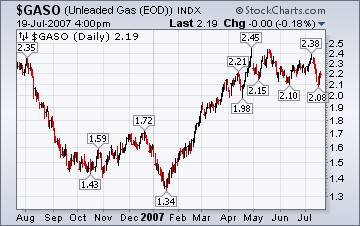

Will crude oil reach $80 per barrel?

The EIA's report on Wednesday brought up this question and seemed to answer to the affirmative. Add refinery outages and the combination should be a toxic mix for the price of gasoline. But what have we here? The price of gasoline is declining!

The EIA's report on Wednesday brought up this question and seemed to answer to the affirmative. Add refinery outages and the combination should be a toxic mix for the price of gasoline. But what have we here? The price of gasoline is declining!

How can one product be shooting up while another product that is so reliant on the first be going down? The answer may be that speculators are driving the prices of oil and gold due to being risk adverse to stocks and bonds.

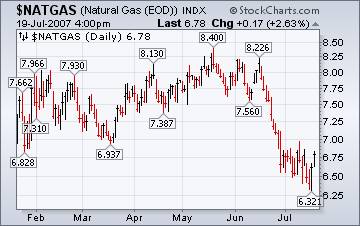

Is natural gas nearing storage capacity?

Most Americans relate to higher natural gas prices in the summer as air conditioning needs increases the output of gas-fired electric production. But as I mentioned last week, the rig count is up and Natural gas is approaching storage capacity limits. So, even though there is a short-term blip in prices, the trend still appears to be down.

Most Americans relate to higher natural gas prices in the summer as air conditioning needs increases the output of gas-fired electric production. But as I mentioned last week, the rig count is up and Natural gas is approaching storage capacity limits. So, even though there is a short-term blip in prices, the trend still appears to be down.

Back on the air again.

Tom Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. You may listen to our comments by clicking here .

Money created. Money destroyed.

Have you ever though about how money is circulated in our economy? Or how money is created to finance all the good things in life? Michael Nystro m does an excellent job of explaining how the money that made all the good things in life available is now being destroyed.

The Practical Investor will be moving its business location at the end of July. Further updates on the move will follow.

Please make an appointment to discuss these strategies by calling me or Claire at (517) 324-8741, ext 19 or 20. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.