The New Dumb Economic Idea: Velocity Of Money Was Driven By Securitization

Economics / Economic Theory Mar 15, 2010 - 10:41 AM GMTBy: Andrew_Butter

Oh I do love it so when the economists sit all us little boys and girls down, pat us on the head and start talking to us in Baby Language.

Oh I do love it so when the economists sit all us little boys and girls down, pat us on the head and start talking to us in Baby Language.

Once upon a time there was “inflation targeting” and then the Big Bad Wolf came along and ate it for breakfast. So now we are going to bake a magic cake, we will take a little bit of Keynes, a little bit of Friedman, mix in a dash of Austrian Chocolate…and WOOPIE!! We saved the world…again!!!

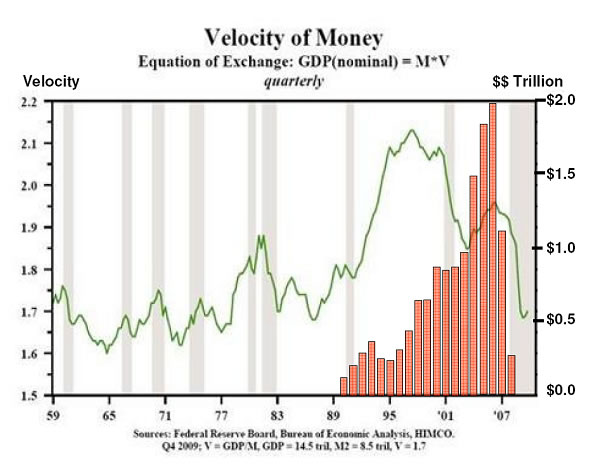

The latest idea is that securitization caused the spike in velocity of money (that’s how often it changes hands (V), so if you know how much money there is out there (I’m extremely sceptical about how that’s measured but anyway that’s called “M”) you can calculate it from nominal GDP (which is relatively easy to measure):

Here you go…just for anyone with Physics Envy: GDP (nominal) = M*V…QED!!

That’s the “Quantum Theory of Money” for you which is the economist’s answer to “Quantum Mechanics”, just like Keynes’ “General Theory” was their answer to the “General Theory of Relativity”. I’m not sure what we can conclude from that…perhaps economists have small…you know?

OK well let’s check that one out, here’s a chart of the velocity of money in USA (green line) with the amount of securitized debt issued in USA (pink columns):

All I can say about that theory is…Err…

From about 1989 to 2006 the rate of manufacture of toxic assets (securitized debt), went up exponentially; just like “Velocity” had gone up from about 1985.

So initially until about 1995 you could make some sort of a case for either velocity driving securitization or securitization driving velocity. Err…then the velocity went flat, but the rate of issuing securitized debt kept on going, then velocity went down a lot, but the rate of issuing securitized debt kept on going, accelerating in fact. Now, OK velocity is back to its 100 year mean line, and securitization has gone down to zero.

Sorry guys, you can talk to me in Baby Language all day, but I’m not going to buy that theory.

More like securitization and other things like credit cards, even ATM machines increased the “money supply” or at least distorted measurements of it, but the economists didn’t notice.

If you look up what the “money supply” is defined as you get a host of different answers, as a general rule though “broader” measures of money are stuff that is either notes or coins, or stuff that can be used instead of money or easily converted to notes or coins at zero or minimal cost.

That’s where the grey are comes in, so what’s “easy”, and what’s “minimal”.

I dunno – I took Physics up to the first year of Natural Science (then it just got much too complicated), but I’m racking my brains, “easy”…”minimal” …Err how do you measure that?

In the old-days there was no problem, money was stuff issued by the Central Bank, they knew how much there was because they had printed it (or at least they ought to have known).

So in the old-days some of that “money” might have been under someone’s mattress, but it was still part of the “money supply”, but fast forward to now…what about if a credit card company increases my limit – so I got another $10,000 I could spend – but I won’t, like I’m keeping it under the mattress for a rainy day.

Is that money? And when is it money?

How about if a drug dealer buys a flat in Moscow using a suitcase full of dollar bills, what does that do for the US economy? How does the Fed even know about that transaction?

Once upon a time securitized debt was “as good as money”, like a short-term US Treasury that’s M3, or M4 or “L” depending on who you talk to. The US Federal Reserve uses M2 to work out “Velocity”, that’s cash, current account balances, plus short term savings deposits…but is that the “money” in the economy?

Fast forward to Wikipedia – the source of all knowledge, talking about the Quantity Theory of Money:

Still, practical identification of the relevant money supply, including measurement, was always somewhat controversial and difficult. As financial intermediation grew in complexity and sophistication in the 1980s and 1990s, it became more so. As a result, some central banks, including the U.S. Federal Reserve, which had targeted the money supply, reverted to targeting interest rates.

OK so this is what happened.

1: The economists came up with a great theory.

2: To apply the theory you had to measure the supply of “money”, so they tried doing that for a while, but then it became too complicated.

3: So they dumped the theory (just like I dumped Physics) and instead they just played around with interest rates.

Talk about the blind leading the blind.

Here’s another theory (if economists with Physics Envy can have theories, then failed Physicists with no envy at all can have theories), all those AAA rated Collateralised Debt Obligations and so on manufactured by Goldilocks & Co were “counterfeit” money.

For a while everyone thought that was REAL money, so they “spent” it buying houses, Hummers, and generally partying; that caused inflation because there was too much “money” chasing too few houses and too many girls who ran slower than Tiger Woods (but the Fed didn’t notice because they were watching owner’s equivalent of rent, and rents went down because everyone stopped renting and went to live in a house in the suburbs).

At that time the Goldilocks-Special toxic assets were “liquid”, you could use them instead of money.

Then everyone realised they were counterfeit, no one wanted to exchange them for anything, and the party stopped…dead.

And all along Alan Greenspan thought he was in charge; well here’s another notion; perhaps economists didn’t have a clue what was going on, and they still don’t have a clue what’s going on, and if you want to know what’s going to happen next…who knows? Have a look at his Physics Envy and make a prediction.

The only thing that is certain is that the economists will probably do something stupid…that’s called history repeating itself.

Here’s another “theory”, if you live beyond your means, one day the Big Bad Wolf will come and eat you for breakfast.

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe; currently writing a book about BubbleOmics. Andrew Butter is managing partner of ABMC, an investment advisory firm, based in Dubai ( hbutter@eim.ae ), that he setup in 1999, and is has been involved advising on large scale real estate investments, mainly in Dubai.

© 2010 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.