What if the Chinese Let the Renminbi Float and Nothing Much Happened?

Currencies / China Currency Yuan Jun 22, 2010 - 01:55 AM GMTBy: Paul_L_Kasriel

The People's Bank of China (PBOC) announced Saturday night that it would gradually relax the peg between the renminbi and a basket of currencies (primarily the U.S. dollar). This is the resumption of a policy the PBOC had initiated in mid 2005 and suspended in mid 2008. Although there are political motivations for the resumption of a controlled renminbi float - to deflect scapegoating at the upcoming Toronto G-20 confab and to get Senator Schumer off the backs of Chinese officials - there is a domestic economic motivation as well.

The People's Bank of China (PBOC) announced Saturday night that it would gradually relax the peg between the renminbi and a basket of currencies (primarily the U.S. dollar). This is the resumption of a policy the PBOC had initiated in mid 2005 and suspended in mid 2008. Although there are political motivations for the resumption of a controlled renminbi float - to deflect scapegoating at the upcoming Toronto G-20 confab and to get Senator Schumer off the backs of Chinese officials - there is a domestic economic motivation as well.

With credit inflation resulting in real estate price inflation, the PBOC needs to be able to pursue a more independent monetary policy. Pegging the yuan to the greenback can result in pegging PBOC policy to Fed policy. The Fed may not be ready to tighten monetary conditions, but the PBOC is.

Scapegoaters are fond of ascribing trade "imbalances" to the PBOC's currency-pegging policy. But it is not clear that the PBOC has been doing all that much "pegging" in recent years. As discussed in an April 5, 2010 Global Daily Commentary, "Guess Hu's Coming to Dinner at the White House," the behavior of the PBOC's balance sheet does not suggest as much currency intervention as the scapegoaters would lead you to believe. And if the renminbi is not being all that constrained in seeking its market-determined level vs. the dollar, then we might not expect much in the way of reversals in trade "imbalances."

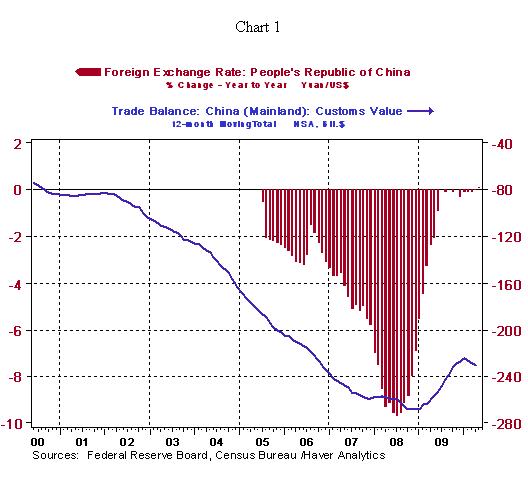

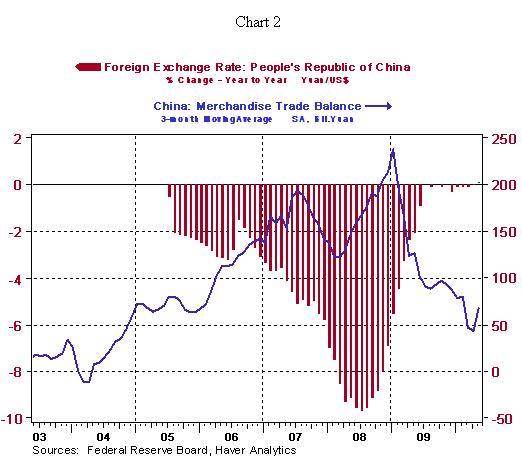

A test case for this is what happened to the U.S. trade deficit with China when the PBOC last allowed a controlled float in the renminbi, between mid 2005 and mid 2008. The largest year-over-year percent appreciation in the renminbi vs. the dollar was 9.8% in July 2008. What was happening to the U.S. trade deficit with China as the renminbi was appreciating? A peak at Chart 1 shows that the trade deficit in dollars was getting wider until the end of 2008. J-curve effect, you say? If it takes more dollars to buy one renminbi, then the dollar-value of the U.S. trade deficit with China might widen. I do not have Chinese bilateral trade data in renminbi, but I do have the overall Chinese trade data in renminbi, as shown in Chart 2. Did the Chinese trade surplus valued in renminbi narrow as the renminbi appreciated vs. the U.S. dollar between mid 2005 and mid 2008? Yes, a little in the first four months of 2008. But nothing to get too excited about.

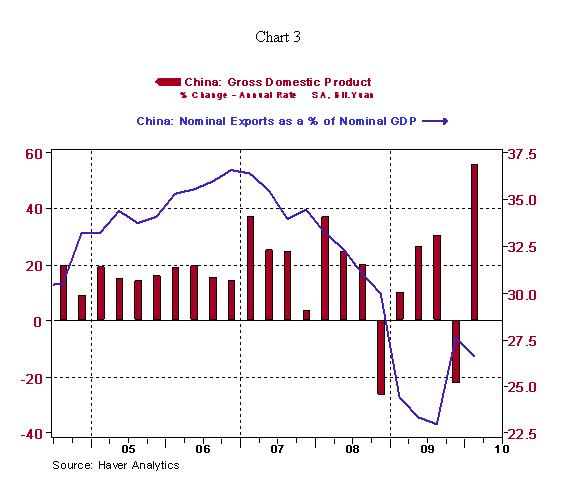

Now, I do believe that the rate of increase in China's trade surplus will be slowing in the coming years, but not primarily because of an appreciating renminbi. But rather because rising incomes among Chinese households will lead to increased discretionary spending by them. Also, in order to keep the population relatively happy, Chinese politicians will re-allocate government spending more toward services and infrastructure spending to benefit households rather than export industries. Chart 3 suggests that the Chinese economy's recent re-accelerated growth has not been powered as much by exports as in the past.

by Paul Kasriel

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.