Eurozone and U.S. LIBOR Interbank Interest Rates Divergence

Interest-Rates / Credit Crisis 2010 Jun 30, 2010 - 02:35 AM GMTBy: Paul_L_Kasriel

A Tale of Two Cities - New York vs. Frankfurt - Chart 1 shows the recent behavior of the 3-month interbank loan rates in U.S. dollars and euros. Both in dollar and euro terms, these interest rates began drifting up in the second half of April as the Greek, Portugal and Spain (GPS) sovereign debt challenges came to the fore. If GPS were to default on its sovereign debt, this would have an adverse impact on some European banks. These potential losses for European banks caused interbank lending to "tighten up," thereby driving up interbank loan rates.

A Tale of Two Cities - New York vs. Frankfurt - Chart 1 shows the recent behavior of the 3-month interbank loan rates in U.S. dollars and euros. Both in dollar and euro terms, these interest rates began drifting up in the second half of April as the Greek, Portugal and Spain (GPS) sovereign debt challenges came to the fore. If GPS were to default on its sovereign debt, this would have an adverse impact on some European banks. These potential losses for European banks caused interbank lending to "tighten up," thereby driving up interbank loan rates.

Although U.S. banks have much less direct exposure to GPS sovereign debt than do European banks, U.S banks have indirect exposure via their interbank lending to European banks. Hence, the interest rate on U.S. dollar interbank loans went up. Another reason the interest rate on U.S. dollar interbank loans increased was that European banks were scrambling to obtain U.S. dollar funding in addition to euro funding. Toward the end of May, the interest rate on 3-month dollar-based interbank loans leveled off, but the interest rate on 3-month euro-based interbank loans has continued to rise.

Why the divergence between the interest rates denominated in dollar vs. euros? Part of the explanation might have to do with the Fed's re-activation of dollar swap lines with major foreign central banks on May 9 and May 10. This alleviated some of the liquidity tightening being experienced by European banks with regard to their dollar funding needs. By re-activating its dollar swap lines, the Fed has indirectly helped alleviate liquidity pressures on U.S. banks as well as European banks.

The ECB has agreed to take Greek sovereign debt as collateral for short-term loans to euro-zone commercial banks regardless of the credit rating of this Greek debt. And this is good. But the ECB is discontinuing as of Thursday a 1-year maturity funding program for euro-zone banks. This has created anxiety among some Spanish banks. Although the ECB has said that 3-month funding will be abundant, some capital-challenged banks would prefer to lock-in funding for a year rather than having to refund four times a year. This is a factor putting upward pressure on term euro-based interbank loan rates.

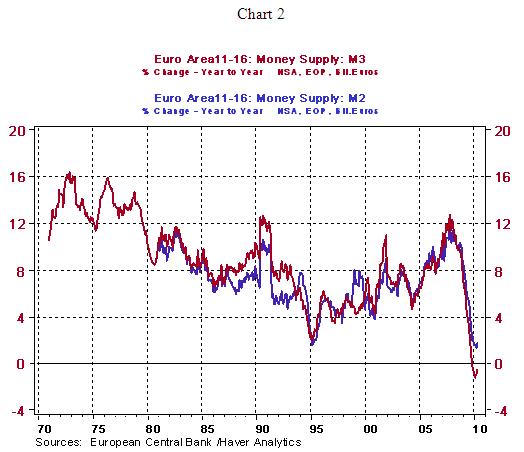

It is interesting to me how the ECB's policy approach has shifted of late. Prior to the Lehman crisis, the ECB seemed to pay more attention to the behavior of monetary aggregates than other central banks. The ECB appeared to buy into the Friedman proposition that inflation is always and everywhere a monetary phenomenon. But for some reason, the ECB now appears worried that it might be pursuing too accommodative a monetary policy despite the fact that growth in euro-zone monetary aggregates is exceptionally weak (see Chart 2). Jean-Claude, lighten up. Renew the 1-year term funding.

by Paul Kasriel

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.