Financial Markets Update: Top of the 9th

Stock-Markets / Financial Markets Sep 09, 2007 - 02:33 PM GMTBy: Dominick

Like most of the posting in the forum during the week, this update is going to be brief for the simple reason that the market is treading over the same ground week after week. Despite that sinking feeling in the pit of the bulls' stomachs as Friday wrapped up at the lows, the market validated our theme last week by not crashing – the S&P was only off by 17 points, hardly a disaster!

Like most of the posting in the forum during the week, this update is going to be brief for the simple reason that the market is treading over the same ground week after week. Despite that sinking feeling in the pit of the bulls' stomachs as Friday wrapped up at the lows, the market validated our theme last week by not crashing – the S&P was only off by 17 points, hardly a disaster!

But, as this week's title suggests, real fireworks could be ahead. At TTC we've been monitoring a variety of markets all year long, looking for patterns to develop and targets to be reached before the grand finale, all of which appear to be materializing, but we aren't quite there yet. The volatility of recent weeks is proof, though, that a fixed bullish or bearish bias can be disastrous to a trading account.

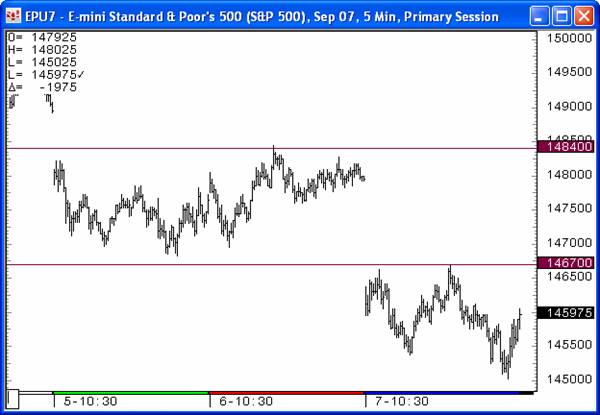

Except for the V-bottom in August, the market has been roughly flat since the end of July. As the market bides it's time, so far avoiding an all-out crash, we've adapted our trading style to factor out bias as we trade each day based on our numbers. Last week's update mentioned two, 1467 and 1484, and to see how the S&P futures responded to these levels, just look at a chart!

The new high on Tuesday confirmed our sense at the end of last week that the advantage had shifted to the bulls. But coming off that high and losing a critical level indicated to us a poke back down to 67, which we got after the gap down on Wednesday. And, as you can see, Thursday's high was 1484, Friday's high was 1467, and these are only two of the proprietary levels my members receive well in advance of the market reaching them!

Another part of our approach to this market, one that really had the chance to shine on Friday, is to react to what the market gives rather than predict what the market will do, not to try to game the news. So, going into the employment numbers, instead of deciding which way the market HAD to go, we posted a chart that showed we would be gapping Friday morning to the payroll numbers. The only thing we needed to know was that the move, in whichever direction, was going to be big.

With that in mind, we knew we'd be able to use our numbers and trade whatever might come. When the payroll data came in very weak, we immediately had a strategy and a target in the low 1450s. Chart 1, below, was posted to show we ran right into resistance, which should turn the market down into my target. When support appeared as expected, as seen in chart 2, the next idea was a relief rally back to 1467. Chart 3 was posted as the market rallied, and showed that 1467 needed to be broken or our plan of even lower numbers was due to come.

Chart 4 shows the precise target having been hit and the subsequent push back down in the ES. It also shows what I was thinking would happen next, a lower low and a rally back up. Finally, chart 5, which was posted just before the close, shows that lower low being made, and 9.5 point rally from that low in the last fifteen minutes of the day and week. We took our last gain off the table into the close as others covered their losses or went home short, unsure of what Monday will bring. Clearly, Friday's market responded to our numbers, and we were able to trade it with precision.

Now, no doubt the week ahead will return our thoughts to the events of Sept. 11 th and, unfortunately, there will be traders and commentators who want to game this like any other piece of news. Obviously you have to do what you have to do trading the market, but please, when the talking heads do their thing on Tuesday and traders speculate on rumors of another attack, take a second to remember the people of 9/11, the ones working in the financial industry, the firemen, the children, and all the families touched by that tragedy. They are not just another piece of data.

So, again, this week was not the end of the ballgame, but maybe it's more like now we've entered the ninth inning. Make no mistake, the course for the rest of the year will be determined by the action over the next few days and weeks. We believe we know where the market will be headed for the rest of the year, but we also know where we'd have to revise our expectations if incorrect. That's just part of being unbiased. Others will fret about the Fed, an '87 replica, the October effect, or another 9/11 – and most will wind up being fooled. Instead, as the S&P churns in the current range, ripping both the bulls and the bears, our proprietary numbers continue to be the critical market pivots and we trade them precisely in both directions.

Gold

Gold also pulled off a fascinating rally. The chart below was posted last week as gold was continuing to consolidate since the start of the year. The chart clearly shows how we are in front of the move, not behind it. Be sure to read the rest of Joe's weekly article for more on precious metals.

Have a profitable and safe week trading, and remember:

“Unbiased Elliott Wave works!”

By Dominick

For real-time analysis, become a member for only $50

If you've enjoyed this article, signup for Market Updates , our monthly newsletter, and, for more immediate analysis and market reaction, view my work and the charts exchanged between our seasoned traders in TradingtheCharts forum . Continued success has inspired expansion of the “open access to non subscribers” forums, and our Market Advisory members and I have agreed to post our work in these forums periodically. Explore services from Wall Street's best, including Jim Curry, Tim Ords, Glen Neely, Richard Rhodes, Andre Gratian, Bob Carver, Eric Hadik, Chartsedge, Elliott today, Stock Barometer, Harry Boxer, Mike Paulenoff and others. Try them all, subscribe to the ones that suit your style, and accelerate your trading profits! These forums are on the top of the homepage at Trading the Charts. Market analysts are always welcome to contribute to the Forum or newsletter. Email me @ Dominick@tradingthecharts.com if you have any interest.

This update is provided as general information and is not an investment recommendation. TTC accepts no liability whatsoever for any losses resulting from action taken based on the contents of its charts, commentaries, or price data. Securities and commodities markets involve inherent risk and not all positions are suitable for each individual. Check with your licensed financial advisor or broker prior to taking any action.

Dominick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.