Politicians Hopelessly Bad at Economics

Politics / Government Spending Mar 03, 2010 - 06:10 AM GMTBy: LewRockwell

Wilt Alston writes: Nancy Pelosi claims that the new "healthcare" bill will "create 4 million jobs – 400,000 jobs almost immediately." The audacity and shamelessness of these lying politicians is something to behold. ~ Bill Anderson (on the LRC Blog)

Wilt Alston writes: Nancy Pelosi claims that the new "healthcare" bill will "create 4 million jobs – 400,000 jobs almost immediately." The audacity and shamelessness of these lying politicians is something to behold. ~ Bill Anderson (on the LRC Blog)

After my pedestrian attempt at some basic erudition on stimulus the other day, I got a note from a respondent. Even though he completely agreed with me, that respondent offered examples of the bogus justifications politicians like Pelosi use to sell their boondoggles. He suggested that attacking these misconceptions head-on might be instructive. Given Pelosi's statement, and the (no doubt) enthusiastic reception it received, I am forced to conclude that my respondent was correct.

It seems that much of the American public – and almost the entire American legislature – believe two things that Austrian economics and basic math would refute. One, that stable, legitimate jobs can be created by government spending. Two, that the national economy is improved by this act of creation, i.e., that we are collectively better off because of this spending than we would otherwise be, ceteris paribus. With ample apologies to the giants who have already explained this before me, I feel compelled to offer not only a hearty "Right On!" to the points Anderson raised in his blog post cited above, but also a throaty "Hell No!" to both of these assertions.

Quoting my respondent, all emphasis is mine:

Politicians sell the stimulus not just as a make-work scheme, but that it will produce tangible benefits. Just as the federal highways increased productivity, the argument goes, new high-speed trains, better bridges, and keeping teachers employed will increase American productivity. The debt will be repaid from that increased productivity.

Further:

The proponents of stimulus would argue that but for the stimulus, taxpayers' incomes would be that much lower. To the extent that taxpayers' incomes increase more than the increased tax burdens to repay the borrowed funds, taxpayers are conceivably better off.

Finally:

[A]t least from a theoretical standpoint, the concept makes sense. After all, businesses leverage their balance sheets every day in hopes of paying off that debt with increased future productivity.

This essay will serve to answer my respondent's examples and, with luck, address these misconceptions, at least for the people not as delusional as Pelosi and Krugman. To wit:

Tangible Benefits Versus Lost Purchasing Power

If one is talking about the person who is receiving government largess, it would be foolish to dispute that he is tangibly benefiting, particularly from a standpoint of high time preference. That a person with no job and no (apparent) prospects can be bribed with a high-paying (or even moderate-paying) make-work job is no discovery. Under closer scrutiny this short-term tangibility turns into long-term horse feces.

Consider: According to census figures, a "MALE HOUSEHOLDER" made an income of $10,742 (in 1973 dollars) in 1973. That same person made an income of $41,844 (in 2006 dollars) in 2006. According to the computations at MeasuringWorth.com, it took $4.54 in 2006 to have the same "purchase power" as $1.00 in 1973. You can already see where I'm going, right? A person would need 4.54 times the income he was receiving in 1973 to purchase the same items in 2006. Multiplying $10,742 by 4.54 equals $48,768. Our hero is $6,924 in the hole and he hasn't paid any taxes – income, excise, duty – anything, yet!

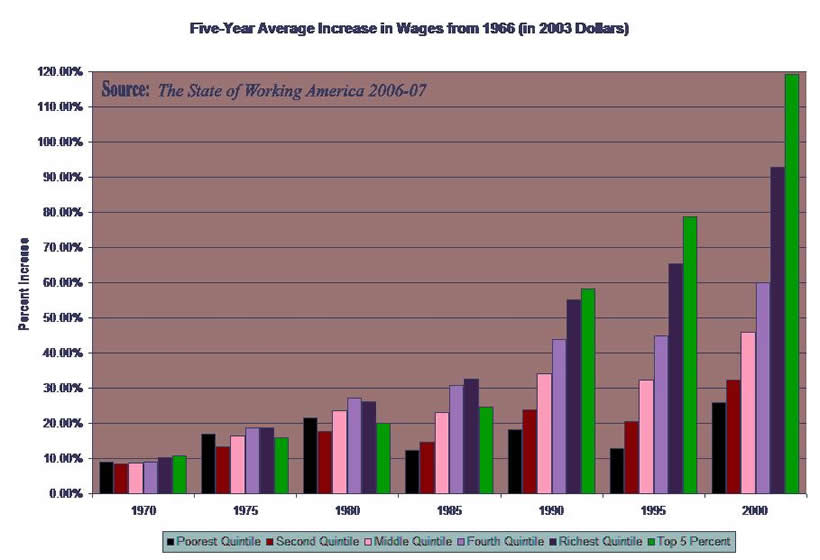

Is it any surprise that regular people would be struggling more and more with time? Such is the conclusion one should draw from this chart from a previous (and soon-to-be-updated) essay.

Please note that the income on this chart is already corrected for inflation. Up to approximately the 80's, we all seemed to be growing together, income-wise. Since then not so much. Where did that money go? Pelosi, and plutocrat scum sucking the government teat before her, stole it and/or helped funnel it from the bottom of the socio-economic ladder to the top. (Krugman and his ilk cheered.) What increased productivity? How is anyone except the plutocrats conceivably better off? All I see is a structural transfer of wealth, a transfer of wealth benefiting politicians and their cronies, regardless of party affiliation.

Increased Income Versus Increased Tax Burden

There can be little doubt that long term (in a time frame covering only a portion of my adulthood) regular people are not better off because of government economics. The indications are all around us. Why did a person need more money in 2006 than they needed in 1973? Inflation. (Recall that the printing of fake money does not cause inflation; the printing of fake money is inflation.) One way inflation is perceived is as rising prices. From whence does inflation come? The Fed.

Contra the myths of stimulus, not only does the taxpayer not have increased long-term income, but he also has increased tax burden in its place. Simultaneously, he gets to enjoy the Cantillon Effect – whereby "income and wealth is redistributed to those who receive the new [inflation] money early in the process, at the expense of those who receive the new money later, or those who live on fixed incomes and receive none of the new money." Worse, the Cantillon Effect is a generally not perceived, yet remains a direct result of the Fed’s inflationary actions.

With apologies for being overly dramatic, it rather insults me that plutocrats (and their academic court jesters) continue to suggest that rising prices are inflation. Such an assertion attempts to place inflation in the realm of naturally-occurring phenomena. It just happens, out of the blue. If that were true, one might be convinced that those smart guys at the Fed were trying to help. They aren't. The example of MALE HOUSEHOLDER shown above should provide ample evidence.

Theory Versus Reality Involving Leverage

My respondent suggested, again as an example, that the government investing via stimulus was similar to targeted investment by a business, noting "Businesses leverage their balance sheets every day in hopes of paying off that debt with increased future productivity." Several differences should be apparent.

One, truly private businesses are risking their own money, or the money of their voluntary investors. The government has neither a legitimate balance sheet nor voluntary investors. (If you stole that which you have, does itemizing it make your enterprise legitimate?) Two, if the risks don't pan out, a truly-private business will fold and go under, well, unless the business is GM or Chrysler or AIG or Citibank or, well... (At least we can agree that they should go under.) Three, a private business can efficiently manage resources, using the feedback of the aggregate decisions of its customers, A.K.A., the market. A public enterprise cannot, since its market is captive. This truth has been borne out over and over again since before people like Mises and Hayek and Rothbard (and maybe even Aristotle) first observed it. Four, private businesses make money by producing that which is in-demand and/or not obtained from elsewhere. In other words, they excel if that which they supply is more novel (higher value, higher utility, etc.) and/or cheaper than that which might otherwise be obtained. With few if any exceptions, the items supplied by the government can be produced elsewhere at a cheaper price and supplied more efficiently as well.

In the case of the government – or a government-owned enterprise like General Motors – using leverage, the risk side of the equation is missing. This is what is known in Austrian circles as moral hazard. The poorer the performance of a government enterprise, the more money the enterprise receives. (Read: FEMA, the firms noted above, the recipients of TARP, etc.) Unfortunately, that additional risk capital comes from the same well-spring as the initial public burnt offering – the tax payer and/or the printing press. Again, see the adventures of MALE HOUSEHOLDER to get a glimpse at the climax.

Conclusion

There is no scenario under which the government can spend money more effectively than a truly-private enterprise and no scenario under which the money spent by the government won't hurt those who it was supposed to help, eventually, probably sooner rather than later. The fact that such money is deficit-financed just makes bad matters worse. When the Republicans say that spending helps, they’re helping their cronies. When the Democrats say that spending helps, they’re hurting their supposed constituency, which makes the hoopla over Jim Bunning all the more ironic. Occasionally, as in the case of TARP, it's pretty clear at the outset that the money is specifically intended to provide corporate welfare, and no one on either side of the aisle even pretends that they're trying to help the common folk.

At least they were honest in their dishonesty that one time.

Wilt Alston [send him mail] lives in Rochester, NY, with his wife and three children. When he’s not training for a marathon or furthering his part-time study of libertarian philosophy, he works as a principal research scientist in transportation safety, focusing primarily on the safety of subway and freight train control systems.

© 2010 Copyright Wilt Alston / LewRockwell.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.