Investor Equity Market Re-Entry Prices for EEM, EFA and SPX

Companies / Investing 2010 May 10, 2010 - 10:36 AM GMTBy: Richard_Shaw

If you are out of the equity markets as a result of stops last week. The question of re-entry

conditions arises.

If you are out of the equity markets as a result of stops last week. The question of re-entry

conditions arises.

The US futures are up strongly this morning as a result, no doubt, of the nearly $1 trillion European bailout package for Greece and other contingent country credit problems (Spain, being the largest economy of concern). We take note of the fact that the US stock market continued to fall after enormous bailout packages. However, each time has a different fact set.

This bailout may be the proof of a failed international rescue begun in 2008, or it may simply be later stage cleanup of a healing process well on its way to completion. If the fundamentals are acceptable to you (and that varies widely by person – we are a bit on the wait and see side), then these charts may be helpful in determining when to re-enter.

If you are confident of ultimate recovery and can deal with possible strong down drafts, now may be a good opportunity to buy quality stocks, and in particular quality equity income stocks. If you are a trend follower, you need to wait for confirmation of up trend restoration. That would require some chart repair.

For the non-US developed markets (proxy EFA) which have been flat for months, we would want to move above prior peaks which have successively served as a “glass ceiling” in the broad $57.50 to $58.00 range for EFA since October 2009.

Re-entering based on some percentage retracement model is a high-risk approach given the multiple failures in the vicinity of $58. If you are now a “buy on the dips” investor here, and you are more of a trader than an intermediate trend follower, you would probably wait for half or more of the recent decline to be recovered before re-entry. That level would be around the high $53ʼs to low $54ʼs.

Even that, however, would not put the stock price above the 200-day average, which we think is an important minimum criterion for re-entry.

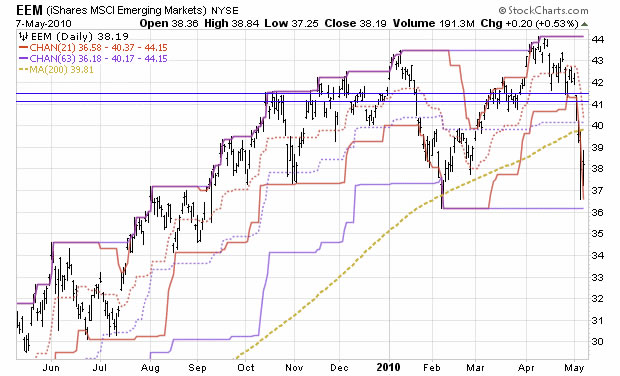

For emerging markets (proxy EEM), which are not as financially stressed as is Europe, a major retracement approach may make some sense, particularly if you believe import demand from Europe will not substantially erode.

For this stock a 50% retracement from the recent low close would be in the $41ʼs.

That level is at least somewhat above the 200- day average.

For the US market (proxy S&P 500 index), which has been strong this year until last weekʼs tremendous dive, we would expect trend followers to wait for a price level of about 1150 to 1165 before re-entering.

That is about a 50% retracement from the recent low close.

More conservative types might wait for something in the 1180 to 1185 area.

Todayʼs open will be somewhere near the 50% retracement level. Weʼd like to see that price hold or improve for a day or two before becoming a believer.

This next chart shows the S&P 500 futures level from about 9:00 AM today (bold red horizontal line). You can see how the rough halfway retracement levels (blue horizontal lines) cluster around that futures price.

If you can withstand “whipsaws” and you have faith in the near future. Re-entry could be reasonable today, but we will wait with our own money. The world has been encouraged and then disappointed over Europe too many times in the past month or two to make todayʼs announcement reason for complete comfort. Is this a last act of desperation, or a true solution? Will Greek protesters burn another bank and kill more bankers, or settle down? Weʼll wait.

By Richard Shaw http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.