Gold Investor Sentiment Surprise, Are We In a Bubble?

Commodities / Gold and Silver 2010 Apr 26, 2010 - 04:27 AM GMTBy: Q1_Publishing

Is gold already in a bubble?

Is gold already in a bubble?

News for gold bulls just keeps getting better and better. A few weeks ago the World Gold Council announced it expects China gold-buying to double over the next 10 years.

Gold has been on a solid run over the past few months. Other than a sharp correction when the SEC announced it had filed charges against Goldman Sachs (NYSE:GS) a week ago, gold has been on a remarkable run. It was up 16 out of the past 20 days.

The run-up from the February correction put the price of the yellow metal less than 10% from its recently set all-time high.

Also, gold stocks are really starting to do really well. Although gold stocks still remain severely undervalued relative to gold due to a Fortune-Making Anomaly in Gold Stocks, the gap is starting to close.

But many investors still worry gold is still in a bubble. A quick look at these three gold sentiment indicators reveals we’re nowhere near the top of the emerging gold bubble.

Gold Prices “Too High” To be in a Bubble

A few weeks ago the St. Petersburg Times looked into whether gold had reached bubble highs.

In Financial Advisors Warn Gold May be at Bubble Level the paper reported:

At least one-third of Kimberly Sterling's clients have sought her advice in the past year about investing in gold. The Orlando financial planner has successfully discouraged all but one of them from doing so.

That one investor insisted on having some gold in his portfolio, she said, despite her warnings. Eventually, she referred him to a gold commodities exchange-traded fund that has done well during the metal's decade long run-up in price. But her firm, Resource Consulting Group, still wouldn't buy in; it would only make the referral.

"Our bottom line is this: Gold is a bubble now, and it is too late to get in," she said. "It is like someone who bought real estate in 2006, at the height of that bubble. You could get hurt really badly."

"There are obviously some periods where you could have made a killing (in gold) if you timed it just right at the beginning of the bubble and got out at the top," she said.

Although a few financial planners’ opinions aren’t necessarily representative of the entire market, this attitude does show that gold is not in a bubble right now.

The funny thing about bubbles is that when you’re in a true bubble price is not an issue.

Think about the last two bubbles: housing and tech stocks.The prices were high. Everyone knew they were high. But it didn’t matter to most folks because “prices were going higher.”

With gold comfortably above $1,100 an ounce and many investors still actually concerned it’s too high, shows we’re not in a bubble.

Remember, bullion dealers sell a lot more gold at $1,000 an ounce than they did at $400. Just imagine how much they’ll sell at $2,000 an ounce when, although the price is twice as high. Buyers won’t care about the price because they “know” it’s going much higher.

That’s not the only indicator gold hasn’t reached bubble-stage yet, there’s also the fact the world’s worst investors haven’t bought big into gold yet.

The Worst Investors Have Not Bought Yet

It’s no secret that mutual fund investors are the embodiment of “the herd.” As a group, they are the worst investors. They sell out at market bottoms and buy big at market tops.

For example, back in 2009 when the current rally was in its early stages, we noted how mutual investors were “done” with the markets.

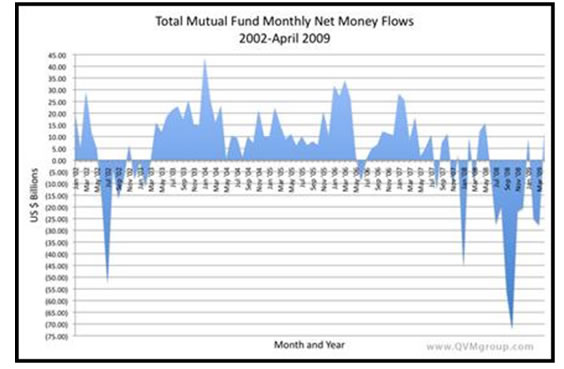

As the chart below shows, they were had been pulling out money faster than they have in over a decade:

As you can see, mutual fund investors were selling out in 2002 and 2003 as the markets were bottoming out. Then in 2008 and early 2009, they really ran for the hills.

Right now, we haven’t seen the mutual fund investor crowd jump on the gold bull. Just take a look at what has happened at mutual fund investment management company U.S. Global Investors (NASDAQ:GROW) to see why.

Headed by the indefatigable gold bull Frank Holmes, U.S. Global is positioned as one of the leading gold fund managers in the world. It’s two precious metals funds have been doing very well. The Gold and Precious Metals Fund (USERX) which has returned 22.77% annualized over the last five years. And the World Precious Minerals Fund (UNWPX) annualized 19.88% annualized over the last five years.

But that performance hasn’t attracted the hot fund-chasing herd. U.S. Global’s assets under management (AUM) show why.

In 2006 when gold, precious metals, and global investments were thought to be unbeatable, U.S. Global reported more than $5 billion AUM.

Since then, a lot has changed. The credit crunch sent the herd running away. At the end of 2008, U.S. Global had a mere $1.98 billion AUM – a 60% decline from its peak.

Jump ahead a year and U.S. Global’s AUM has climbed to $2.7 billion at last report.

They are recovering, but when the gold bubble really does come, we expect U.S. Global to have around $10 billion to $20 billion AUM.

The final sentiment indicator shows gold isn’t a bubble yet because investors are too prepared for a downturn in the price of gold.

“Insurance” Against Gold Collapse Still High

Most institutional managers buy “insurance” against market downturns. When they manage broad portfolios, they'll buy put options (the right to sell a security at a predetermined price) against a major index like the S&P 500. The cost of this insurance is tracked by the Volatility Index (a.k.a. the VIX) which tracks the implied volatility on an option contract.

They also can and do buy put options and for individual positions. In the case of gold all we have to do is look at the SPD Gold Trust (NYSE:GLD) to see the cost of insurance against a downturn in gold prices.

It turns out the March 2011 put options have an implied volatility of 22. This level is still relatively high.

When gold is in a bubble and there is no need for downside protection because it can “only go up,” you’ll see the implied volatility on the options fall down into the low teens.

This IS a Bull Market in Gold

Right now there are almost no signs a bubble has formed in gold.

There’s no overwhelmingly bullish consensus that would signal a true bubble has formed in gold. And there is still a big opportunity in gold stocks.

We continue to believe the gold bubble is coming for a number of reasons and recommend gold stocks where the rewards far outweigh the risks. For example the five gold stocks detailed in them climbed 1646% while the price of gold climbed 13% over six months period last year (follow this link to get your own copy of the report – 100% Free).

Bubbles create the greatest opportunities to make fortunes in a relatively short period of time. Don’t let this one pass you by because “it’s too late to get in.”

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2010 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.