Goldonomics, The Economics of Gold

Commodities / Gold and Silver 2010 Feb 21, 2010 - 10:58 AM GMTBy: Fresbee

Gold Economics is an art in itself and I think B-Schools should start introducing this as part of their courses. Of special mention should be the study of Gold price suppression and how it is essential for the survival of

capital markets.

I call it GOLDONOMICS: The Economics of Gold.

Gold Economics is an art in itself and I think B-Schools should start introducing this as part of their courses. Of special mention should be the study of Gold price suppression and how it is essential for the survival of

capital markets.

I call it GOLDONOMICS: The Economics of Gold.

Attached is summary of latest demand – supply situation and concluding remarks on Gold prices forecast.

Updates from World Gold council Q4 2009 reports.

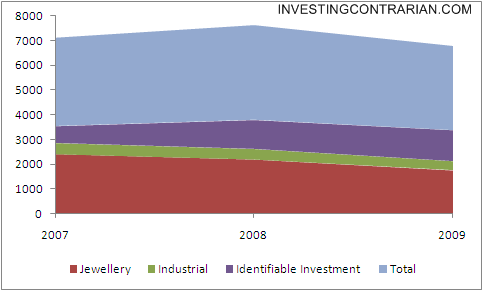

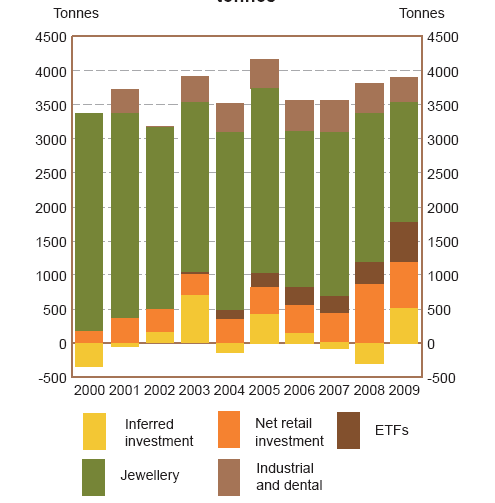

- The volume of total identifiable gold demand during 2009 was down 11% on 2008 levels at 3,385.8 tonnes. In $US value terms, the two years were broadly on par. Tonnage demand in Q4 was down 24% on Q4 2008, equivalent to a 5% rise in $US value terms. If we add the less visible side of investment, total tonnage demand in 2009 enjoyed an 11% rise over 2008 levels.

- The $US gold price in 2009, at an average of $972.35/oz, was up 12% on $871.96 in 2008. In Q4, the gold price averaged $1,099.63, up a very strong 38% on the levels of Q4 2008. Consumers in India and Turkey experienced slightly smaller increases of 32% and 34% respectively, while consumers in the Euro area experienced a considerably smaller 23% rise.

- Identifiable investment in 2009 was up 7% relative to 2008, the only sector on the demand side to record positive growth. Industrial and dental and jewellery demand recorded declines of 16% and 20% respectively. China was the only major jewellery market to record annual growth in tonnage.

- A comparison of Q4 2009 demand against Q4 2008 shows that the only sector to enjoy positive growth was industrial and dental demand (11%), albeit off a low base. Jewellery demand declined 8%, also off a low base, while identifiable investment declined 50% relative to an exceptionally strong Q4 2008. Q1 2009 was also exceptionally strong; although investment flows subsequently tapered significantly, they remained high in absolute terms.

- After a very weak Q1, jewellery and industrial demand enjoyed three consecutive quarter-on-quarter gains. By Q4, jewellery demand had risen to 500.4 tonnes, up from 336.3 tonnes in Q1. The recovery in jewellery demand was driven largely by a rebound in the Indian market. Industrial demand benefited from a strengthening in the electronics sector, reflecting improved economic conditions.

- Strong investment flows in western markets generally offset weakness in non-western markets during 2009. The only non-western country to record positive growth in net retail investment during 2009 was China. India was the largest contributor on the downside, influenced strongly by dishoarding in the first quarter, although this was followed by a subsequent rebound. The

- strongest quarter-on-quarter performance came from the US, rising 104%.

- Other identified retail investment, which largely covers the western markets, rose 11% between 2008 and 2009 and 77% quarter-on-quarter.

- Bar hoarding, which largely covers the non-western markets, experienced a significant decline in both annual terms and in Q4 relative to Q4 2008.

- ETF demand in 2009, at 594.7 tonnes, was 85% higher than in 2008. The strong 2009 result was driven by an exceptional first quarter, which soared to 465.1 tonnes. Demand in Q4 2009 was significantly lower than in either Q4 2008 or Q1 2009, but still healthy in absolute terms at 31.6 tonnes.

Demand Statistics

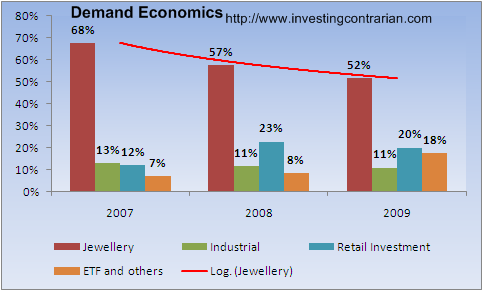

It is little disturbing to note that while prices have been steadily rising across Q4, it has not yet been supported as well with strong demand. The total demand in terms of tonnage has fallen by nearly 10%. Except Investment demand (within that only ETF has shown positive volume growth), all other forms of demand have shown a steady de growth.

Demand 2000-2009

- As visible from the graph, ETF demand works out to be 18′% of the overall world demand, up from 7% in 2007. It does seems that bubble economics in GOLD is really not that far.

- Retail investment pumped up to an incredible 23% of world demand in 2008 up from 12% in 2007. It has taken a breather in 2009 to slump down to 20%. It is anyone guess of how long the retail will stay out of the bubble party as GOLD is being marketed all over the place in China and India. In the case of China, it almost seems the government is encouraging common folk to own some Gold. It almost reminds me of how diagonally contrarian that is to when Hitler declared “Gold owners are state enemy”. (Do a google search and am sure you will find a lot more on Hitler and Gold)

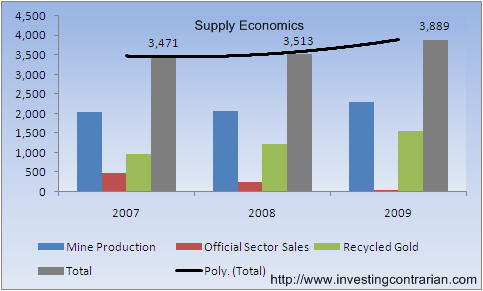

Supply Economics

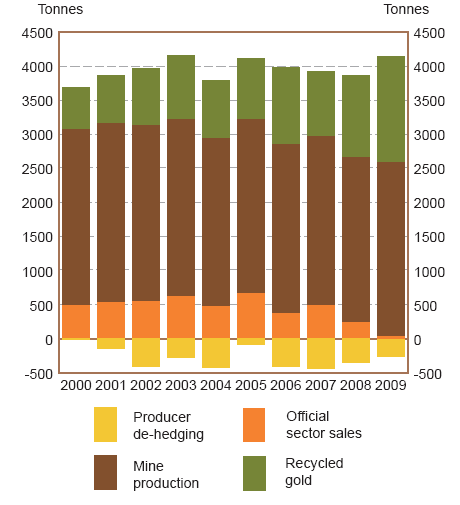

Supply segmentation 2000-2009

- Gold supply overall picked up annual growth of 11% in 2009 compared to paltry 3% in 2008. This was mainly led by recycled gold and traditional Mine Production.

- The year saw a radical shift in the way central banks have viewed Gold as 85% contraction was seen in CB Gold sales. This in our view can be a major source of irritation of fiat currency printers like FED and BOE as it undervalues there paper currencies.

Country Update

Quoting from World Gold Council report

China

Gold demand in the fourth quarter followed the pattern that had been established across the Greater China region throughout 2009 – namely, solid gains from mainland China partially offset by weaker demand in both Hong Kong and Taiwan. Total Q4 demand of 116.3 tonnes, although below the previous quarter’s strong result, was 3% above Q4 2008 levels. Retail investment demand added 17% to year-earlier levels, while jewellery demand was flat over the same time period. In mainland China, a 20% rise in investment demand was the driving force behind a 5% increase in total fourth quarter demand relative to Q4 2008, while gains in jewellery demand were more muted at 2%. Mainland China’s full-year record was equally impressive, with a 6% rise in jewellery demand (the only country to experience an improvement in annual jewellery off-take) and 22% growth in net retail investment translating to an increase in total consumer demand of 9% over 2008.

India

Following on from an extremely weak first quarter, the Indian market enjoyed a solid recovery over the remainder of 2009. Tonnage off-take in Q4 totalled 180.7 tonnes, up 17% from 154.4 tonnes the previous quarter and up 13% from 159.6 tonnes in Q4 2008. Seasonal factors assisted the quarter-on-quarter improvement, as Q4 marked the start of the wedding and festive seasons, including Diwali. Nevertheless, in light of the rally in the gold price during that quarter, it is still an encouraging result. Over the year as a whole, tonnage off-take totalled 480.0 tonnes, down 33% from 712.6 tonnes in 2008. Nevertheless, India held onto its position as the world’s largest gold consuming nation. Any move below $US1000/oz is likely to attract heavy buying – anecdotal evidence suggests that this has effectively become the new price ‘floor’.

I am pretty sure most Gold bugs will not agree with that last statement. For them the Floor is well above $1000/ounce.

Gold charts

A quick look at the charts and notes

I continue to expect a super fast move in Gold from March with a target of $1400 on the minimum but I expect the longs to unwind soon after that.

Source :http://investingcontrarian.com/global/goldonomics-gold-economics/

Fresbee

http://investingcontrarian.com/

Fresbee is Editor at Investing Contrarian. He has over 5 year experience working with a leading Hedge fund and Private Equity fund based out of Zurich. He now writes for Investing Contrarian analyzing the emerging new world order.

© 2010 Copyright Fresbee - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.