Gold Remains Firm on Geopolitical Risks and Fears of a 'Perfect Storm'

Commodities / Gold and Silver 2010 May 25, 2010 - 06:47 AM GMTBy: GoldCore

Gold's safe haven qualities are again being seen after its higher close yesterday despite falling US equity indices and it remaining robust today (down 0.4% in USD terms) despite sharp falls in Asian and European indices. Some analysts are warning of a "perfect storm" that could again destabilise the global financial and economic system. While "perfect storm" talk may be hyperbole there can be little doubt that the many extreme headwinds have led to a degree of risk similar to that seen after the collapse of Lehman Brothers.

Gold's safe haven qualities are again being seen after its higher close yesterday despite falling US equity indices and it remaining robust today (down 0.4% in USD terms) despite sharp falls in Asian and European indices. Some analysts are warning of a "perfect storm" that could again destabilise the global financial and economic system. While "perfect storm" talk may be hyperbole there can be little doubt that the many extreme headwinds have led to a degree of risk similar to that seen after the collapse of Lehman Brothers.

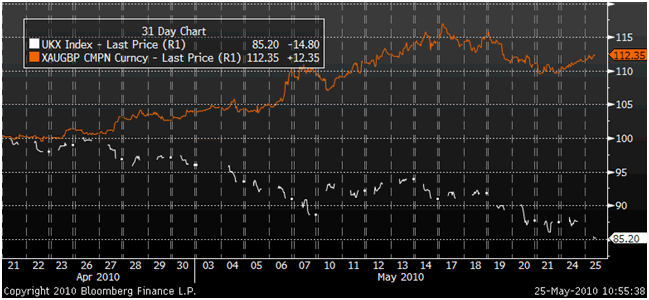

Gold in GBP and the FTSE (30 Days)

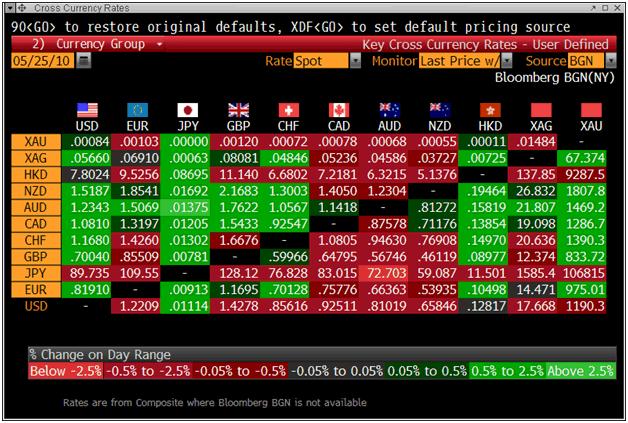

Gold closed with a gain of 1.51% yesterday (in dollars) and was higher in other currencies, especially in the beleaguered euro. It has range traded between $1,195/oz to $1,185/oz in Asian and early European trading this morning. Gold is currently trading at $1,188/oz and in euro and GBP terms, at €971/oz and £832/oz respectively.

Gold remains firm (near record nominal highs in most major currencies) due to renewed banking system risks, sovereign debt concerns, growing concern of a double dip recession and rising geopolitical tensions on the Korean peninsula. Demand for physical bullion and ETFs remains robust. Reports that North Korean leader Kim Jong Il ordered his military to be on combat alert amid rising tensions will likely contribute to further safe haven demand - particularly if the tense situation was to deteriorate and nuclear brinkmanship come into the equation.

The banking system is again showing signs of distress as seen in European bond spreads over German bunds and in surging Libor rates - US dollar three month Libor has doubled from 0.25% in late February to 0.50%. It is very worrying that despite the humongous scale of the 'European Stabilisation Fund' which cost €750 billion, markets appear to be showing signs of a possible Lehman style systemic crisis.

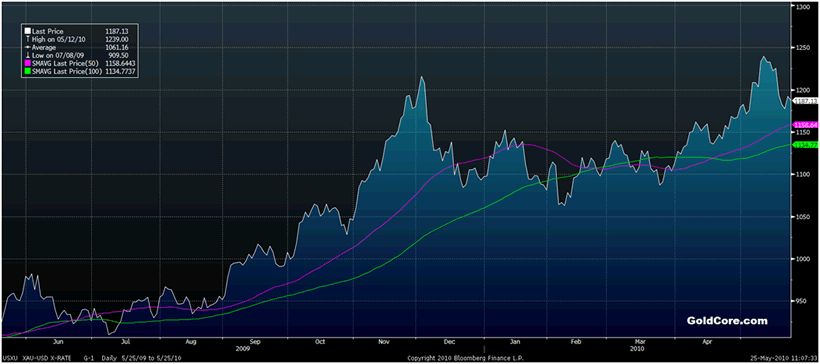

Gold 1 Year (Daily) - 50 and 100 Day Moving Averages

Gold's record nominal high of $1,249.40 an ounce reached on May 14 as investors sought a haven for their money on concern that the European debt crisis may worsen, looks likely to be breached again as the eurozone debt crisis has not abated with Spain's banking system now under serious pressure.

Gold is supported at $1,165/oz and $1,125/oz but a close above $1,200/oz could see us test the recent record high of $1,248/oz. The next price target is the psychological resistance at $1,300/oz.

Silver

Silver has dropped from $17.80/oz to $17.60/oz this morning in Asia and Europe. Silver is currently trading at $17.63/oz, €14.42/oz and £12.33/oz.

Platinum Group Metals

Platinum is trading at $1,495/oz and palladium is currently trading at $430/oz. Rhodium is at $2,675/oz.

Cross Currency Rates - JPY, USD and Gold Higher while EUR and Commodity Currencies Fall

News

Deutsche Bank AG said gold may average $1,215 an ounce this year, up 6 percent from a previous forecast. The bank cut its 2010 silver estimate 3.4 percent to $18.10 an ounce, it said today in a report (Bloomberg).

Morgan Stanley raised its forecasts for platinum and palladium through 2015. Platinum will average 6 percent more than previously expected this year at $1,672 an ounce, while palladium will trade 13 percent more than earlier forecast at $502 an ounce, the bank said in a report (Bloomberg).

Platinum prices may "spike" next month as the soccer World Cup in South Africa potentially disrupts power supplies to mines, said ETF Securities Ltd. Mines in South Africa, the world's biggest producer of platinum, were stopped for about five days in 2008 because of blackouts by state-owned utility Eskom Holdings Ltd., which generates and distributes about 95 percent of the country's power. The World Cup runs from June 11 to July 11, with most of the matches played next month (Bloomberg).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.