The Fed says, “Don't Panic!”

Stock-Markets / Credit Crunch Aug 10, 2007 - 05:14 PM GMTYesterday the Federal Reserve “injected” $24 billion into the market. This morning they “injected” another $19 billion. Yesterday the world banks collectively “injected” $150 billion of cash into the markets. This morning, they repeated the procedure with another $173 billion that I can account for. What does that mean? In a nutshell, the Federal Reserve and the other central banks have become the buyers of last resort for Wall Street's toxic waste.

Last night, the banks raised their overnight interest rate from 5.25% to 5.5% as a move that reflected an increased demand for cash and higher risk, even in the overnight (read: bank funds and money markets) accounts. The Fed move was meant to keep markets “orderly” by lowering rates back to 5.25%. The result was to stop the market decline , if only temporarily.

Here's the good and the bad side of Federal Reserve intervention. The good side is that they have the ability to slow the decline and temporarily mitigate the damage. The bad news is that this may prolong the decline and may make it worse. Why? This type of action creates the impression that the Federal Reserve is coming to the rescue and bailing out the markets. This causes many of the money managers and investors to postpone doing what they ought. They still haven't caught on how risky this market truly is…and the Fed can't bail out all their sins.

This is the very attitude that caused Wall Street to create these risky assets in the first place. And the banks followed suit by lending Wall Street the money that encouraged the creation of even more toxic waste. The problem now is, the size of the monster they created cannot be contained.

As I write, the Fed stepped in again and raised the ante to $35 billion . Brother Ben, can you spare a dime?

Don't' be fooled by this rally.

The Nikkei plunged 406.5 points to 16764 last night, putting it back into the “bear” mode for Japanese investors. The fundamental reason is that the Japanese banks have been the prime movers of Wall Street. This is known as the Japanese carry trade, in which hedge funds could borrow at nearly zero percent and invest in virtually anything that moved. The Japanese Central Bank also did a lot of money shuffling while we were asleep.

The Nikkei plunged 406.5 points to 16764 last night, putting it back into the “bear” mode for Japanese investors. The fundamental reason is that the Japanese banks have been the prime movers of Wall Street. This is known as the Japanese carry trade, in which hedge funds could borrow at nearly zero percent and invest in virtually anything that moved. The Japanese Central Bank also did a lot of money shuffling while we were asleep.

Do the Chinese have something different from us?

The answer is, fundamentally, no. So far, the Shanghai market has been relatively unscathed by the credit market woes in Japan , Europe and the U.S. That may be because the Central Bank of China has predominantly invested in U.S. Treasuries and only recently nibbled on the subprime market. But Chinese investors have “mortgaged the farm” to get into their stock market. That may come to grief very soon.

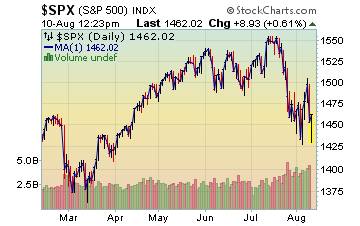

The S&P 500 rally failed this week…

…and the market is probing deeper lows. I am watching today to see whether this index “takes out” the Monday low of 1423. We are at a perilous spot, since , once that is accomplished, the March lows are next.

The Federal Reserve's attempt to put money into the markets and soothe investors' fears seems to be working so far, despite yesterday's sell-off. The real battle lies at the end of the day, when the institutional investors weigh in. This weekend the media will have a field day, slicing and dicing what happened in the past two days. The next battle for the hearts and minds of the investor public will be on Monday, after they have had time to digest what has happened this week. Who will be taken down next?

Bonds are being sold off, too…

…which is something I haven't seen in a while. That means the credit crunch may be more severe than what appears on the surface. It started on Wednesday when the Bank of China threatened to sell the U.S. dollar. (See the article below.) Could it be that the bond market isn't paying attention to the Federal Reserve's attempt to keep rates steady? Remember Greenspan's conundrum when he raised rates, but the bond market rallied instead of declining? Now we're on the other side of that equation.

Realtors lower forecast…

…which is stating the obvious . The National Association of Realtors' revised forecast calls for existing home sales of 6.04 million in 2007, down 6.8 percent from last year. The forecast was 1 percent lower, or 70,000 fewer homes, than July's prediction of 6.11 million.

…which is stating the obvious . The National Association of Realtors' revised forecast calls for existing home sales of 6.04 million in 2007, down 6.8 percent from last year. The forecast was 1 percent lower, or 70,000 fewer homes, than July's prediction of 6.11 million.

China threatens the “nuclear option.”

The Central Bank of China's threat to sell U.S. dollars shook up the bond market more than the dollar futures. The Korean news headline put it more aptly, “China threatens to shoot self in foot.” A good analysis, here.

Gold investors are seeing the glass ceiling…

…and another trip below 660 could be devastating for the bulls. Many analysts are watching this spot. Some are calling for a breakout, while others are just waiting. The problem is that there have been multiple attempts to get through the ceiling, each at lower levels. My model suggests that a decline will ultimately be the path of least resistance. Liquidity matters here, too.

…and another trip below 660 could be devastating for the bulls. Many analysts are watching this spot. Some are calling for a breakout, while others are just waiting. The problem is that there have been multiple attempts to get through the ceiling, each at lower levels. My model suggests that a decline will ultimately be the path of least resistance. Liquidity matters here, too.

Finally! Relief at the pump.

The EIA's report on Wednesday suggests that the U.S. is flush with crude for the time being. Shorter term trends aren't as promising, but they can change fairly quickly. Meanwhile, refinery capacity has been brought back up to speed, building gasoline inventories again. Are lower prices still ahead? The charts say, “Yes.”

The EIA's report on Wednesday suggests that the U.S. is flush with crude for the time being. Shorter term trends aren't as promising, but they can change fairly quickly. Meanwhile, refinery capacity has been brought back up to speed, building gasoline inventories again. Are lower prices still ahead? The charts say, “Yes.”

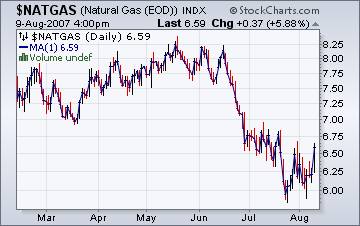

Blame it on the sweltering heat last week.

But the natural gas supplies are keeping up with demand quite nicely, says the Energy Information Agency . That means the spike in prices is due more to the cost of shipping and pipeline bottlenecks than to a lack of supply. We'll be through the hurricane season in another ten weeks, so pricing pressure could see a few more blips on the screen.

But the natural gas supplies are keeping up with demand quite nicely, says the Energy Information Agency . That means the spike in prices is due more to the cost of shipping and pipeline bottlenecks than to a lack of supply. We'll be through the hurricane season in another ten weeks, so pricing pressure could see a few more blips on the screen.

Back on the air again.

Tom Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. You may listen to our comments by clicking here .

Cramer has a melting moment.

Last Friday during the 285 point decline in the Dow, Jim Cramer really lost it. The problem is, his rants about what the Fed should do is exactly what created the problem to begin with . http://www.youtube.com/watch?v=GKZgfrsItmw

Meanwhile George Bush ……says the economy can deal with volatility . Maybe he should talk with Ben Bernanke about being on the same page.

The Practical Investor is finally moved! Please note the phone number that follows.

Please make an appointment to discuss our investment strategies by calling me or Claire at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.