Gold, There Is a Way to Beat JPMorgan at Their Game

Commodities / Gold and Silver 2010 Apr 06, 2010 - 05:32 AM GMTBy: Peter_Degraaf

The revelation at last week’s CFTC meeting that JPMorgan was the prime instigator behind the repeated ‘takedowns’ of the price of gold and silver came as no surprise to those of us who study the markets on a regular basis.

The revelation at last week’s CFTC meeting that JPMorgan was the prime instigator behind the repeated ‘takedowns’ of the price of gold and silver came as no surprise to those of us who study the markets on a regular basis.

JPM inherited a large ‘short position’ when they took over Bear Stearns, and they turned this liability into an asset, using their short position to force prices down by adding to the position and then covering as much as they can, once they’ve brought the price down to their target.

Unless and until the CFTC and Congress stop JPM from their price fixing the practice will likely continue. In view of the fact that many people in the financial sector of the government are in favor of keeping the price of gold and silver dormant, the expectation is that this practice will continue. After all, it was Alan Greenspan who admitted a few years ago that the central banks were prepared to cap the gold price (by selling some of their gold), if the price rose too fast. (How fast is ‘too fast’ he did not say). The lower the gold price, the easier it is to convince people that the dollar is sound.

The way to beat JPM at this game is to take away the supply of physical gold that backs the paper gold that trades at the COMEX. Once the physical gold is taken off the table, ‘paper gold’ will shrivel and disappear.

We do that by refusing to trade futures except with the intent to take delivery. By taking delivery we reduce the pile of gold that is left.

Mining companies need to find buyers for their gold while bypassing the COMEX and the LME. Every mine should find a way to sell finished product to the public and to gold and silver trusts such as CEF, SGOL and PHYS. Already some mines are doing just that: Producing one ounce bars and rounds with their logo direct to the public.

Investors who make a profit from trading stocks and ETFs should take a portion of their profits and use the funds to buy physical gold and store it in a safe place. If we all do this on a regular basis, we not only reduce the amount of physical metal that can be traded, but we cause our stock portfolio to appreciate in value at the same time.

The following example will prove this point. Imagine if you will what would happen to the price of corn if every farmer in the US and Canada decided to let the land lay fallow for one year and at the same time they each bought one corn contract. The price of corn would go through the roof. The same principle applies to gold and silver.

People who trust in certificates for gold or silver that is stored at arms length should demand bar identification numbers. Recall the news article last year about a US bank that issued certificates for silver stored at this bank. Not only did the bank not have the silver but they had the nerve to charge the customers storage charges.

Finally there is one more tool in our toolkit. Every time the price of gold and silver drops ‘off the cliff’ without any reason as happened in this KITCO example:

…use some of your spare funds to jump in and take away the punch bowl from the short sellers by purchasing physical gold and silver. The longer prices stay down, the more ammunition the bears can accumulate for their next raid.

To make a profit it pays to ‘buy low’. When the fundamentals are positive, (as they were on February 4th), the opportunity to ‘buy low’ was at hand. The quicker we jump in at the bottom of a raid, the more difficult it will be for short sellers to cover short positions.

It’s time to protect yourself from the corruption that is out there. If you don’t, you will end up feeding the beast. People who trade commodities and allow themselves to be stopped out are ‘feeding the beast.’ Buy physical metal and nobody can ‘stop you out.’

With reference to the fundamentals for gold and silver, they are at present very positive.

(Chart courtesy Stockcharts.com). Featured is the weekly gold chart. The blue arrows point to bottoms in the 7 – 8 week gold cycle. The energy that is building here, leads to the expectation that this next cycle will take price back up to the 1200 level fairly quickly.

(Chart courtesy Stockcharts.com). Featured is the daily gold chart. Price has just broken out from beneath the four month old downtrend (blue arrow). The target is at the green arrow. The supporting indicators are positive (green lines). The 50D is in positive alignment with the 200D (green oval). The 200D is rising steadily. All systems are GO!

(Chart courtesy Stockcharts.com). My subscribers knew from reading the weekend report on April 1st that gold was about to break out on the upside. This chart shows the index that compares gold to bonds (‘stuff to paper’). It began to break out last week (green arrow). In October 2009 I mentioned that the breakout at 8.50 (blue arrow) was a signal that this index was headed for 11.50. I indicated at that time that when this index reaches 11.50, gold will be at the 1,300.00 level. Both of those targets are still very much alive.

Featured here is the comparison chart between gold and the US dollar. The action inside the circle shows the diminishing effect of a rise in the US dollar (red lines) on gold (black line).

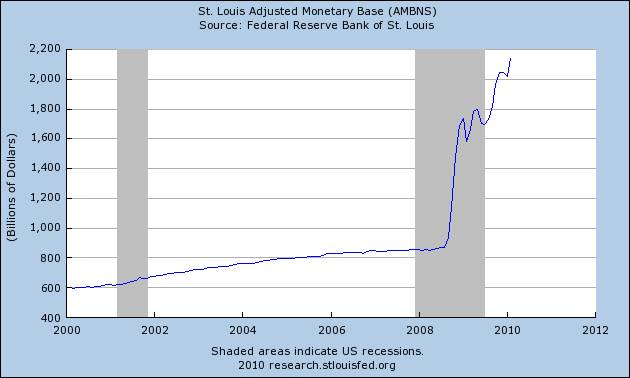

(Chart courtesy Federal Reserve Bank of St. Louis). Much of the fuel for the rise in the metals is coming from this source. The Fed is notorious for adding liquidity, not known for drawing it back out. The trend has now gone exponential. This is very bullish for gold and silver.

If you care to take the time to check my track record (by visiting archived articles at this website), you will find that my record is ‘right on the money’ – real money: GOLD and SILVER.

Happy trading!

By Peter Degraaf

Peter Degraaf is an on-line stock trader with over 50 years of investing experience. He issues a weekend report on the markets for his many subscribers. For a sample issue send him an E-mail at itiswell@cogeco.net , or visit his website at www.pdegraaf.com where you will find many long-term charts, as well as an interesting collection of Worthwhile Quotes that make for fascinating reading.

© 2010 Copyright Peter Degraaf - All Rights Reserved

DISCLAIMER: Please do your own due diligence. I am NOT responsible for your trading decisions.

Peter Degraaf Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.