FOMC Statement and U.S. Housing Market Post Tax Credit Fundamentals

Housing-Market / US Housing Jun 24, 2010 - 01:26 AM GMTBy: Paul_L_Kasriel

FOMC Statement “… low levels of the federal funds rate for an extended period.” - No big surprises from the FOMC today. The committee's economic outlook was marginally downgraded and its financial conditions outlook was more substantially downgraded. To wit, "Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad." And, oh yes, "Bank lending has continued to contract in recent months." The fact that KC Fed President Hoenig dissented about the "extended period" language also was no surprise, but of no significance either.

FOMC Statement “… low levels of the federal funds rate for an extended period.” - No big surprises from the FOMC today. The committee's economic outlook was marginally downgraded and its financial conditions outlook was more substantially downgraded. To wit, "Financial conditions have become less supportive of economic growth on balance, largely reflecting developments abroad." And, oh yes, "Bank lending has continued to contract in recent months." The fact that KC Fed President Hoenig dissented about the "extended period" language also was no surprise, but of no significance either.

Given the fiscal austerity packages being implemented in Germany, the UK and Japan and given the lack of credit creation in the U.S. by monetary financial institutions, the FOMC may be keeping the federal funds rate at a low level for a really long extended period.

The U.S. Housing Market - Post-Tax Credit Give-Back or Something More Fundamental

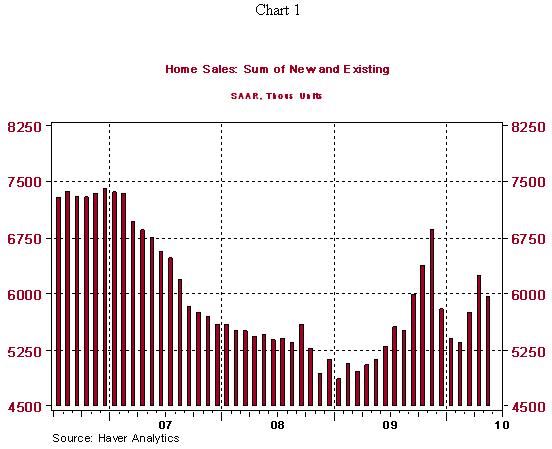

Yesterday, it was reported that existing home sales dropped 2.25% in May, a bit of a surprise as these contracts were likely signed prior to the April 30th expiration of the house-purchase tax credit. Today's 32.7% decline in May new home sales was less of a surprise in that these contract signings likely took place after April 30th. And while the May level of new home sales, at 300 thousand units saar, was the lowest in the series history dating back to January 1963, the sum of new and existing home sales in May was far from a record low (see Chart 1). That dubious distinction was achieved in January 2009.

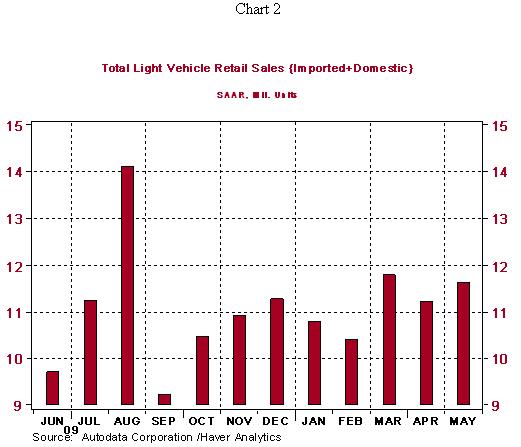

Now, the important issue is whether the May slump is just some temporary give-back after sales were "borrowed" from the future in March and April in order to take advantage of the tax credit. Something similar to this happened in the motor vehicle sector with regard to the "cash-for-clunkers" program. As shown in Chart 2, car and truck sales surged in August 2009 only to plunge in September. However, thereafter, motor vehicle sales picked up again and have been well above their pre-cash-for-clunkers level.

Is there any reason to believe that after a couple of months, home sales will pick up again? Yes. Why? Because with mortgage rates at rock-bottom levels and with house prices very low in relation to household incomes, housing is about as an attractive a purchase as it has been in the past 40 years. Are we on the eve of a renewed housing boom, given this attractiveness? No. But are we likely to slip back into a full-fledged housing recession? No. Two steps forward, one step backward.

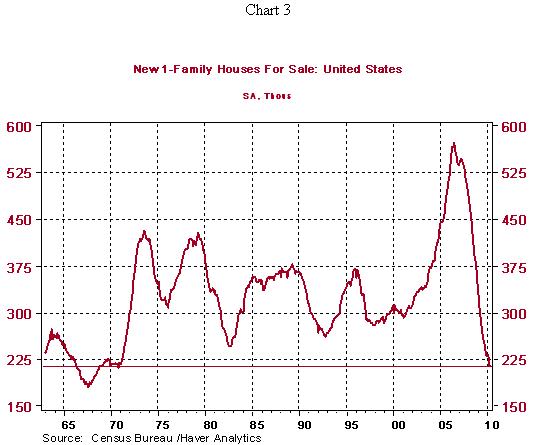

The absolute number of new housing units for sale stood at 213 thousand in May. As shown in Chart 3, this is the lowest inventory of new homes since November 1970! You have to believe that in some locales - not necessarily Las Vegas - and in some price ranges - not necessarily $1 million and above - there is a modest shortage of new homes for sale. This should spur a modest increase in housing starts in the months ahead.

by Paul Kasriel

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.