Grain Bull Market - The Cartel in Your Cupboard

Commodities / Agricultural Commodities Sep 12, 2007 - 10:05 AM GMT Sean Brodrick writes :Russia has asked Australia (among others) to join a group of grain-exporting nations that would seek to regulate production, much as OPEC regulates the production of crude oil.

Sean Brodrick writes :Russia has asked Australia (among others) to join a group of grain-exporting nations that would seek to regulate production, much as OPEC regulates the production of crude oil.

An OPEC of grain sounds a bit odd. Visions of sheiks riding camels through Kansas wheat fields immediately come to mind. But Russia knows there is a lot of money to be made from grains. Fortunately, if you make the right moves, you also stand to reap profits as high as an elephant's eye.

More on what investments to look at in a moment. First …

Why the U.S. Deserves to Serve As the Head of the Grain Cartel

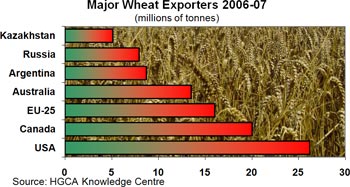

Russian Agriculture Minister Alexei Gordeyev first raised the possibility of a grain producers' group in June, when he suggested Russia, Ukraine and Kazakhstan should coordinate their international trade. Later, he approached Australia because, together, the two countries represent a quarter of global wheat exports.

We'll see how the wily Russians factor the U.S. into their calculations. The U.S. is the world's biggest exporter of grain — shipping out twice as much as Australia or Russia. Heck, if there were an OPEC of grain, the U.S. would be the Saudi Arabia!

This year, U.S. farmers are expected to produce 2.11 billion bushels of wheat, up 16% from last year's $7.7 billion worth. But wheat's not even our biggest crop! In 2006, the U.S. produced even larger amounts of corn, soybeans, and hay.

All told, the U.S. is growing more grain than ever before. And corn is where America really shines …

America is looking at the largest corn crop in history this year — 13.176 billion bushels, according to the crop production report released in August by the U.S. Department of Agriculture. That's up 25% from 2006, and some experts say it will be even bigger than expected.

Now …

If We're Producing All this Grain, Prices Are Going Lower, Right? No Way!

The first thing you need to know is that not everyone is having a bumper year. Russia, despite its cartel talk, is having a horrible wheat harvest, and may actually restrict exports. Australia is having a poor harvest, too, and may import corn for only the second time ever.

They're not the only ones. Germany, France, Italy and the U.K. all had sub-par wheat harvests. Romania and Bulgaria saw their harvests fall 40%. India's having problems. It's so dry in Argentina that farmers have had to delay planting their wheat.

As a result, orders for U.S. wheat (since the beginning of June) are at almost twice the level of a year ago. Algeria, Egypt, Iraq, India, Morocco, Japan, Korea and Taiwan are all in the market for more and more grain.

World Grain Production Consumption & Balance |

|||

| Production | Consumption | Surplus or Deficit | |

Million tonnes |

|||

| 1996 | 1,873 |

1,808 |

64 |

| 1997 | 1,876 |

1,820 |

58 |

| 1998 | 1,876 |

1,834 |

41 |

| 1999 | 1,872 |

1,853 |

19 |

| 2000 | 1,842 |

1,857 |

-14 |

| 2001 | 1,874 |

1,900 |

-26 |

| 2002 | 1,821 |

1,910 |

-89 |

| 2003 | 1,862 |

1,935 |

-73 |

| 2004 | 2,043 |

1,990 |

54 |

| 2005 | 2,009 |

2,014 |

-5 |

| 2006 | 1,967 |

2,040 |

-72 |

| Source: Earth Policy Institute | |||

So try as we might, we can't feed the world. Global stockpiles are projected to fall to a 26-year low as of May 31, 2008, according to the U.S. Department of Agriculture. The group expects worldwide supplies of wheat to decline to 114.8 million tons by the second quarter of next year. That's why prices for wheat have DOUBLED in the past year.

And let me tell you, wheat isn't at a top. There is a bigger shift occurring in grains, one that closed out a 20-year bear market last year. In other words, it's just beginning a new bull market.

One of the Biggest Reasons for this Emerging Bull Market in Grains: China

Beijing is choosing not to issue any more export quotas for corn and wheat. China is a big exporter, so this is huge news for the global market.

Why would China do such a thing? After all, the country's official statistics center says China is likely to harvest a record 149 million tonnes of corn this year, a rise of 2.42% from 2006.

Well, when you think about that number, consider the old saying about lies, damned lies, and statistics. The fact is, China's harvest is under attack like never before:

- Drought has withered 27 million acres in the northern and western sections of the country.

- Floods have drowned 21.5 million acres in southern China.

- A plague of brown rice-plant hoppers have damaged 1.2 million acres in Sichuan Province. Rice-plant hoppers aren't native to Sichuan, but weather changes wrought by global warming are widening the range of these little bugs with big appetites.

As bad as all this is, the year isn't over yet, and there is still plenty of time for weather to ruin even more of the harvest.

End result: China's food prices are soaring! The country's Consumer Price Index (CPI) jumped 5.6% in July 2007, the fastest pace in 10 years. Pork led the way with a 43% rise, but poultry, eggs and grains all went along for the ride.

Another part of the problem is that China's diet is changing as the nation gets richer. China's middle class grew from around 15% of the population in 1999 to around 19% in 2003. The population is eating four times as much beef today as it did in 1980, a trend that is accelerating. And since it takes proportionally much more grain to produce beef or pork, this further increases the supply/demand squeeze.

China is so panicked over its grain crisis that it even temporarily outlawed construction of corn-based ethanol plants. (New ethanol plants are being built, but they'll run on sweet potatoes.) Considering how China has made fuel independence one of its top priorities, this is another huge piece of news.

|

| China has a lot of hungry mouths to feed! |

It goes to show that ethanol can make you choose between food and fuel. And for the Chinese, it's no contest — people would rather eat than drive cars.

China's grain squeeze is humiliating for a country that is used to grain surpluses. And double humiliation looms for China if it has to follow in India's footsteps …

After years of exports, India purchased 795,000 metric tonnes of wheat at sky-high prices to rebuild stockpiles. This, despite the fact that India is the world's second-largest producer of wheat! Egypt is also paying top dollar for wheat imports.

Jacques Diouf, director-general of the UN's Food and Agriculture Organization, recently said that surging prices for basic food imports such as wheat, corn and milk could lead to social unrest and political upheavals. Mega-populated countries like China and India are taking these extraordinary steps because they understand the risk of food riots.

Heck, we've already seen unrest over food prices. In Mexico, citizens took to the streets in protests sparked by rising corn prices. Remember, food represents about 10-20% of consumer spending in industrialized countries, but up to 65% in developing nations. So when poor citizens see a problem arising, they're not shy about speaking up or acting out.

Global Warming Turns Up the Heat Another Notch

The effect that global warming is having on agriculture is hotly debated. But some scientists say that for each temperature rise of 1.8 degrees Fahrenheit (1 degree Celsius) above the historical average during the growing season, there is about a 10% decline in grain yields.

Looking ahead, global warming could lay waste to a wide arc of fertile, wheat-growing farmland stretching from Pakistan through Northern India and Nepal to Bangladesh.

And this has to be taken in the context of an expanding global population — 78 million more people every year — who need at least 31 million more tons of grain every year. Is that a long-term boost for prices? I sure think so!

Do You Have a Hunger for Profits? Then Look at Agriculture Investments!

The good news is that even though food prices are rising, your profits can rise even faster … if you invest in the right stocks. All along the food chain — from fertilizer makers to seed companies to farm equipment companies to processors — business is booming.

If you want a diversified way to play it, take a look at the Fidelity Select Consumer Staples Portfolio (FDFAX) . Formerly known as the Fidelity Select Food & Agriculture fund, it covers the gamut of food stocks, including some great agriculture-oriented stocks.

Of course, you know that I tend to favor picking the absolute best stocks in any given area. That's why I've just picked six individual stocks and one red-hot ETF that I'm going to recommend in a special, limited-edition report on September 13 (that's tomorrow!).

I'll be selling this report, " 6 Stocks and 1 ETF to Ride The Agriculture Boom " — including three follow-ups — for $198, and I think it would be cheap at triple the price. But if you contact us at 1-800-814-3047 by midnight tonight, and mention my name, you can reserve a copy for the low pre-publication price of just $99.

That way, I can rush you a PDF copy of the report tomorrow so you can jump on the recommendations just as soon as they come off the press.

One other thing: Just because I'm bullish on agriculture doesn't mean I'm cooling on other commodities. Far from it! If you want a fund that gives you a stake in all kinds of commodities — corn, wheat, aluminum, oil, and more — consider the PowerShares DB Commodity Index Tracking Fund (DBC) .

Yours for trading profits,

by Sean Brodrick

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.