Economic Long Kondratieff Wave Master Interview

Economics / Cycles Analysis Apr 09, 2010 - 10:25 AM GMTBy: Clif_Droke

David Knox Barker is one of the leading authorities on the economic long wave, otherwise known as the Kondratieff Wave (a.k.a. “K Wave”). Barker has had an impressive career both as a financial market writer and long wave analyst, as well as being an entrepreneur in the field of emerging nanotechnology. Back in the late 1980s and ‘90s, Barker was known for his insightful and accurate views on the U.S. economy and financial markets via his “K Wave Report” newsletter.

David Knox Barker is one of the leading authorities on the economic long wave, otherwise known as the Kondratieff Wave (a.k.a. “K Wave”). Barker has had an impressive career both as a financial market writer and long wave analyst, as well as being an entrepreneur in the field of emerging nanotechnology. Back in the late 1980s and ‘90s, Barker was known for his insightful and accurate views on the U.S. economy and financial markets via his “K Wave Report” newsletter.

Barker first emerged on the financial market scene in June 1987 with the publication of his first book, Jubilee on Wall Street: An Optimistic Look at the Coming Financial Crash. The book made quite a stir among investors as it was released a few months before the spectacular crash on Wall Street. It accurately predicted a number of financial market and economic trends for the U.S. and global economies and was followed up by a second edition, entitled, “The K Wave” [Irwin Publishing, 1995]. This particular volume has long been a staple of my financial library and I’ve made frequent reference to it over the years to broaden my understanding of the economic long wave.

Barker took a long hiatus from the financial markets after 1999 to concentrate his attention on his company, ALP Life Sciences, a life sciences and research company that is currently working on a revolutionary application of nanobiotechnology known as the Nanoveson™ project. Last year, Barker took time out to revise the book and publish a third edition entitled, Jubilee on Wall Street: An Optimistic Look at the Global Financial Crash.

They say the “third time is the charm” and this saying definitely applies to the latest edition of Barker’s book. The third edition of Jubilee on Wall Street is, in my opinion, an instant classic that should be read by anyone interested in the outcome of the global financial crisis. As an aside, the latest edition contains a forward by the famous evangelist Billy Graham (Barker is married to Mr. Graham’s eldest granddaughter).

Barker recently discussed the book with me and shared his thoughts on what he sees ahead for the United States and the emerging markets. What follows is the transcript of that interview.

Q: When did you first discover the long wave?

Barker: I wrote the first edition of Jubilee on Wall Street [1987] in my senior year of undergraduate school. I told the story in the author’s note about the history of the book. I was probably a sophomore or junior in college when I came across the speech by Julian Snyder on the long wave. And immediately it just got my attention and I did some research and from that point I knew exactly where we were in the long wave. I’ve never changed my view that the 1980-82 recession was the shift from summer to fall in the long wave and the beginning of the speculative season.

Q: What inspired you to write the latest edition of Jubilee on Wall Street?

Barker: The second edition of the book [in 1995] projected the end of the long wave in 2009 and the beginning of a new long wave advance led by emerging markets. Because I believe that government intervention has expanded the smaller cycles, which therefore expanded the longer cycle, I realized it wasn’t going to be over until 2012. I believed I owed it to my prior readers to bring them up to speed with my thinking after 15 years of a hiatus of actually publishing anything on the long wave. In the late 1930s and 1940s we had the worst years of the long wave winter season early in the winter. In this cycle I think the government has postponed the worst years of the long wave winter until the final years of the cycle.

Q: The sub-title of your latest book is, “An Optimistic Look at the Global Financial Crash.” What reasons are there for optimism?

Barker: There are certain reasons for why I’m optimistic. Just look at the emerging markets coming online. In the last long wave which ended in 1949, we were losing periphery countries to communism and international capitalism was actually shrinking its market. This time around we’re coming to the end of this long wave and the beginning of the new long wave we have the exact opposite. We have the potential for the emerging markets to come online since the fall of communism and the spread of free markets. The scale of the free markets that are coming online is truly astounding. With just the BRIC countries alone [Brazil, Russia, India and China] we have close to 2.5 billion people and they’re now in international free market capitalism. This will accelerate the next advance of the long wave cycle. The question is did we truly enter the advancing cycle in 2009 with that bottom? Or do we have a debt bust that takes us into 2012 and the emerging markets will pull us out then? So I’m very optimistic in terms of what I see as the potential for the emerging markets to pull us into the next long wave advance. But at the same time I’m very pessimistic about the debt structure that has been created during this decline in the current long wave. So we’re in a transition period where the bottom that should have already happened has been postponed.

Q: Your book is all about the economic long wave, or Kondratieff Wave, and what it portends for the U.S. and global economies. For the benefit of those not familiar with long wave, could you explain it?

Barker: The long wave at its heart is an ebb and flow of corporate efficiency and that is manifested in debt structures and price structures. It’s the ebb and flow of international capitalism. The important components of that are debt and innovation that produces the next advance of the long wave cycle. But the debt structure gets too big and there is overcapacity when you enter the long wave winter season. So right now we’re in a phase where the global economy is overproducing everything and that production has funded very expensive debt and that debt has to get purged from the system. Corporate efficiency is suffering during the long wave winter we’re currently because there is price pressure and everyone is overproducing and it’s funded with excessive debt, so effectively the math just doesn’t work. You have to purge the debt from the system. And purging the debt means that companies that are over-leveraged need to go out of business to remove excess capacity from the global economy so that you can reset the system to begin the next advance.

Q: You use the four seasons of the year – spring, summer, fall and winter – throughout the book to explain the four major phases of the economic long wave. Can you provide a summary of these long wave “seasons”?

Barker: The long wave was discovered by Nikolai Kondratieff, a Russian economist. Kondratieff formed his view of the long wave over a number of years. His famous paper, “The Long Wave in Economic Life” first introduced the notion of long waves to the world [in the 1920s]. Kondratieff himself never appears to have used the seasonal analogy in long waves, which likely originated with PQ Wall and his study of Oswald Spengler’s seasonal approach to cultural epochs.

The long wave can run anywhere from 50 to 70 years and can be divided into four segments. The first advance of the long wave is spring, which is characterized by early inflation. Spring witnesses very low inflation but a steady advance in prices. Next comes long wave summer, or the runaway inflation phase. This is when inflation heats up and military conflicts typically arise. Raw materials and commodity prices spike up at the end of summer. The long wave fall season is a time of disinflation, which is good for stock and bond prices as commodity prices come down. Financial speculation tends to heat up during this phase. The final long wave season is winter, or runaway deflation. This season tends to be harsh on stock and commodity prices as global stock markets enter extended bear markets. Overcapacity and overproduction are purged during the winter phase of the long wave and recessions tend to be long and recoveries brief.

Q: You also mention in the book that during the winter phase of the long wave, new technologies are developed which fuel the next advance for the spring season. Please elaborate.

Barker: There are new innovations that have to take place [during long wave winter] to drive us into the next advance in the cycle. I think that’s the most exciting aspect of what we’re seeing now are the advances we’re going to see in alternative energy, nanobiotechnology and space exploration that will be the drivers in the next cycle. Although these technologies get developed during the winter phase of the long wave, they become capitalized for the next advance in the spring time of the cycle. Because we’re in that period of the end of the winter season and the beginning of long wave spring, we’re right in that window where these things are being invented and put in place but they won’t be fully capitalized until probably 2012, which will drive the next advance in the cycle.

Q: You make frequent mention of the possibilities for trade wars in your book. Please expand on this.

Barker: If you look at all the emerging markets you probably have close to 4 to 5 billion people that are coming online to international capitalism, which will drive the next long wave advance. This is why it’s so important that we keep free trade in place for this next wave of capitalism. That’s the one thing that could create disasters between now and 2012, namely trade wars, which are inevitable. Because of excess capacity the natural tendency will be to have trade wars.

Q: Based on the latest news headlines there seems to be a potential trade war developing between the U.S. and China. Do you get that impression?

Barker: Absolutely. It’s classic long wave; it’s overproduction. China is overproducing and the U.S. is overproducing. Yet it’s not that simple because a lot of the U.S. production has been moved to China. Washington is complaining about Chinese production and the goods they’re dumping on our market but 60 percent of those exports out of China are owned by U.S. Fortune 500 companies, by our manufacturing facilities in China.

This really gets to the heart of the whole inflation versus deflation debate and how this ties into the trade wars. If you’re in China and your view of Bernanke and his helicopter is that it’s a Blackhawk and it’s engaged in a trade war with you. By trying to stop the deflation, what he’s is doing is exporting deflation to global markets. So effectively when the U.S. says it will stop its deflation here, it means it will export it to China, Brazil, Russia and India. These countries are under major pressure because of how we’re trying to pull out of this crisis. We’re trying to export the natural deflation of the long wave to our trading partners. They’re simply not going to stand there and take it. They have to respond in kind to hold their currencies down in order to stop the trade war. I believe the biggest force of the trade war for the U.S. is not tariffs and it’s not import quotas. It’s trying to reduce the value of the dollar to export our deflation.

Q: Speaking of trade wars, in the book you discuss how they have the potential to lead to actual military wars if carried far enough. Yet you point out that most “shooting wars” occur during the “summer” phase of the later part of the long wave advance….

Barker: [Wars occur] during the late spring and getting into the summer part of the inflationary advance when you’re in an expanding economy and there’s demand for commodities. So look forward to 20 years from now when China is three times the size they are now and their demand for copper, silver, oil, wheat and corn is three times the level it is today. That’s when the real shooting wars – what I call the wars between the Great Powers – happen. World War II was an exception due to a mad man [Hitler]. But it wasn’t a resource war as much as we see historically when we look back 200 years at different phases of the long wave.

Q: Is there any chance that the developing trade war between the U.S., China and other nations could lead to a shooting war during the current winter phase of the long wave?

Barker: I don’t believe so. The problem now is that everyone is overproducing. There’s not a shortage of goods yet; there’s overproduction in virtually every industry with a couple of exceptions, notably oil due to shipping and the global energy situation. And that’s also important as the emerging markets begin demand energy. But I don’t think we’ll see a shooting war anytime soon. We’ve got a 200 year supply of natural gas in the U.S. If you look at the last two years you actually see a significant drop in energy production in the United States. During a long wave winter you’re demanding less energy. If I’m correct, the short-term cycle, or business cycle, is going to peak in 2010 and then decline into 2012. It will remove the pressure from the energy markets and to answer your question specifically, I believe energy demand will be slack going into 2012. Electricity production will be declining and the demand for oil to produce that energy will be declining. Once we get through this short term phase of inflation I still see serious deflation going on into 2012. The danger for the next couple of years is a trade war due to overproduction and due to currency manipulation, not a shooting war.

Q: You make clear in the book that you see 2012 as being the most likely end to the current long wave winter. Is there any chance that 2009 was an early bottom or do you see the subsequent rebound in financial markets as strictly a product of government intervention?

Barker: Fifteen years prior to that date [in the second edition of the book], 2009 is what I predicted as the bottom for the long wave. There is a chance that 2009 was the bottom because the one area that we could overestimate is the power of the emerging markets to pull us into the next long wave advance and to overcome the debt problems we have. But right now I don’t believe the emerging markets are strong enough to overcome the debt problem. We really need to have the failure of a lot of those debts that is producing the overcapacity and to get us into the next advance of the cycle.

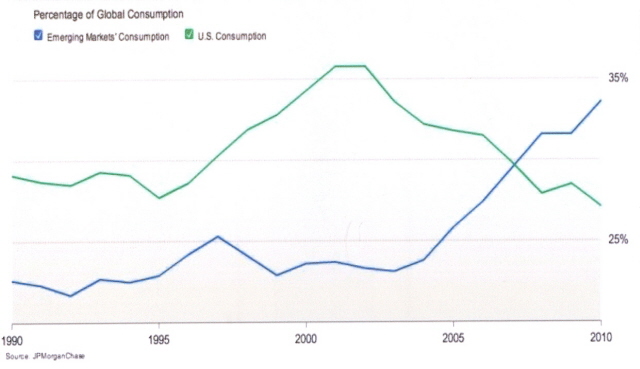

In the April edition of my newsletter I highlighted the chart entitled, “X Marks the Spot.” That chart jumped out at me because what you see there is probably the most important chart I’ve seen in 20 years. It shows that the U.S. consumer, which has carried the weight of the global economy on its shoulders, has been collapsing relative to the growth rate of global consumption coming from emerging markets. I don’t believe those lines will ever cross again. The emerging markets are booming. The optimistic side of me wants to see these emerging markets keep growing and booming and pull us out of this debt problem. But I just don’t see it yet. Because we have this overcapacity and because the debt problem is so severe due to government intervention and the issues with sovereign debt, we need to have a crisis where [the debt] is dealt with.

I’m a big believer in austerity and that’s one reason why I’m optimistic. If you see what’s going on in Ireland and in Greece, forcing austerity to reduce government spending. Frankly, we need a debt crisis to totally retool the government spending process to bring it in line with reality and reduce it. So the bottom line is that I think the odds still favor a bottom in 2012. The exciting thing is that in terms of emerging markets and in terms of technology and innovation that will drive the next cycle, we’re starting to see some of the signs of spring. I don’t believe it’s here yet but it does give optimism for a milder long wave winter season here. We had a mild long wave winter season in the late 1800s during the last long wave bottom. The long wave winter of the 1930s was certainly more severe. Hopefully this one will be a milder winter as well, but that remains to be seen.

Q: In the book you briefly discuss the Obama presidency and the potential for a return to a more limited government with greater emphasis on free market capitalism as opposed to state capitalism or socialism. Has the recent passage of health care reform caused you to alter this view?

Barker: It’s my own version of hope [laughs]. I think health care was the last lurch to the left. I believe Obama will have no choice. It really all comes down to this: do you believe Obama is an ideologue or a pragmatist? I have a lot of friends that I debate this with. They all believe he’s an ideologue and I believe he’s a pragmatist. I believe if he could he would still be going to the left, but I think with the crisis that we’re sailing into between now and 2012, I think he’ll have no choice but to cut government spending.

Getting back to China and the fact that they now have more imports than exports, that means they have no more dollars to buy our debt. But the implication of that just on the U.S. Treasury market alone is massive. And the implication on the U.S. government to keep spending is also huge if the number one purchaser of U.S. debt [China] is taken out of the market because they now have more imports than exports because they’re building their domestic economy. Who is going to be buying this government debt? In order for Washington to sell this debt they’re going to have to show some fiscal discipline. We’re asking Greece to cut back, and if the Irish can do it, I’m sorry, but the U.S. has got to show that it can reduce spending and get the deficits under control. If the Obama administration tries to move toward more taxes it would produce the greatest disaster between now and 2012. This appears to be the direction he’s going in but I think very quickly he’s going to realize that increasing taxes is not an option. We have to cut government spending. It’s a situation where necessity is the mother of invention.

I think the necessity of collapsing tax revenues is leading to a crisis between now and 2012 that will force us to cut government spending. We’re also moving into the elections of 2010 and I think there will be a lot of independents that potentially take some seats in Congress. Obama will have to be able to work with them and I think the social mood is to cut spending, not to increase taxes. If he wants any chance of re-election in 2012, he’ll have to move in the direction of free markets, reducing government spending and I believe ultimately cutting taxes. He’ll be cutting programs that I wouldn’t cut, but I believe he’ll be cutting programs.

Q: Should Americans fear another Great Depression? How bad do you think things will get during the coming years of deflation?

Barker: I tend to agree with Robert Prechter in terms of his views on deflation. I just don’t think it will be as bad [as he thinks]. One reason for this is because of the power of the emerging markets we’ve been discussing. In the U.S. we’ve got roughly 300 million in terms of population. We’ve got debt problems, we’ve got other issues. But if you look at the emerging markets, as the lower class in the emerging markets are working hard and trying to pursue middle class status, the power of just the 2.5 million people in the BRIC countries coming into the global economy and pulling us into the [long wave] advance I believe has to be optimistic for the U.S. in terms of not being as bad as it otherwise would be. That’s why the trade war situation is going to be so critical. It’s important that we don’t enter the trade wars. I do think there will be a brief period here of a debt crisis and a deflation that will be very severe, but hopefully we make the right decisions and enter the spring season rather quickly. But it could be rather ugly between now and 2012.

Q: Japan was one of the first major countries to enter into long wave winter around 1989-1990. Do you think Japan will be the first to emerge from deflation?

Barker: I would love to be more optimistic on Japan because they’ve gone through much of the deflation in the long wave winter and I’d like to assume they’ll be the first one to pull into the next long wave advance. But the problem is their debt structure. They’ve been trying to stop the deflation for 20 years and they’ve been doing it by monetizing the debt and increasing it. However, since the Japanese citizens are big savers they’ve been purchasing their own debt. I do believe there will be lots of opportunities in Japanese companies before there are opportunities in some other markets. I’m talking about some of their large cap, attractive, dividend paying companies that have access to global markets. But I’m not as optimistic because of their 200 percent debt-to-GDP structure, which is terrifying.

Q: What about China? Do you foresee any major economic difficulties for them between now and 2012?

Barker: Recently there was a lot of discussion about the balance sheet debt and the overbuilt real estate market in China. We’re in a global long wave winter season and they have tried to stop it by stimulating their domestic economy and with massive infrastructure projects like trains, highways, office buildings, housing. They have empty cities and unlike the U.S. their economy isn’t totally mature.

So I believe they’ll have a serious debt crisis and real estate crisis between now and 2012. But they also are a far more immature economy and have more upside for growth, so I think they’ll get past [the crisis] far quicker than people would otherwise expect. But they’re going to learn some serious free market lessons. They need to learn to not keep the bubble inflated but to let it pop quickly. I think their markets will step in and that China will be the leader of the spring season of the next long wave in many respects. The U.S. has the opportunity to be the leader in the spring season but it will take the right policy action between now and 2012 and that remains to be seen.

Note: David K. Barker’s book, “Jubilee on Wall Street” is available from Amazon.com by clicking on the following link:

https://longwavedynamics.com/?page_id=16

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.