The Debt Time Bomb

Economics / Global Debt Crisis Dec 18, 2009 - 02:46 AM GMTBy: Puru_Saxena

BIG PICTURE- “It’s a question of how do you achieve the deleveraging. Do you go through a long period of slow growth, high savings and many legal problems or do you accept higher inflation? It would ameliorate the debt bomb and help us work through the deleveraging process” – Kenneth Rogoff, Professor of Economics at Harvard, Former Chief Economist at the International Monetary Fund

BIG PICTURE- “It’s a question of how do you achieve the deleveraging. Do you go through a long period of slow growth, high savings and many legal problems or do you accept higher inflation? It would ameliorate the debt bomb and help us work through the deleveraging process” – Kenneth Rogoff, Professor of Economics at Harvard, Former Chief Economist at the International Monetary Fund

Make no mistake; the developed world is drowning in debt and as outlined above, there are only two viable options – a global economic depression or very high inflation. It is our contention that the policymakers have chosen the latter option and over the following years, we will experience the trauma of severe inflation.

Look. The American government is staring at total obligations of US$115 trillion, America’s debt to GDP ratio is off the charts and the American public is also up to its eyeballs in debt. Under this scenario, you can bet your bottom dollar that the American establishment will try to reduce this debt overhang through a process known as monetary inflation. If you have any doubt whatsoever, take a look at Figure 1 which captures the incredible expansion in America’s monetary base. As you can see, over the past two years, the monetary base in America has expanded from US$827 billion to an astonishing US$1.93 trillion! Up until now, this surge in the monetary base has not permeated through the broad economy but once the money velocity picks up, the money supply will zoom and the end result will be surging price inflation.

Figure 1: Explosion in America’s monetary base

Source: Federal Reserve

It is notable that America is not alone in pursuing inflationary policies; most nations all over the world are printing money and debasing their currencies. In this era of globalisation, no country wants a strong currency and everyone is engaged in competitive currency devaluations. Given this reality, we firmly believe that this money and debt creation will cause an inflationary holocaust over the coming years.

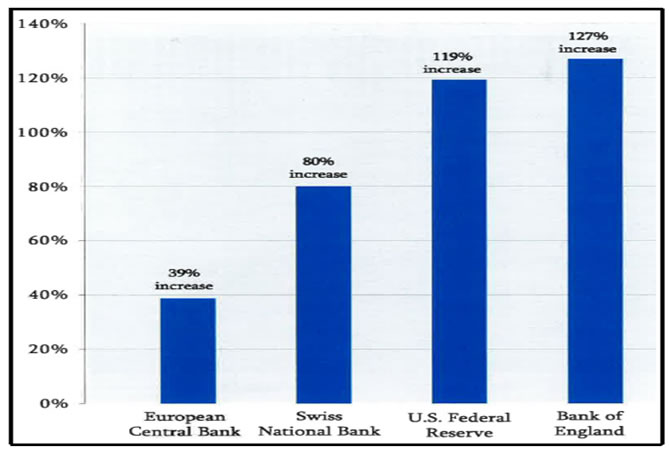

In fact, those who erroneously believe that deflation is unavoidable should review Figure 2 which highlights the mind-boggling expansion in the balance sheets of various central banks. As you can see, America alone is not the only nation guilty of printing money; the Europeans have also jumped on this train to Inflationville.

Figure 2: Central bank balance sheet expansion (15 Sept 2008 – 1 July 2009)

Source: Various central banks

Now, we are aware that many prominent commentators are still calling for deflation and their argument is based on the strength in American Treasuries. “After all, how can inflation be a problem when bond yields are so low?” seems to be their reasoning. Well, these deflationists seem to be missing the point because the American Treasury market is no longer a free market and we would argue that the Federal Reserve’s intervention is largely responsible for keeping bond yields artificially low. It is noteworthy that over the past several months, the Federal Reserve has purchased most of the newly issued American Treasuries. It goes without saying that the American central bank is engaged in this desperate act in order to keep interest-rates low. However, it is buying these Treasuries by creating money out of thin air. This is inflationary.

If our assessment is correct, somewhere down the road, the Federal Reserve will lose its battle and long-dated American Treasuries will plummet in value. As more and more bond investors wake up to the looming inflationary menace, they will start demanding a higher rate of return on their capital. When that happens, the dyke will break and the Federal Reserve will become irrelevant.

We have no doubt in our minds that over the next decade, various central banks will intensify their money-printing efforts and Mr. Bernanke will lead by example. After all, America has run out of choices and if the Federal Reserve does not inflate away this mountain of debt, the biggest sovereign default in history is guaranteed. Now, given the ability of the Federal Reserve to create confetti money, we are convinced that it will opt for the inflation tonic. Remember, inflation dilutes the purchasing power of each unit of money and it will make America’s debt more manageable. Of course, this inflationary agenda is not a secret and this is why many creditor nations with huge reserves are beginning to diversify out of the American currency.

It is our observation that throughout history, monetary inflation has caused asset prices to rise and this time should be no different. In the past, when inflationary expectations spiralled out of control, hard assets were the prime beneficiaries and this trend is likely to remain intact in this inflationary episode. If our assessment is correct, over the coming years, stocks, precious metals, commodities and real-estate will appreciate in value versus paper currencies. Furthermore, on a relative basis, we expect precious metals and commodities to outperform all other asset-classes. Conversely, we anticipate that cash and fixed income instruments will probably turn out to be the worst assets to own over the next decade.

Bearing in mind the looming inflationary nightmare, we urge you to protect your purchasing power by allocating capital to precious metals and commodities related businesses. Finally, we suggest that you consider allocating a portion of your capital to the fast growing economies in Asia (China, India and Vietnam).

For our part, we have invested our clients’ capital in world-class businesses in our preferred themes and we expect our holdings to benefit during this low-growth, high-inflation environment.

Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com.

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2009 Puru Saxena Limited. All rights reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.